Solana’s native token SOL is losing momentum, and the derivatives market is flashing clear warning signs that traders are stepping back rather than gearing up for a rebound.

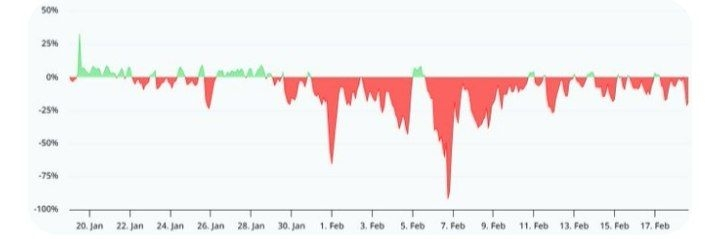

SOL has struggled to reclaim the $89 level for weeks. After getting rejected near $145 in mid-January and plunging to $67.60 during the Feb. 6 sell-off, the token hasn’t been able to rebuild confidence. Instead of fresh bullish bets, leverage demand has dried up as many participants shift into defensive mode.

The futures market tells the same story. Open interest tied to Solana has collapsed by 75% from its $13.5 billion peak just five months ago, showing that capital is leaving rather than accumulating. Traders simply aren’t interested in taking new positions.

At the same time, bearish sentiment is unusually strong. Funding rates remain deeply negative, with short sellers paying around 20% annually just to maintain their positions. When traders are willing to absorb that cost for days on end, it signals high conviction that further downside is possible. By comparison, Ethereum funding rates hover near 1% — slightly soft but far from the aggressive imbalance seen with SOL.

Over the past month, SOL has also underperformed the broader crypto market by 11%. And while it still ranks among the top cryptocurrencies by market capitalization, the 67% drop from its $253 high last September continues to weigh heavily on sentiment.

The weakness isn’t just visible in price charts. Activity across Solana’s decentralized app ecosystem is slowing too. Lower token prices reduce staking yields, shrink protocol revenues, and weaken incentives for long term holders. That combination risks creating a negative feedback loop where falling prices discourage usage, which in turn pressures prices further.

Weekly dApp revenue on Solana has fallen to $22.8 million — the lowest level since October 2024. Nearly 40% of that came from the memecoin launchpad Pump alone, contributing $9.1 million. This highlights how dependent the network has become on retail-driven trends rather than diversified, durable use cases.

Meanwhile, Ethereum’s ecosystem appears more resilient. Its leading revenue generators include infrastructure-heavy DeFi protocols such as Flashbots and Aave, which cater to institutional and professional users. Weekly Ethereum dApp revenue recently reached $16 million, inching higher month over month.

This contrast underscores a structural difference: Solana leans heavily on retail activity and memecoins, while Ethereum continues to dominate in higher-value decentralized finance and total value locked.

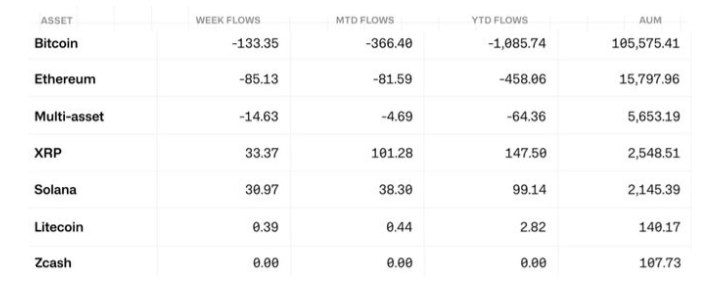

Institutional appetite reflects that divide. Despite strong transaction throughput and second place in TVL, SOL-based exchange-traded products haven’t gained meaningful traction. Asset managers like Bitwise, Fidelity Investments, Grayscale Investments, 21Shares, CoinShares, and REX Shares have launched products tied to SOL, yet combined assets under management sit near $2.1 billion — still about 86% behind Ethereum’s $15.8 billion.

For Solana to regain bullish momentum, it may need fresh narratives beyond memecoins. Emerging areas like AI infrastructure and prediction markets could help diversify demand, but competition across those sectors is intense.

For now, both derivatives data and onchain activity suggest caution. If sentiment doesn’t improve soon, another leg lower could put the fragile $78 support level under real pressure.