The private market represents one of the largest and most lucrative segments of global finance, yet it has remained stubbornly exclusive. Access to pre-IPO stock in high-growth companies has been reserved for venture capitalists, accredited investors, and institutional players. But the emergence of the private market onchain is beginning to crack open this walled garden.

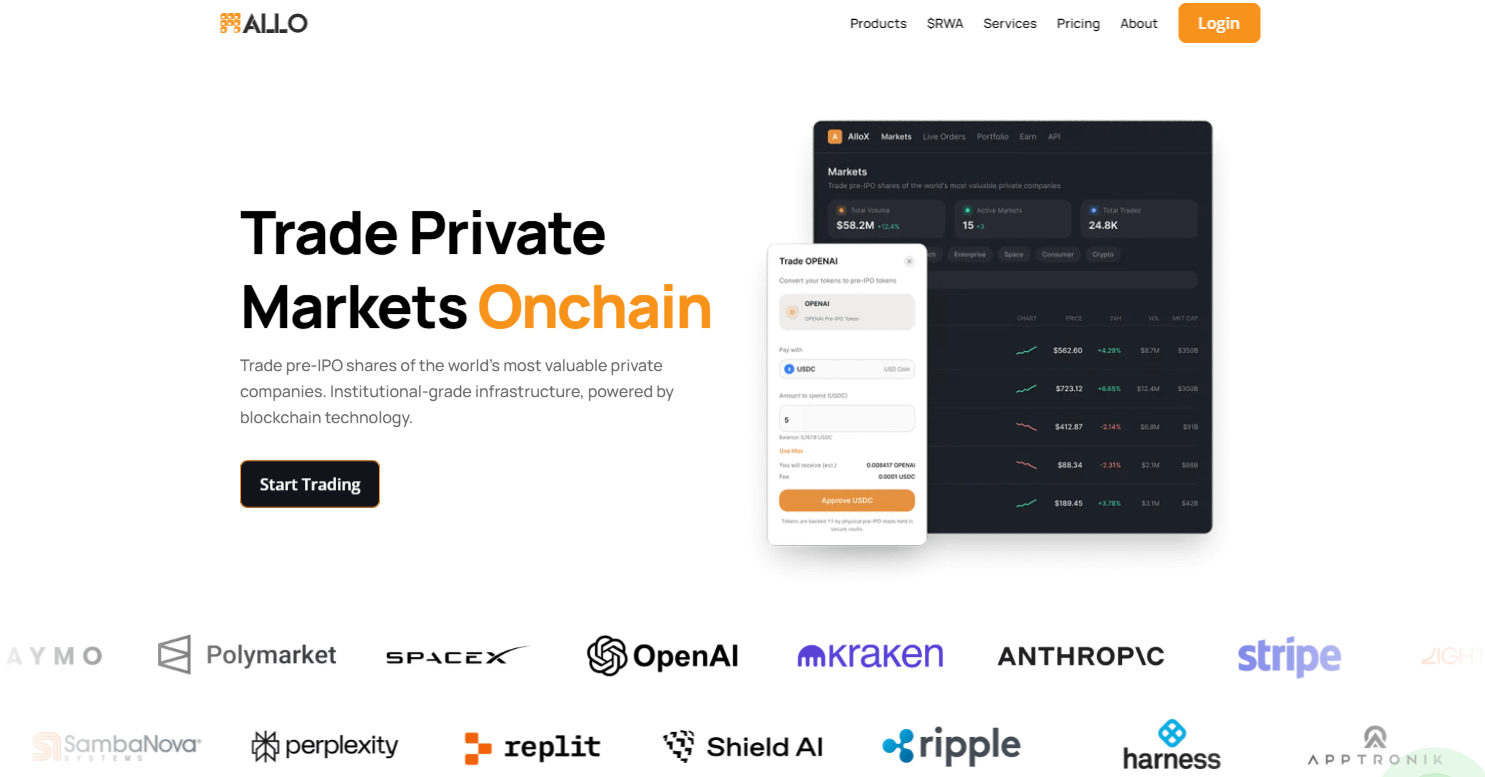

At the center of this shift is RWA tokenization, which creates digital representations of private company equity using asset tokenization blockchain protocols. This enables fractional ownership, 24/7 trading, and global accessibility. The convergence with institutional DeFi is bringing traditional financial players into this new ecosystem. Platforms like Allo Finance provide the regulated infrastructure necessary for institutional RWAs on chain, making it possible to trade pre-IPO stock with the same confidence as public securities.

Sophisticated financial products are emerging around these tokenized private assets. RWA perpetuals and RWA derivatives allow traders to gain exposure to private company valuations through the on-chain derivatives market. These tokenized asset perps offer capital-efficient ways to speculate on or hedge against pre-IPO price movements. The Allo trading platform serves as a premier venue for accessing this liquidity.

The lessons from commodity tokenization are instructive. Tokenized gold has demonstrated how commodity backed crypto can bring tangible assets on-chain, while tokenized silver and silver backed tokens expand the model. This evolution in blockchain commodities trading provides a blueprint for decentralized rwa trading in private equity.

The tokenization of traditional finance assets is still in its early stages, but the trajectory is clear. By building the infrastructure for private market onchain trading, Allo Finance is enabling a future where pre-IPO stock is accessible to a global audience of investors.

Follow @ALLOxyz on (@allo_xyz) on X & visit at: allo.xyz

$BNB #RWA #BinanceAlpha $RWA