This is a very important and timely question for the Ethereum ecosystem right now.

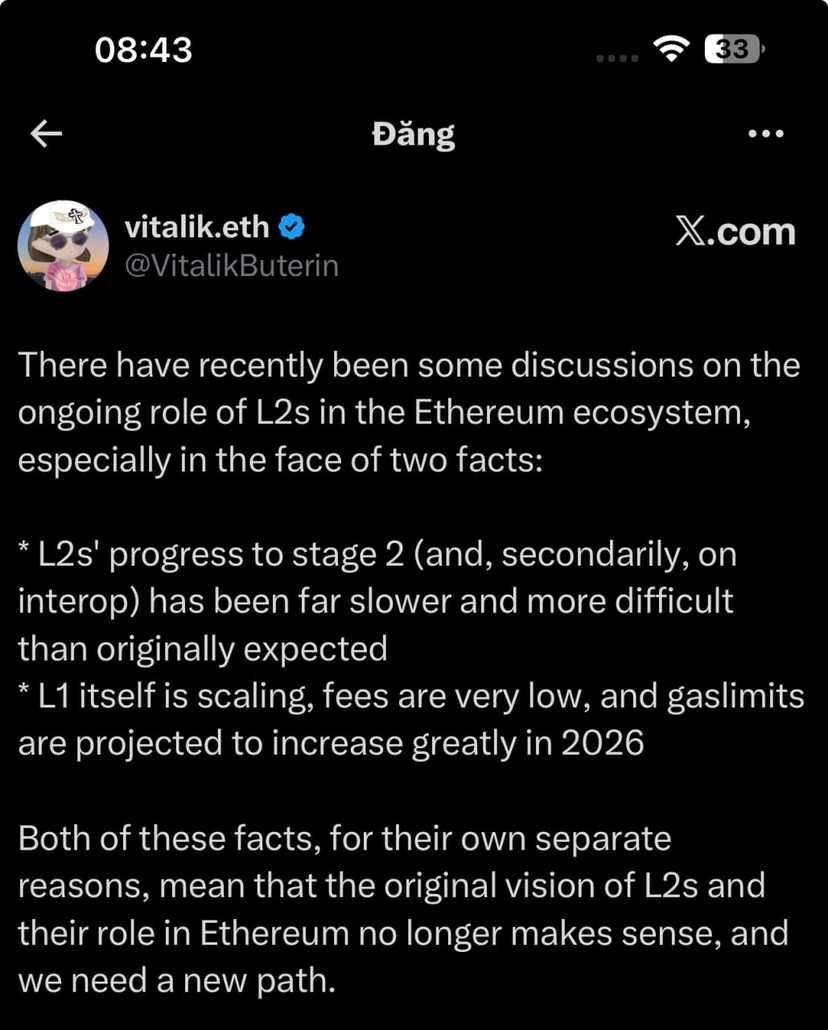

First, what Vitalik is pointing out revolves around two major facts:

L2s progressing to “Stage 2” (fully decentralized, no reliance on multisig or admin control) has been much slower and harder than expected.

L1 itself is scaling, fees are very low, and gas limits are projected to increase significantly in 2026 — meaning L1 is no longer as constrained as before.

This challenges the original thesis that Ethereum is just a settlement layer and everything must move to L2.

The shift in narrative around $ETH

What we may be witnessing is not the death of L2s, but a strategic recalibration of $ETH’s long-term positioning.

The old narrative was:

L1 is congested and expensive → L2s are mandatory.

The emerging reality is:

L1 is becoming more efficient → L2s must justify their existence beyond cheap fees.

As $ETH strengthens at the base layer, the power dynamic changes. L2s can no longer rely purely on the scaling narrative. They need independent economic gravity.

If L1 keeps scaling, what happens to L2s?

There are three realistic outcomes:

1️⃣ L2 consolidation

Only a handful of L2s with strong ecosystems, revenue, and decentralization survive. The rest slowly fade out or merge.

2️⃣ App-specific evolution

L2s shift from “Ethereum scaling tools” into specialized execution layers for gaming, DeFi, social, or AI. They stop competing with L1 and instead complement it.

3️⃣ Market stress test

If gas limits increase significantly in 2026, the market will naturally test which L2s provide real value versus which ones were driven mainly by token incentives and airdrop cycles.

The real risk is not L1 scaling

The real risk for L2s is:

Centralized sequencers

Weak decentralization guarantees

Bridge vulnerabilities

Poor interoperability

If L2s fail to reach credible decentralization, the “secured by Ethereum” promise becomes fragile.

Strategic takeaway

This moment could actually be bullish for $ETH.

If L1 scales while maintaining security and decentralization, Ethereum becomes a stronger economic core. L2s that survive will be those that:

Are truly decentralized

Generate sustainable revenue

Offer unique execution advantages

Build real developer ecosystems

Weak L2s may disappear.

Strong L2s may evolve into powerful modular extensions anchored to $ETH.

The future likely isn’t “L2 vs L1.”

It’s a stronger $ETH base layer with fewer, more meaningful L2s built on top.

If you want, we can go deeper into how this affects L2 tokens specifically or what it means for capital rotation across the ecosystem.