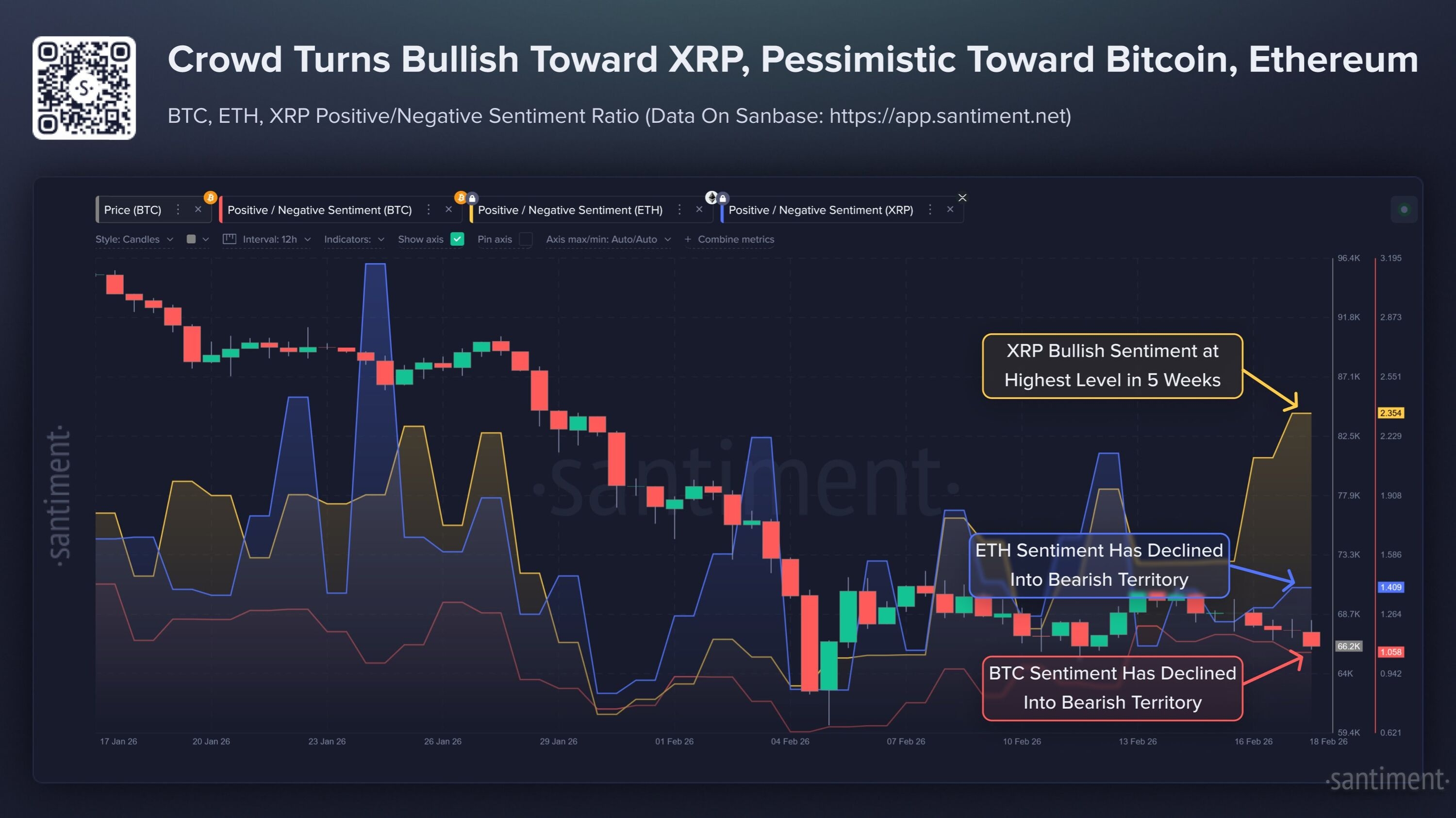

In a week marked by market turbulence, $XRP has emerged as a rare bright spot. While the "big two"—Bitcoin and Ethereum—struggle with bearish sentiment, XRP is riding a wave of institutional optimism.

According to recent data from Santiment, social sentiment for XRP has surged to a five-week bullish high, diverging sharply from the cooling interest in the broader crypto market.

As of mid-February 2026, global crypto community is split. Bitcoin and Ethereum have faced persistent selling pressure, with Bitcoin recently testing critical support levels around $68,000 following significant ETF outflows.

In contrast, XRP has demonstrated "decoupling" behavior. After bottoming out during the February 6th market correction, XRP surged nearly 38%, outperforming its peers and reclaiming price levels above $1.50.

$BTC : Sentiment is currently Bearish to Fearful. Price action is testing support and appears vulnerable as ETF outflows persist.

$ETH : Sentiment remains Bearish to Neutral. The asset is largely range-bound, struggling to maintain a position above the $2,000 mark.

XRP: Sentiment is Strongly Bullish. The asset is reclaiming multi-week highs and leading the market in recovery momentum.

Why is the Sentiment Shifting?

The shift isn't just hype; it is well grounded in significant ecosystem updates and institutional partnerships that have reignited investor confidence.

1. The Aviva Investors Partnership

The primary catalyst for the recent sentiment spike is the partnership between Ripple and Aviva Investors, a major European asset management firm.

The collaboration aims to:

Tokenize traditional fund structures on the XRP Ledger (XRPL).

Integrate real-world assets (RWA) into the decentralized ecosystem.

Leverage XRPL for faster, low-cost institutional fund management.

2. Technical Milestones & Privacy Updates

The XRPL is evolving to meet institutional demands for privacy. A new update slated for Q1 2026 aims to introduce confidential transfers.

This will Feature: Encrypted balances and opaque transfers and allow businesses to transact privately while remaining auditable by regulators—a "holy grail" for institutional adoption.

3. Institutional Inflows (ETFs)

While Bitcoin ETFs saw outflows, XRP-related products have seen steady interest. The XRPI (XRP ETF/Volatility Shares Trust) recently declared its first dividend on February 17, 2026, signaling a maturing financial product suite for the token.

Data also shows a shift in how the "crowd" holds XRP. The threshold to enter the Top 10% of XRP holders has adjusted to approximately 2,232 XRP. Interestingly, while large "whales" have remained stable or slightly consolidated, the number of wallets holding under 500 XRP has grown by nearly 30% since late 2024, indicating a massive influx of retail participants.

NOTE: When the crowd is "fearful" of Bitcoin but "excited" about a specific altcoin like XRP, it often indicates a period of independent price discovery for that asset.

Conclusion:

The market is currently eyeing two major hurdles: the $1.67 resistance level for XRP and a looming U.S. Supreme Court decision regarding macro-economic powers (expected around February 20th). If XRP can maintain its current momentum through these external shocks, the "decoupling" from Bitcoin could become a defining trend for the first half of 2026.