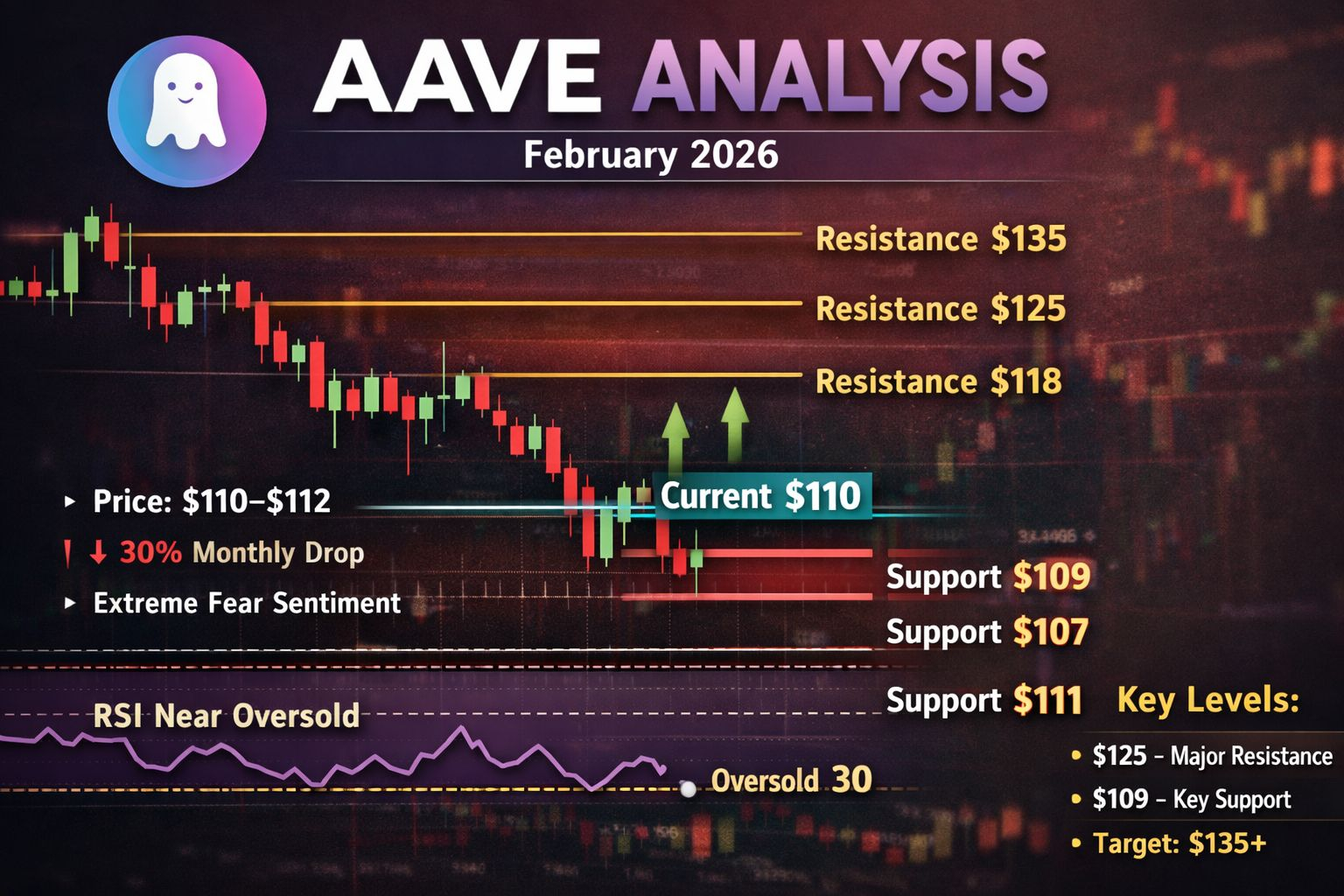

$AAVE Current Price Zone: ~$110–$115

Market Sentiment: Bearish to Neutral (Extreme Fear)

Technical Overview

AAVE is trading around $110–$112 after a sharp monthly decline of 30%+. �

MEXC

RSI near oversold (≈30–32) suggests a possible short-term bounce. �

MEXC +1

Key Support:

$111

$109

$107

Key Resistance:

$115

$118

$125 �

MEXC

Short-term outlook: If $109–$110 holds, a relief move toward $125–$XRP 135 is possible.Market Structure

AAVE has been in a medium-term downtrend (-33% last month, -55% yearly). �

MEXC

Crypto market fear remains high (Fear & Greed ≈ 14), limiting strong upside momentum. �

CoinCodex

Recent liquidations and leveraged unwinds increased selling pressure across DeFi. �

Bitget

Fundamentals (Bullish Factors)

Aave dominates DeFi lending with ~70% market share and handled $140M liquidations without bad debt during the crash — showing strong protocol resilience. �

BeInCrypto

Analysts still see upside potential toward $134+ if sentiment improves. �

MEXC#USRetailSalesMissForecast #WhaleDeRiskETH #GoldSilverRally #BinanceBitcoinSAFUFund #BTCMiningDifficultyDrop