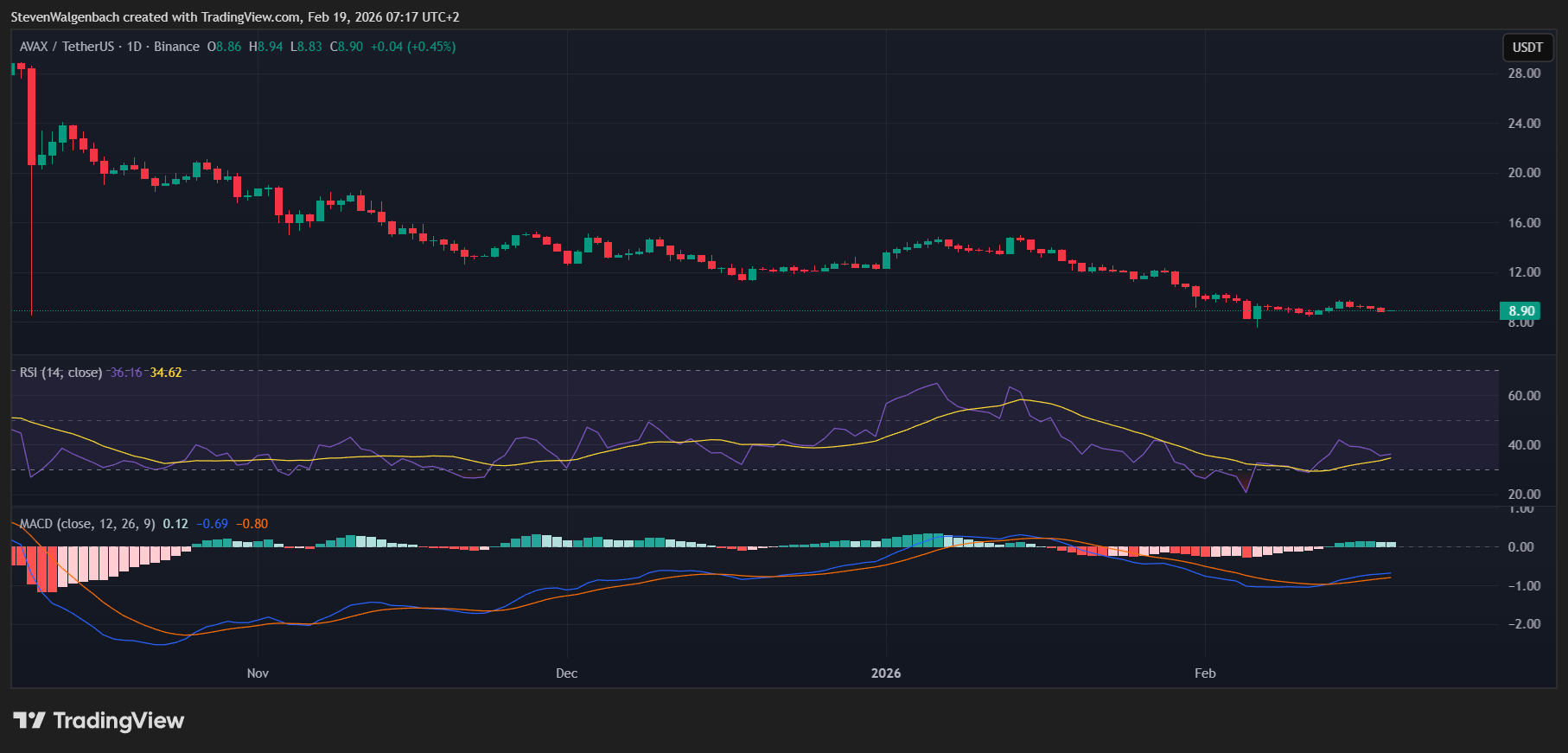

Avalanche’s $AVAX token continues to trade under pressure on the daily chart, with price action reflecting a market that has yet to establish a convincing recovery. Recent sessions have shown a gradual drift lower, with candles slipping beneath important short-term averages while momentum indicators point to weakening bullish conviction.

From a moving average perspective, the short-term trend remains soft. AVAX has been hovering around its fast EMA, but it continues to trade below the more influential 20-day EMA. This positioning typically reflects a market where sellers maintain control, as price has not yet reclaimed the broader trend indicator. The flattening shape of the faster EMA also suggests that bullish momentum is fading rather than accelerating.

Momentum signals offer a cautious outlook. The MACD histogram has moved into positive territory, hinting that bearish pressure is easing, but the indicator remains below the zero line. This usually reflects a transition phase rather than a confirmed reversal. Meanwhile, the RSI sits in the lower neutral zone, showing that buying interest is still limited and the market has room to drift lower before a stronger relief bounce becomes likely.

The nearest resistance sits around the $9.59 region, which aligns with recent price congestion and overhead supply. This zone is likely to act as the first major test for any bullish attempt. A clean break and close above it could open the path toward higher resistance near $12.42 and $12.69, but such a move would likely require a clear shift in sentiment and stronger momentum.

On the downside, the $8.63 level stands as the nearest support, with the $8.32 area acting as the next defensive zone for buyers. A breakdown below these supports would reinforce the bearish structure and potentially accelerate selling pressure.

Order book data adds another layer of caution. Several notable sell walls sit just above the current trading range, particularly between $8.93 and $8.95. These clusters suggest that any short-term upside could face immediate resistance. If cleared, the price may see a modest push higher, but the limited upside implied by these walls indicates that the broader trend still needs stronger buying pressure to shift direction.

For bullish traders, the setup favors waiting for confirmation. A daily close above the $9.59 resistance could signal strengthening momentum and open the door for a move toward the higher resistance band. For bearish traders, the structure still leans toward downside continuation while price remains below the 20-day EMA, with rejection near resistance or a break below $8.63 potentially offering short opportunities.

Overall, the daily outlook for AVAX remains cautiously bearish, with early signs that selling pressure is slowing. However, a meaningful reversal will likely require sustained closes above key resistance levels.