Short-Term Appetite Fades Even as Overall Buying Persists

Bitcoin's market landscape is undergoing a quiet but significant transformation. While the broader narrative of accumulation remains intact, the composition of buyers is shifting and the divergence between retail-oriented short-term holders and deep-pocketed whale entities is becoming increasingly difficult to ignore.

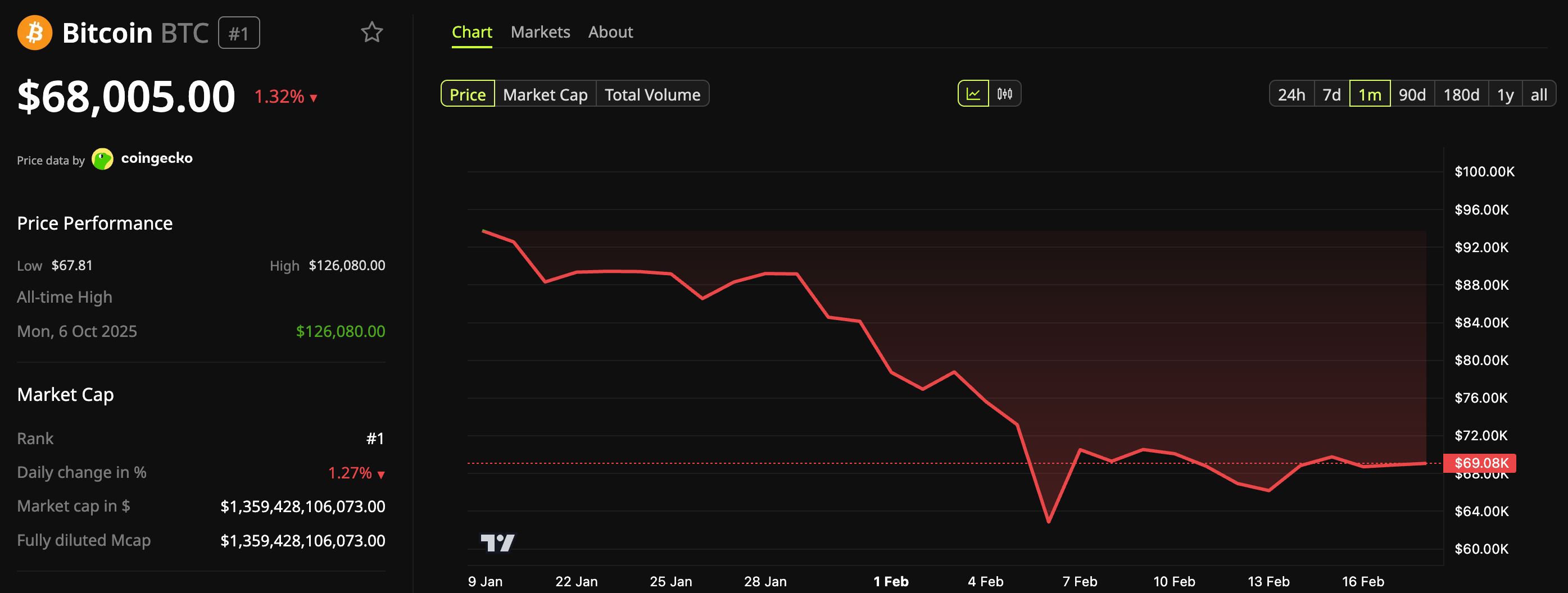

After scaling above $126,000 earlier in the cycle, Bitcoin suffered a steep correction that drove prices toward the $60,000 range before a partial recovery settled near $68,000. Through this turbulence, buying activity has continued but not uniformly across all participant types.

The 90-Day Momentum Problem

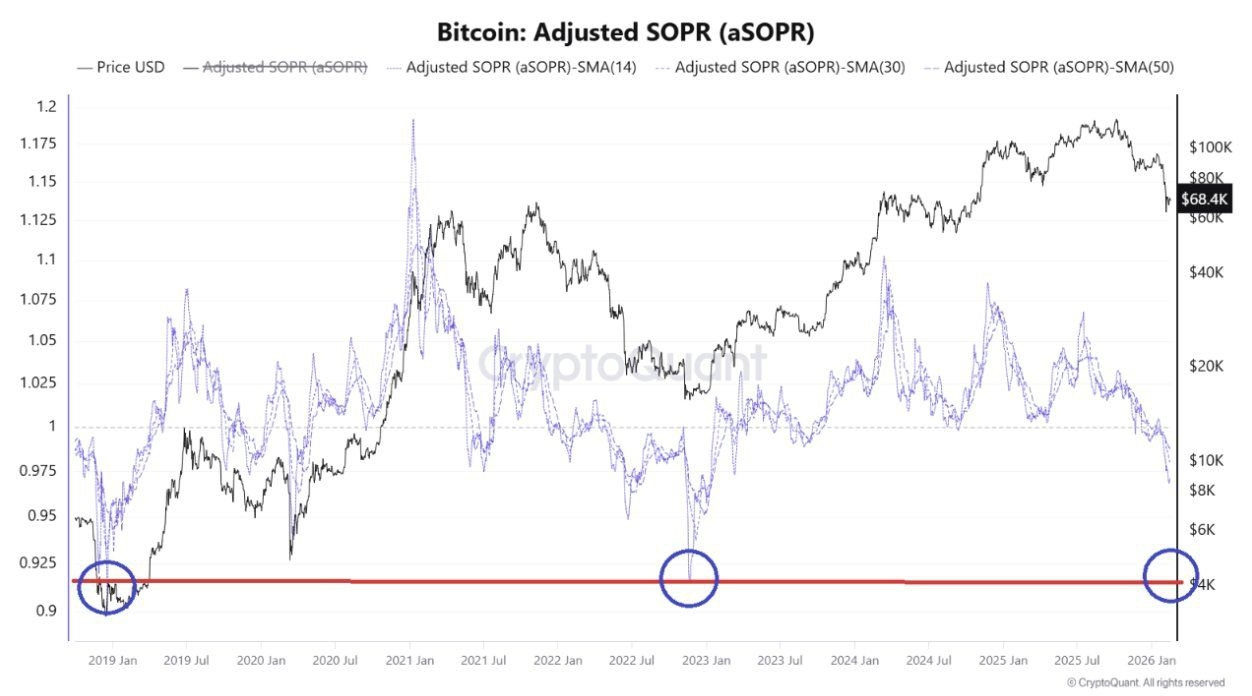

On-chain analytics firm Alphractal recently flagged a notable shift in behavioral patterns among short-term Bitcoin holders. Its Short-Term Holder Net Position Change metric, measured across a 90-day rolling window, reveals that while this cohort has not turned into net sellers, the rate at which they are adding to positions has declined sharply.

The distinction matters. Positive net accumulation with declining momentum is a subtler warning signal than outright selling it suggests diminishing conviction rather than panic. Alphractal has noted that this type of deceleration has historically preceded market consolidation phases, bouts of elevated volatility, or broader structural regime shifts in price action.

Institutional Headlines Are Not Moving the Needle

One of the more striking takeaways from Alphractal's analysis involves the disconnect between institutional buying announcements and actual short-term demand metrics. Strategy's continued Bitcoin accumulation and similar moves by other institutional participants have generated considerable market attention yet these headlines have not translated into accelerated buying among short-term holders.

Alphractal founder Joao Wedson emphasized that evaluating isolated institutional entities offers an incomplete picture. A comprehensive reading of the entire Bitcoin blockchain is necessary to assess genuine underlying demand and that broader picture currently shows slowing momentum at the retail-adjacent level.

Whales Tell a Different Story

Where short-term holders are pulling back, large-scale accumulation by whale entities is picking up the slack in a meaningful way. Data from CryptoQuant indicates that whale-held Bitcoin supply has increased by more than 200,000 BTC over the observed period, rising from approximately 2.9 million BTC to over 3.1 million BTC.

The analysis deliberately uses monthly averages to filter out noise from short-term exchange inflows activity that can superficially appear bearish when viewed in isolation. Despite a temporary uptick in whale deposits to exchanges, their net holdings have continued to expand, reflecting deliberate medium-term positioning rather than distribution.

A Pattern That Has Played Out Before

The current whale accumulation behavior draws a notable parallel to events from April 2025. During that correction cycle, whale buying absorbed significant selling pressure and ultimately helped fuel Bitcoin's advance from $76,000 to $126,000. CryptoQuant notes that Bitcoin is currently trading nearly 46% below its most recent all-time high a discount that appears to be drawing calculated interest from entities with longer time horizons and deeper capital reserves.

What the Divergence Signals

The gap between cooling short-term demand and rising whale accumulation reflects a market in transition. Retail enthusiasm has tempered following the sharp price correction, while institutional and high-net-worth participants appear to be treating current price levels as a strategic entry opportunity. Whether short-term holders eventually follow the whales back into aggressive accumulation mode may well determine the timing and strength of Bitcoin's next directional move.

#StrategyBTCPurchase #CPIWatch #BTC $ETH