I keep seeing people reduce @Fogo Official to a lazy comparison: “It’s an SVM chain, so it’s basically Solana.”

But the more I’ve dug into what they’re shipping and how they’re choosing to ship it, the more I feel like that comparison misses the actual point.

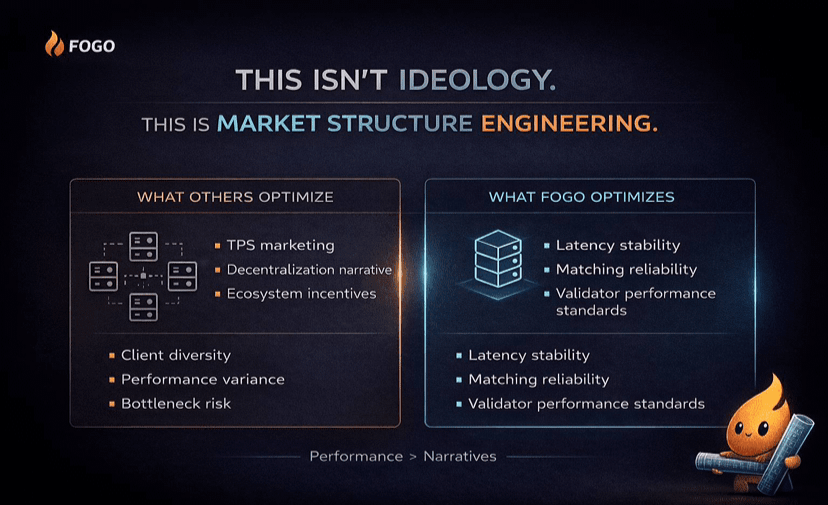

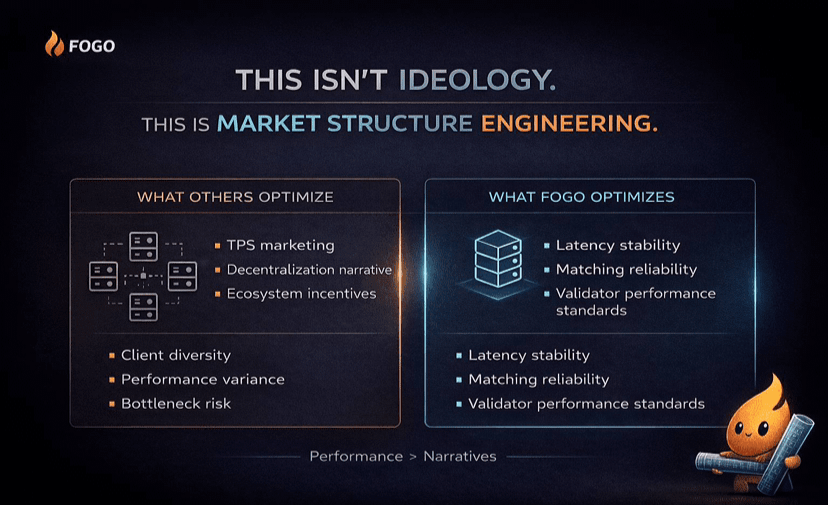

Fogo isn’t trying to win a public race for the loudest TPS chart. What I see instead is a chain trying to fix the part most traders and builders quietly suffer from on SVM ecosystems: performance that changes depending on who’s running what client, where they’re located, and how the network behaves under stress. That’s not a marketing problem. That’s a system design problem.

The unpopular tradeoff: less “anything goes,” more “this must behave like a venue”

Most L1s sell decentralization like a vibe. Fogo seems to treat decentralization like a constraint you optimize around, not a slogan you print on the homepage.

Two signals stood out to me:

1) A performance-first client direction (Firedancer DNA)

Fogo openly frames its stack around a high-performance Solana-style runtime, and it’s explicit about aiming for very fast block times (~40ms) and sub-second confirmations.

They also position their client work around Firedancer-grade performance as part of the chain’s identity.

And here’s where my “this isn’t just a clone” feeling kicks in:

If a chain is serious about real-time markets, it can’t act like the execution client is a casual choice. Client fragmentation is where “in theory” performance becomes “in practice” chaos.

2) Multi-local / colocated consensus as a feature, not a confession

Fogo describes a multi-local consensus model where validators are colocated (tight latency), and the active zone rotates over time to preserve geographic diversity. That’s not the usual “global-by-default” posture most chains insist on.

This matters because in trading systems, the killer isn’t “a bit slower.”

The killer is variance: tail latency, unpredictable inclusion, and timing drift that makes execution feel unfair.

Fogo’s design is basically saying: “We’ll reduce the physical coordination distance, then rotate where that coordination happens.”

That’s market-structure thinking, not crypto aesthetics.

Sessions are the sleeper feature (and I don’t think people respect this yet)

If I’m being honest, I care less about “headline speed” than I care about whether normal users can actually use the system like a product.

Fogo’s Sessions concept is the part I keep coming back to because it attacks the most annoying friction in on-chain trading UX:

too many wallet prompts

repetitive approvals

“sign again, sign again, sign again”

and the constant mental overhead of gas

Sessions are framed as a way to grant scoped permissions (limited actions, limited time, limited risk) so apps can deliver a smoother flow without turning the user experience into a permission-pop-up simulator.

And it’s not just convenience. It’s safety + control.

A good session model lets me say: “You can trade this market for 10 minutes, within these limits.” That’s how CEX UX feels—fast and controlled—without handing custody away.

What I think Fogo is really competing with

People keep comparing Fogo to Solana, but I don’t think Solana is the real enemy.

In my head, Fogo is competing with the thing that keeps winning during volatility: centralized exchanges.

CEXs win because they offer:

predictable execution

consistent latency

tight feedback loops

and a UX that doesn’t ask users to become part-time ops engineers

Fogo’s whole direction—colocation, disciplined timing, sessions, system-level predictability—feels like an attempt to make on-chain markets behave like an actual venue instead of a public experiment.

If they execute, the pitch becomes simple in a way markets understand: “Self-custody, but with venue-grade timing.”

My honest take: this thesis only works if stress testing proves it

I’m optimistic, but not blindly.

Because the moment of truth for a chain like this is never a demo day.

It’s a volatility spike. It’s liquidation cascades. It’s real flow hitting the network when everyone is awake at the same time.

So what am I watching?

Does performance stay consistent under load? (not just “fast,” but stable)

Do builders treat it like production, not a sandbox?

Does Sessions actually make trading feel frictionless, without creating new risk holes?

Does the multi-local design stay robust as zones rotate?

If those pieces start clicking, then “SVM chain” becomes the boring label—and the real story becomes:

$FOGO is trying to engineer market structure at the base layer.

And that’s exactly why I think comparing it to Solana is… shallow.