Imagine you open an app to trade mint or stake You are ready to act Then the system stops you Not because the product is broken but because you do not own a special token just to press the button

That small step has always been presented as normal in crypto Buy the gas token Keep some aside Plan for fees If you forget your transaction fails You see a strange error message You leave confused

When I hear that @Fogo Official allows users to pay fees in SPL tokens my first feeling is not hype It is relief Because it quietly admits something the industry rarely says out loud The gas token step is not part of the product It is a logistics task And forcing users to manage logistics is the fastest way to make a good product feel damaged

In the old model the chain makes every user act like a fee manager Before you mint swap vote or stake you must first get the right token If you are short by a few cents the system does not gently warn you It simply fails That is not education That is friction wearing a traditional costume

Fogo shifting fee payments into SPL tokens changes something deeper than convenience It moves responsibility away from the user and up the stack Now the app layer starts carrying the burden

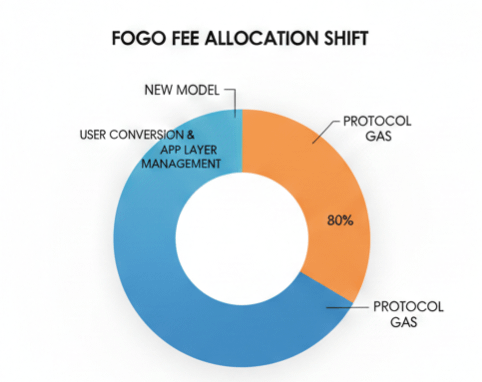

But fees never disappear Someone still pays The real change is who pays first who balances the books and who sets the price

If a user pays in one token but the network needs another there is always a conversion somewhere It might be an automatic swap It might be a relayer that fronts the cost It might be an operator holding inventory and managing risk Behind the smooth surface there is a pricing engine working quietly

And that is where the real story lives

What exchange rate does the user receive at the moment of execution Is there a hidden margin Who decides How does the system react when markets swing hard

This is not just better onboarding It is a structural shift

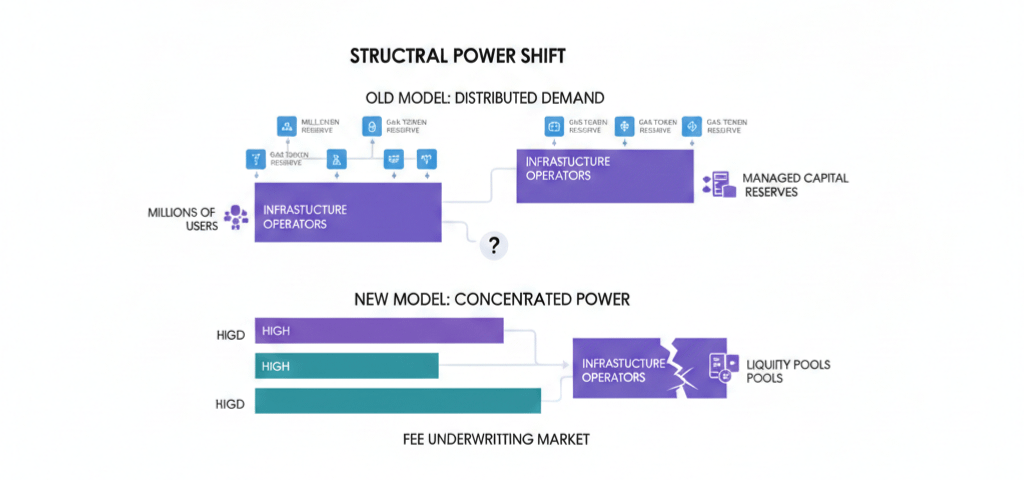

In a native gas world demand for the fee token is spread across millions of users Everyone holds small amounts Everyone tops up constantly It is messy but distributed

In an SPL fee world demand becomes concentrated A smaller group of operators holds large reserves They provision manage and protect capital like working cash That creates efficiency but also concentrates power

When problems happen the failure point changes

Before if you ran out of gas it was your issue Annoying but simple

Now if a paymaster hits limits changes accepted tokens widens spreads or goes offline the user only sees one thing The app failed The root cause sits in a layer most users do not even know exists

That is not automatically negative In many ways it is progress But it means trust moves upward Users now depend on infrastructure providers behaving well especially during stress

There is another layer to this shift When apps reduce repeated signature prompts and enable longer sessions they also change the security balance Instead of confirming every action users delegate authority Delegation can be safe if controlled properly but mistakes in permissions or front end design become more serious

So I do not ask whether this is convenient Of course it is I ask who now guards the system Who sets the limits Who prevents abuse without turning everything back into friction

Because once apps handle fees they inherit expectations If you sponsor or route fees you cannot blame the protocol when something breaks The user sees one product It either works or it does not

That creates a new battlefield

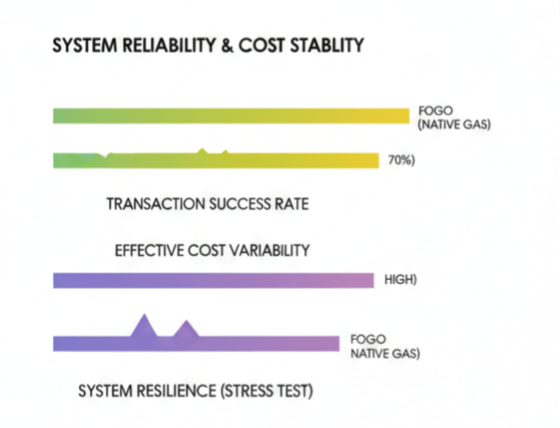

Apps will compete not only on features but on execution quality How often do transactions succeed How stable is the effective cost How transparent are limits How resilient is the system during chaos

The most important outcome is not that users stop buying gas tokens The real outcome is that a fee underwriting market begins to form The best operators may quietly become the backbone of the ecosystem shaping which assets flow smoothly and which apps feel strong

This is why I see Fogo move as more than a user experience upgrade It is a strategic redesign Fees become infrastructure managed by specialists instead of a ritual every user must perform

The real test will not come in calm markets Almost any abstraction works when volatility is low The real test comes when conditions turn ugly When prices move fast when congestion rises when attacks appear

In those moments we will see whether the underwriting layer protects users fairly or quietly charges them through spreads delays or sudden rule changes

So the key question is not can users pay fees in SPL tokens

The real question is who stands behind that promise how they price it and what happens when pressure builds

That answer will decide whether this change becomes a small improvement or a turning point in how on chain products are owned and experienced.