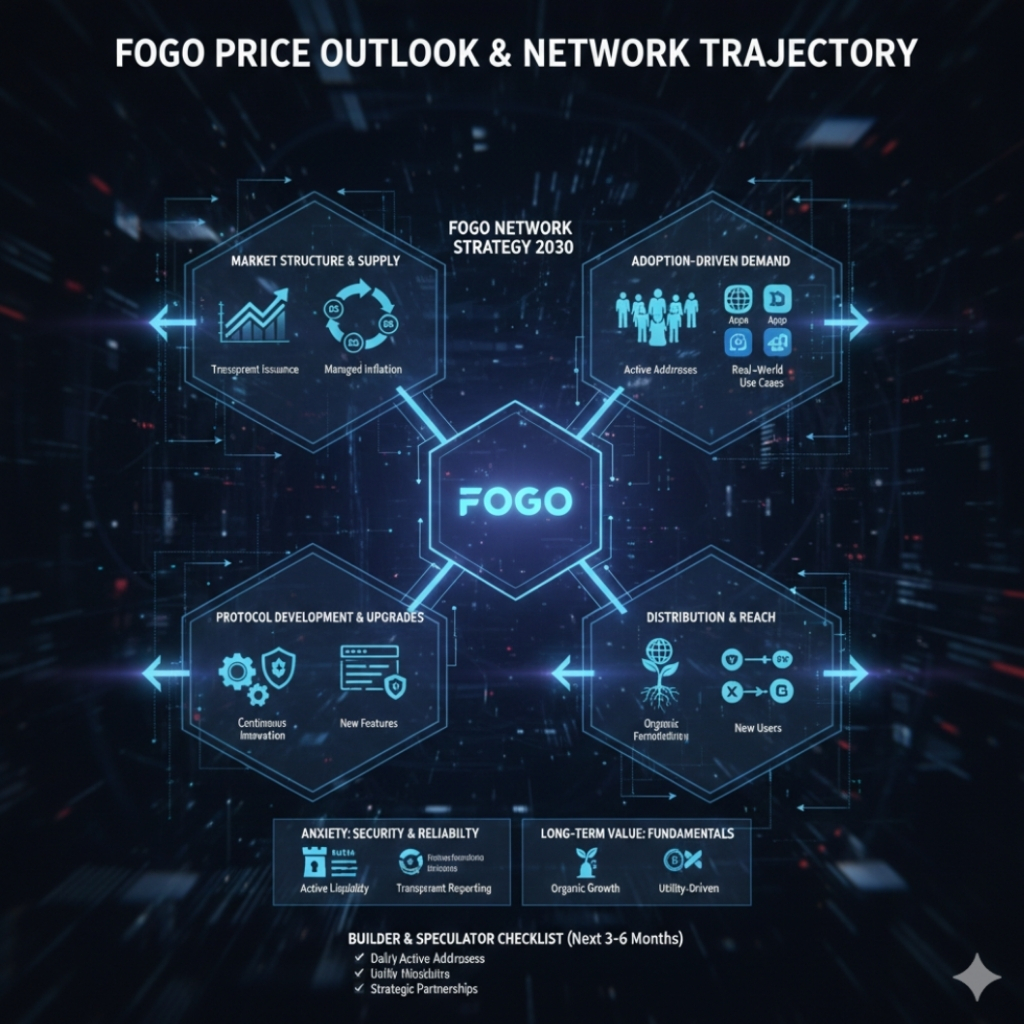

A Deep Dive Into How Fogo’s Market Framework, Token Engineering, and Real-World Infrastructure Set the Stage for Enduring Value Creation

Introduction — Why This Matters Now

The crypto landscape is saturated with projects that launch with great fanfare, generate short-lived excitement, and then rapidly fade into obscurity. For investors, traders, and builders alike, the question isn’t just about catching the next price rally—it’s about identifying what truly underpins lasting value in a token. With the market maturing and participants growing more sophisticated, the superficial metrics that once drove decision-making are giving way to a deeper focus on utility, adoption, and network resilience.

Understanding where FOGO could be headed requires moving beyond surface-level price charts. Instead, the focus must shift to the real-world factors driving network relevance: infrastructure deployment, ecosystem utility, and genuine user engagement. In a landscape where only a handful of tokens will achieve long-term significance, separating signal from noise is more crucial than ever.

Core Thesis — The Strategic Value

At the heart of Fogo’s approach is a deliberate attempt to transcend the “trade and forget” mentality that plagues much of the crypto world. Fogo aspires to function not just as a speculative asset, but as a foundational layer where meaningful participation is rewarded and price appreciation is anchored in tangible ecosystem activity. By aligning token performance with real network growth—rather than fleeting hype cycles—Fogo aims to foster a more sustainable, value-driven economy.

This paradigm shift means price movements begin to mirror the network’s actual evolution: adoption rates, developer engagement, and infrastructure expansion. In the long run, tokens whose value is grounded in genuine utility and collaborative growth will be the ones to endure and prosper.

Problem Statement — The Web3 Bottleneck

The challenges facing token economies are well-known and widely felt:

Liquidity is often dominated by speculators, leading to volatility and instability.

For many projects, the token’s only use case is as a trading vehicle, making it irrelevant outside of exchanges.

Developer enthusiasm wanes when there’s no clear pathway to build for real users, stalling innovation.

Communities form quickly but dissipate even faster, leaving behind a hollow network.

Without deep integration into the daily life of the network—serving as a medium for transactions, governance, or network participation—most tokens are doomed to endlessly chase the next trend, only to be left behind as attention shifts elsewhere.

For a token to weather the inevitable cycles of excitement and disillusionment, it must become an indispensable part of the platform’s activity—woven into how people use, develop, and engage with the ecosystem.

Technology Stack — The Foundations of Sustainable Growth

1. Market Structure & Token Supply

Fogo’s underlying tokenomics—its circulating supply, total cap, and trading volume—form the baseline for market stability. A transparent and predictable issuance schedule reassures participants, while a carefully managed inflation rate avoids the pitfalls of runaway dilution or artificial scarcity.

If supply growth is matched by organic demand—driven by actual network usage and value creation—price appreciation becomes steady rather than erratic. This balance fosters confidence among holders and incentivizes long-term participation over short-term speculation.

2. Technical Trend Indicators

While technical analysis tools like RSI, moving averages, and MACD are staples for traders, their true value lies in providing early signals of shifting sentiment and momentum. Used wisely, these indicators help both retail and institutional participants gauge the strength of trends, identify inflection points, and avoid emotional decision-making.

But their role is complementary; they facilitate smoother price discovery and reduce irrational volatility, but cannot substitute for the underlying fundamentals that ultimately steer long-term value.

3. Adoption-Driven Demand

The real litmus test for any network token is actual usage. Key metrics—active addresses, transaction volumes, app integrations, and the number of real-world use cases—offer a window into true demand.

As more users, developers, and partners integrate FOGO into their workflows, the token’s role evolves from a speculative chip to a critical piece of digital infrastructure. This transformation is what distinguishes enduring projects from those that fade after initial hype.

4. Protocol Development & Upgrades

Continuous protocol development is a hallmark of healthy networks. Every upgrade—whether a new feature, integration, or governance improvement—can unlock new avenues for utility and engagement.

Robust upgrade cycles encourage developer interest, keep the platform competitive, and can even generate fresh demand for the token by enabling use cases previously unavailable. Over time, this adaptability strengthens the network’s resilience and attractiveness to both users and partners.

Addressing Anxiety — Security & Reliability

Long-term participants—especially those staking their resources or reputations—prioritize security, reliability, and transparency. Fogo addresses these concerns by:

Maintaining active liquidity pools across multiple exchanges to ensure robust, accessible markets.

Prioritizing organic adoption, allowing the ecosystem to grow at a sustainable pace rather than seeking artificial spikes in activity.

Committing to transparent reporting around token distribution, governance, and protocol changes.

By building trust through openness and resilience, Fogo seeks to avoid the catastrophic crashes that have felled so many projects in the past, giving long-term holders the confidence to weather temporary turbulence.

Distribution Strategy — The Markers of Real Adoption

FOGO’s future hinges on expanding its reach beyond the crypto-native crowd:

Increasing liquidity across established and emerging exchanges to facilitate easy entry and exit.

Fostering integrations with applications and services that operate outside the traditional crypto sphere, demonstrating real-world relevance.

Attracting and supporting developers through grants, open-source tools, and strong documentation to encourage fresh innovation.

Engaging end-users—businesses and individuals alike—by making the token a seamless part of their daily interactions, not just a speculative instrument.

This approach broadens the base of demand, making the network more resilient to market swings and less reliant on the whims of traders.

Historical Context & Evolution

Fogo’s evolution reflects a broader shift in digital assets—from tokens valued purely on speculative potential to those whose worth is defined by their role in enabling real economic activity. This transition is pivotal: projects that successfully embed themselves into practical workflows and use cases are the ones that withstand the test of time.

Looking back, the crypto industry is littered with projects that failed to make this leap. For Fogo, the path forward hinges on proving its utility and cementing its position as an integral part of a broader digital ecosystem.

The Aha Moment

Ultimately, FOGO’s long-term price trajectory will not be dictated by technical models or short-term speculation. The most important factor is whether the network continues to attract users, developers, and partners who rely on it for real value. Sustainable, organic growth in network activity is the truest signal of enduring potential.

Speculator / Builder Checklist (Next 3–6 Months)

For those looking to assess Fogo’s near-term health and long-range prospects, closely monitor:

A steady rise in daily active addresses, signaling expanding user engagement.

Growth in non-trading transaction volumes, indicating more diverse on-chain activity.

Enhanced liquidity metrics on both centralized and decentralized exchanges, ensuring market robustness.

The pace and scope of protocol upgrades, as well as meaningful integrations that extend Fogo’s reach.

Strategic partnerships, particularly those that draw in new cohorts of users or connect Fogo to real-world applications.

These indicators provide a more holistic picture of network strength than price alone and help separate genuine progress from mere volatility.

Conclusion — What Actually Matters

Price forecasts are just educated guesses, subject to countless unpredictable variables. The true determinants of Fogo’s value are:

Consistent growth in network usage, measured by active users and transaction depth.

Widening participation from builders, businesses, and users who integrate FOGO into their operations.

Sustained, organic demand for the token, rooted in its utility within the ecosystem.

Ongoing investment in infrastructure and protocol development.

When these fundamentals improve, FOGO’s strategic outlook brightens—regardless of short-term market sentiment.

For anyone invested in Fogo’s future—whether as a speculator, builder, or community member—the metrics that matter most are on-chain activity and real trading volume. These are the clearest indicators of whether the network is truly expanding or simply riding the wave of temporary hype.

FAQs

Q1: Are price predictions reliable for crypto assets?

Price predictions can outline possible scenarios but cannot guarantee outcomes. Crypto markets are influenced by a complex web of external factors—including regulation, global events, and investor sentiment—that no model can fully capture.

Q2: What drives FOGO’s value the most?

FOGO’s value hinges on a delicate balance: disciplined supply management, authentic network adoption, and vibrant, sustained activity across the ecosystem. Real-world utility and growing user engagement ultimately drive lasting value.

Q3: Do technical indicators set the long-term price?

Technical indicators are valuable for tracking market cycles and timing entries or exits, but the trajectory over years is set by fundamentals: adoption rates, developer activity, and the network’s ability to deliver meaningful use cases.

Q4: Can upgrades boost token value?

Absolutely. Protocol upgrades can unlock new features, attract additional users, or open up innovative use cases, all of which can translate into heightened demand and more robust network economics. Regular, thoughtful upgrades are a key sign of a project’s vitality and adaptability.