🌊 Most people look at a new L1 and ask “how fast is it?” The smarter question in February 2026 is “how well does the speed translate into usable liquidity and seamless user experience?”

Fogo is answering that question in real time.

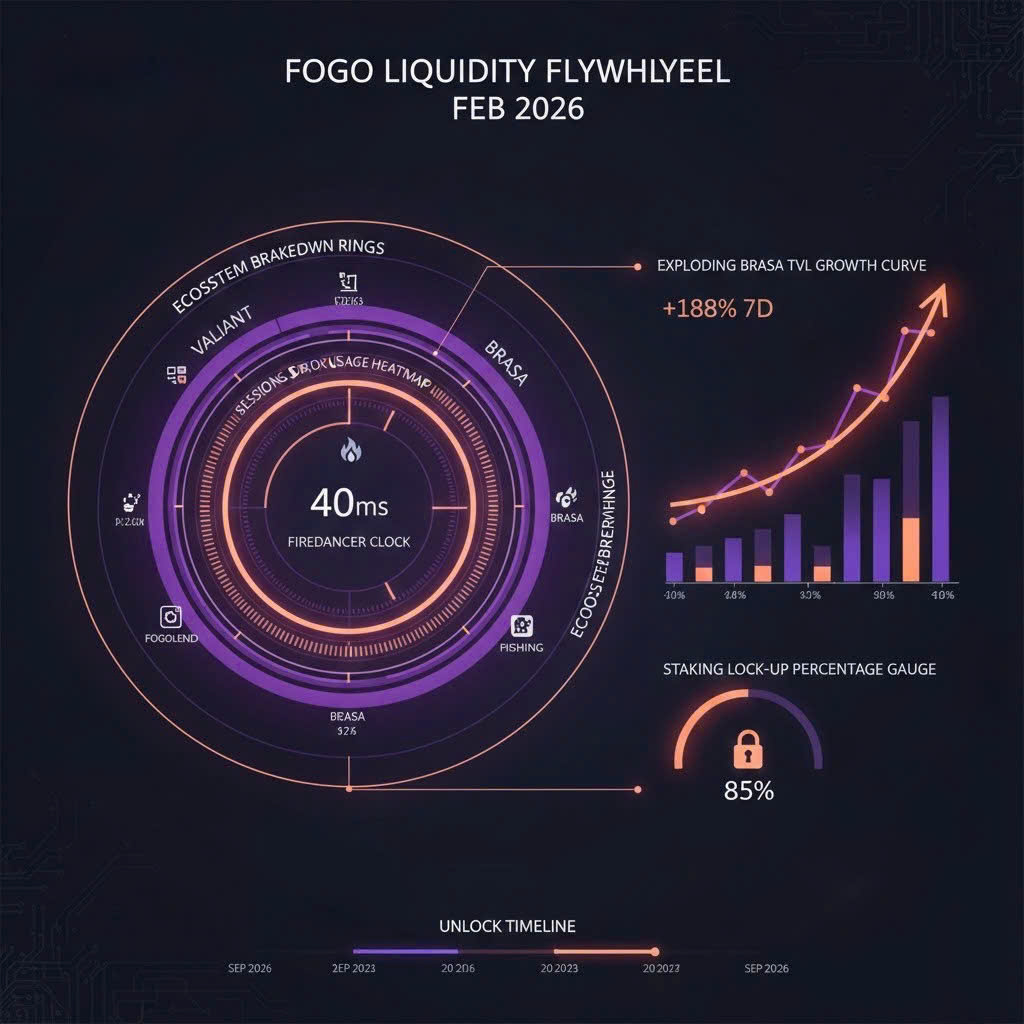

With mainnet now over a month old, the combination of native Firedancer delivering consistent 40ms block times, SVM optimization for deterministic execution, and the February 13 Sessions SDK upgrade is creating something special. I spent last night stress-testing it myself: established one Session, then moved freely between Valiant for low-latency swaps, Fogolend for borrowing, Brasa for liquid staking my FOGO into stFOGO, and even jumped into Fogo Fishing to see how the on-chain game handled high-frequency actions. The experience was shockingly smooth — no gas, no lag, no friction.

This is what composable real-time primitives look like in practice. Not marketing slides. Actual production flows.

The data backs it up. Brasa Finance has seen one of the most impressive growth curves on any new L1, with TVL surging nearly 200% in the last week alone while the total chain TVL climbs toward $1.4M. Users stake FOGO, receive liquid stFOGO, and immediately put it to work on Valiant. That’s the kind of capital efficiency that only a purpose-built low-latency chain can enable.

Compare that to chains that bolted on speed later. Fogo didn’t retrofit — it was engineered from the ground up for exactly this use case: high-frequency, capital-efficient, real-time finance. While many high-performance L1s still fight unpredictable fees and sequential bottlenecks, Fogo’s SVM + Firedancer combo gives deterministic 40ms execution and sub-1.3s finality that turns complex multi-protocol strategies into single-flow experiences.

As we approach the Uruguay Sunset event on February 26 at the iconic Club Hotel Casapueblo, the timing feels perfect. LATAM has always been crypto-native, but the infrastructure has rarely matched the ambition of its traders and builders. Fogo is bringing gasless Sessions and institutional-grade speed straight to the region through targeted onboarding, developer grants, and the kind of real-time primitives that power everything from sophisticated trading on Valiant and OnchainOil to immersive gaming on Fogo Fishing.

The deeper implication is bigger than just speed. In 2026, the winning L1s won’t be the ones with the most hype. They’ll be the ones that remove the mental overhead of using blockchain. Fogo Sessions does exactly that: set your parameters once, and the network handles the rest while keeping full non-custodial security and full composability across the entire ecosystem.

Tokenomics are perfectly aligned for this long game. Major unlocks don’t begin until September 2026, giving the team runway to focus purely on adoption and ecosystem growth. Binance campaigns are bringing fresh users into the Sessions experience right now, while early stakers via Ignition are locking significant supply with strong conviction.

The philosophical piece hits hard: blockchain was supposed to remove intermediaries. Most chains simply replaced them with new ones — gas fees, slow confirmations, bad UX. Fogo is one of the very few actually delivering on the original promise at the speed modern users expect. This isn’t another “fast chain.” This is the chain built so traders and builders never have to think about the chain.

The Uruguay Sunset isn’t just a party. It’s the public signal that the next chapter of low-latency DeFi is expanding south, and Fogo is already laying the rails.

What ecosystem play on Fogo are you most excited to see scale next? Do you believe gasless Sessions will be table stakes for all serious trading chains by end of 2026? How important will regional events like Uruguay Sunset be for L1 adoption?