Global bond markets are undergoing a silent regime change. After a brief but violent period of elevated interest rates, the return on fixed income is rapidly evaporating. New data reveals that the vast majority of global debt is now offering yields that barely keep pace with inflation, leaving investors starved for real returns and raising questions about a potential return to the bizarre era of sub-zero yields.

❍ A Market Devoid of High Returns

The sheer volume of low-yielding debt is staggering, indicating a structural downward shift in global borrowing costs.

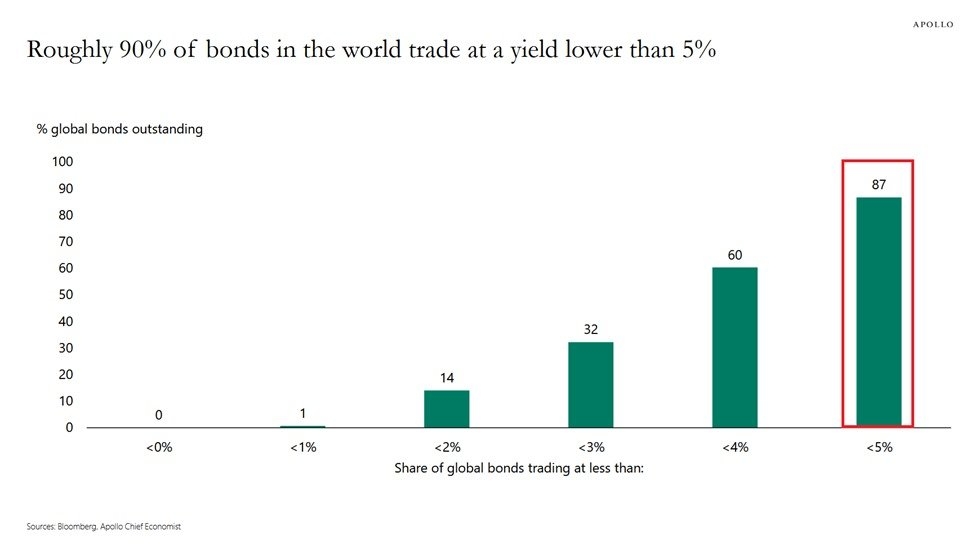

87% Below 5%: A massive 87% of all bonds worldwide currently trade at a yield below 5%.

60% Below 4%: The majority of the market (60%) yields less than 4%, forcing income-seeking investors to take on more risk.

The Bottom Tier: More concerningly, 32% of bonds yield less than 3%, and 14% offer a microscopic yield of less than 2%.

❍ The Illusion of Returns: The Inflation Trap

Nominal yields only tell half the story. When factoring in the current macroeconomic environment, the math becomes grim for fixed-income investors.

~3% Inflation: With global inflation running near the ~3% mark, the "real" (inflation-adjusted) return on most bonds is severely compressed.

Zero or Negative Real Returns: This means the vast majority of bond investors are earning a meager ~2% real return per year. For the roughly one-third of the market yielding under 3%, investors are effectively earning nothing—or actively losing purchasing power—even before factoring in transaction costs and taxes.

❍ Echoes of the Sub-Zero Era

This rapid compression of yields invokes memories of the most distorted period in modern financial history.

The 2020 Peak: In 2020, a mind-boggling $18.4 trillion of global bonds traded with negative nominal yields, meaning investors were paying governments for the privilege of holding their debt.

The 2023 Reset: This anomaly vanished completely, falling to exactly $0 in early 2023 as central banks aggressively hiked rates to combat inflation.

The Pendulum Swings: While we are not yet back in negative nominal territory, the velocity at which yields are falling across the globe suggests the pendulum is definitively swinging back toward an environment of financial repression.

Some Random Thoughts 💭

The bond market is sending a very different signal than the stock market. While equities are priced for a booming, high-growth "soft landing," bond yields are collapsing back to levels that suggest sluggish long-term growth and heavy central bank intervention. The fact that 14% of global bonds already yield less than 2% in a world with ~3% inflation is a classic example of financial repression—governments are effectively forcing investors to accept guaranteed losses in purchasing power to fund massive sovereign debt loads. If central banks are forced to cut rates aggressively during the next economic downturn, the return of the negative-yielding debt pile isn't just possible; it's highly probable.