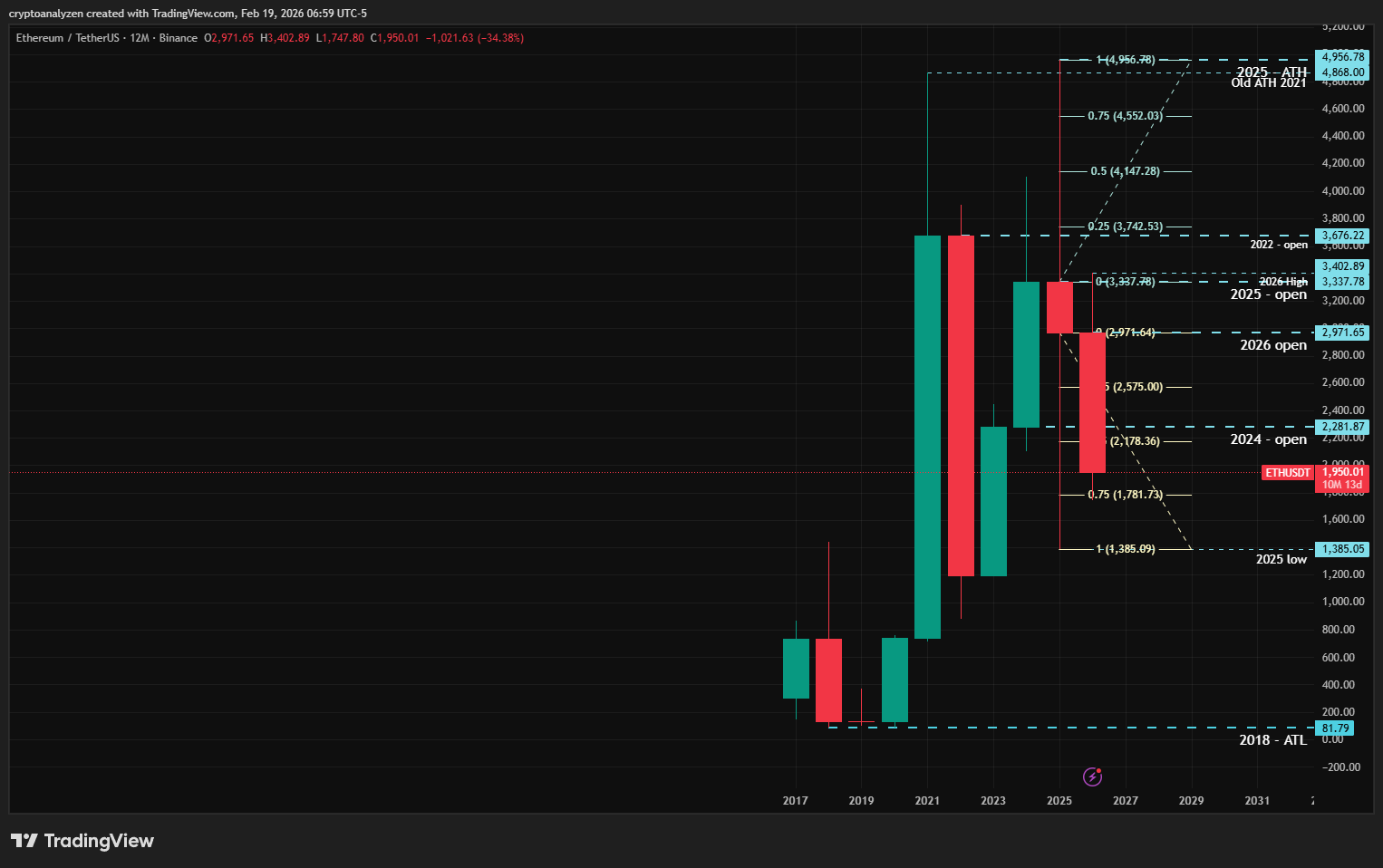

$ETH — Annual Chart

The coin has been trading within a wide range, with an ATH in 2018 at 81.79 and an ATH in 2025 at 4,956.78.

Last year, an attempt was made to break out of the range by forming a new ATH slightly above the previous 2021 ATH (4,868.00).

If we ignore the tails of the annual candles, the price appears to be holding within the boundaries of the 2021 range, suggesting that the upward move may still be incomplete.

I would particularly like to draw attention to the 2025 annual candle, which has almost equal upper and lower wicks.

At the beginning of 2026, the price dropped into the lower wick zone. Measuring that lower wick, the price tested the 75% level (1,781.73).

Considering the sharp decline from the 2026 opening level (2,971.64) at the start of the year, there is a high probability of an upward rebound — potentially testing not only the 2026 opening level but also previous yearly opening levels, as well as the Fibonacci levels derived from the upper wick of the 2025 annual candle.

In this scenario, the following levels should be monitored:

2,281.87 — 2024 open

2,971.65 — 2026 open

3,337.78 — 2025 open

3,402.89 — 2026 high

3,676.22 — 2022 open and 25% (3,742.53) of the 2025 upper wick

4,104.80 — 2024 high and 50% (4,147.28) of the 2025 upper wick

4,552.03 — 75% of the 2025 upper wick

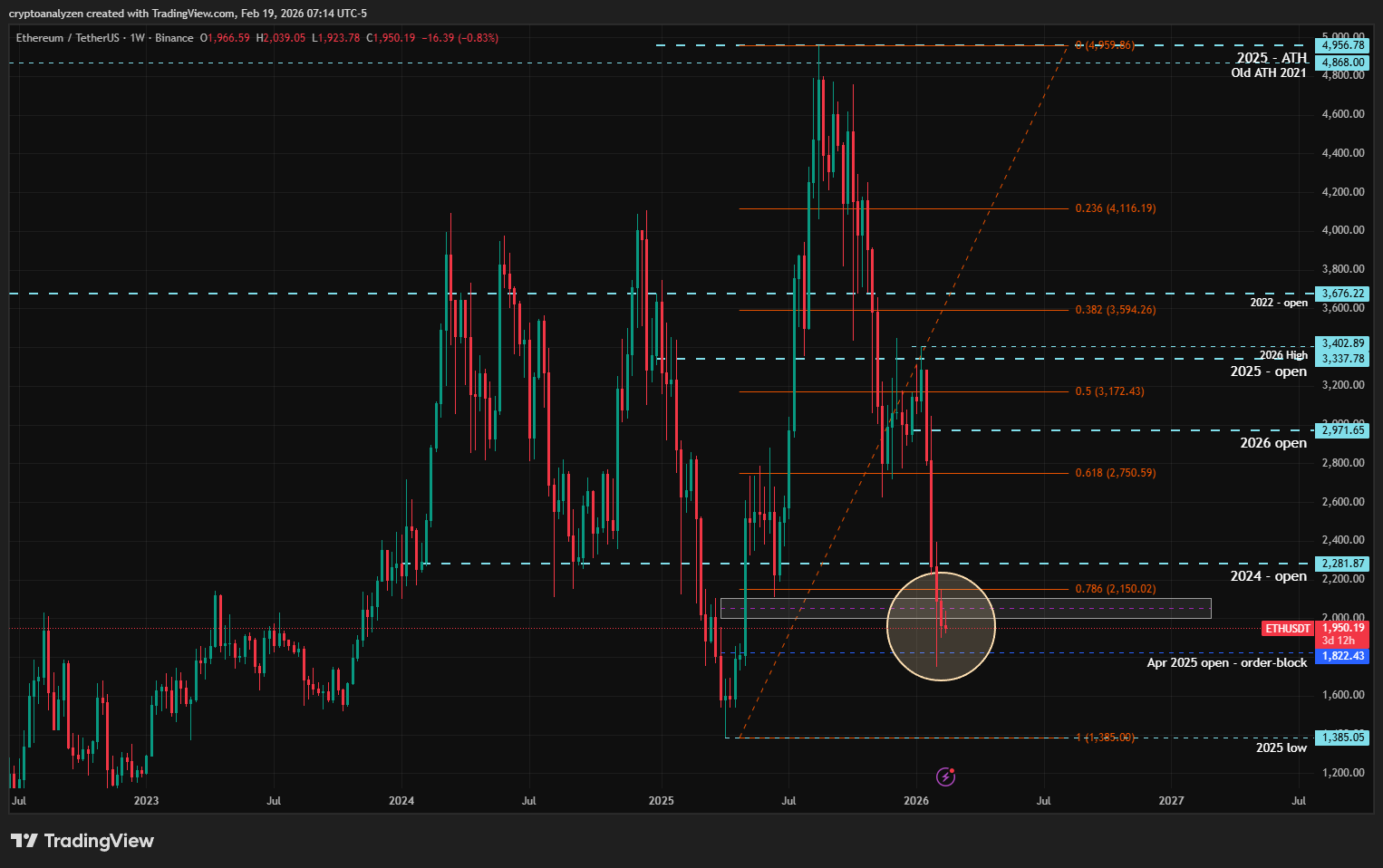

Weekly Chart

On the weekly chart, I have marked the entire 2025 range using Fibonacci retracements.

Currently (week 3 of 2026), the price has dropped below the 78% Fibonacci retracement level and below the gap zone, briefly entering the April 2025 order block zone — the month in which a reversal formation developed, followed by a strong upward move and the formation of a new ATH.

I suspect that a rejection structure may now be forming on the weekly chart.

For confirmation, the current weekly candle should close at or above the open of the previous weekly candle (2,089.73).

Conclusion

All current conditions indicate a high probability of an upward move and favorable conditions for positioning in the spot market, as well as for opening long positions in the futures market.

P.S. This entire analysis is human-generated, without any use of artificial intelligence.