When I first entered Web3, passive income felt complicated. It was either high risk farming, unstable rewards, or complex DeFi strategies that only advanced users could navigate confidently. Over time, I realized the real problem was not yield itself. It was sustainability. That’s where Fogo caught my attention.

What makes Fogo different for me is not just the numbers. It is the structure behind those numbers. Instead of chasing short term hype, Fogo is building an ecosystem where passive income is designed to be consistent, accessible, and strategically integrated into the network’s core architecture. The focus is not only on returns but on creating a stable environment where capital works efficiently without unnecessary complexity.

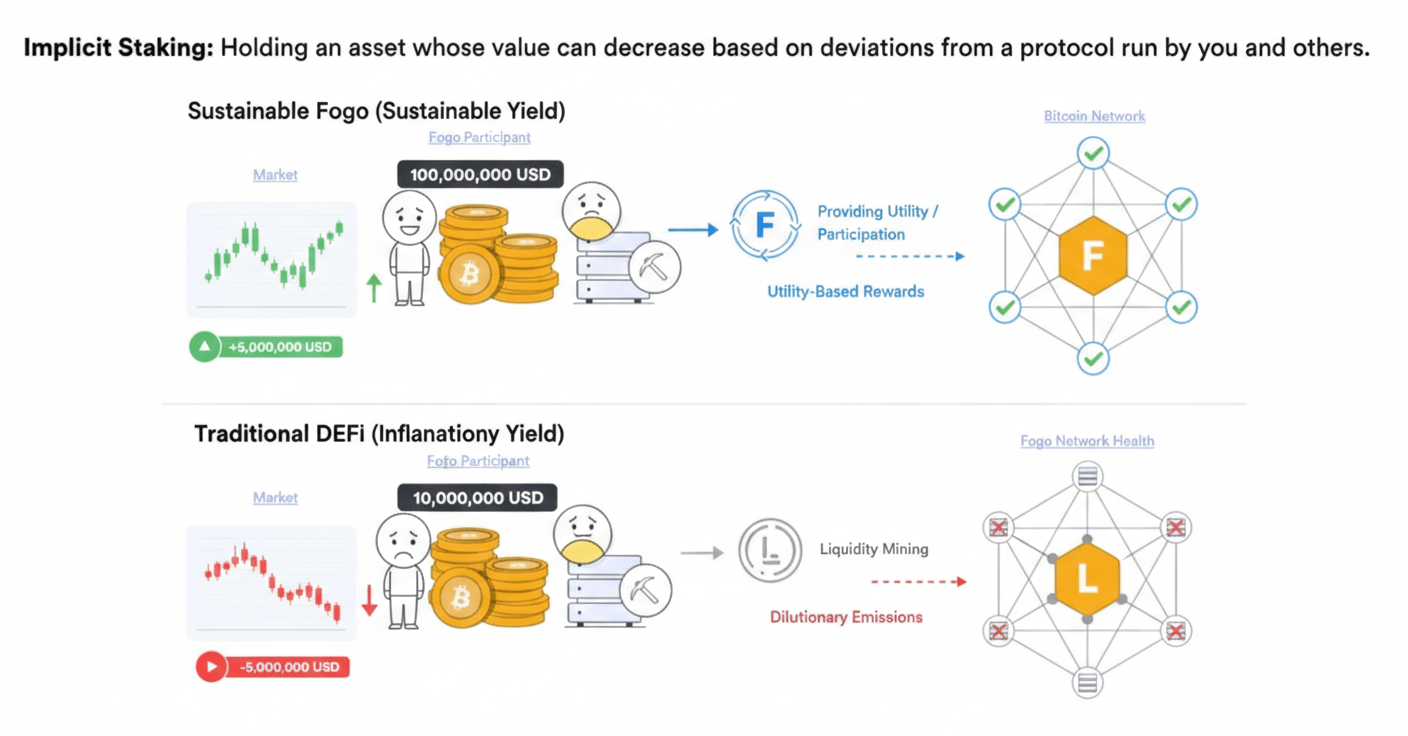

In traditional DeFi models, passive income often depends on liquidity mining incentives that inflate supply. Rewards look attractive at first, but over time emissions dilute value. I have seen this cycle repeat many times across different chains. Fogo approaches the concept differently. The emphasis is on aligning rewards with ecosystem growth, real usage, and network participation.

One of the biggest shifts I see with Fogo is the way yield is connected to utility. Instead of isolated staking pools, passive income mechanisms are integrated into broader financial infrastructure. This creates a more circular economy where participation strengthens the network while generating returns.

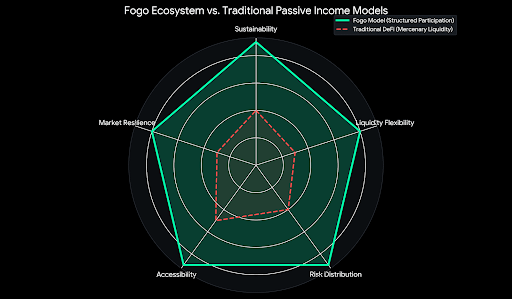

When I analyze passive income opportunities, I look at three things: sustainability, liquidity flexibility, and risk distribution. Fogo appears to optimize all three. Sustainability comes from controlled reward structures. Liquidity flexibility ensures users are not trapped in rigid lockups without options. Risk distribution is improved by building layered participation models rather than single point reward systems.

Another factor that stands out is accessibility. Many DeFi platforms unintentionally exclude average users because of technical barriers. Fogo simplifies participation. The onboarding process feels intuitive, and the earning mechanisms do not require constant strategy adjustments. This lowers the psychological barrier to entry, which in my opinion is just as important as financial accessibility.

Yield in Web3 should not feel like speculation. It should feel like structured participation. Fogo’s approach makes passive income closer to a financial service rather than a temporary incentive campaign. That subtle difference changes everything. It attracts long term capital instead of mercenary liquidity.

Volatility is unavoidable in crypto markets. I do not expect price stability at all times. However, passive income models that are designed with volatility in mind tend to survive market cycles. Fogo appears to build with this mindset. Rewards are not purely dependent on aggressive token emissions. They are supported by ecosystem activity and strategic allocation models.

From my perspective, the future of passive income in Web3 will belong to networks that balance growth with discipline. Excessive APY might attract attention, but intelligent yield design builds trust. Fogo is positioning itself in that second category. It is not just offering returns. It is redefining how those returns are generated.

I also appreciate how Fogo aligns incentives between users, builders, and the network. When builders create applications within the ecosystem, they expand opportunities for capital efficiency. When users participate, they reinforce liquidity depth. This multi layer synergy reduces dependency on artificial reward inflation.

Passive income should not require constant monitoring. It should be strategic allocation with calculated risk. Fogo moves toward that direction by combining yield opportunities with ecosystem development. Instead of short term reward spikes, the vision feels oriented toward long term value creation.

As Web3 matures, the definition of passive income will evolve. It will no longer mean simply staking tokens and hoping emissions remain high. It will mean participating in a network that generates real economic activity. In my view, Fogo represents an early blueprint of that transition.

I am not looking at Fogo as a quick opportunity. I see it as part of a broader shift in how decentralized finance can mature. If the ecosystem continues to grow with the same structured approach, passive income in Web3 may finally move from experimental incentives to sustainable digital finance.

That is what makes Fogo compelling to me. It is not only redefining passive income. It is redefining expectations.