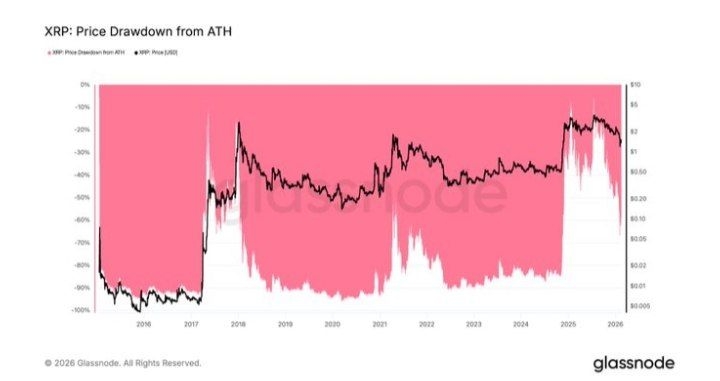

Multiple technical, onchain, and exchange-traded product signals indicate $1.12 may have marked a generational bottom for XRP. XRP climbed 50% from its Feb. 6 15-month low to $1.67, while the current $1.43 remains well below its $3.66 multi-year high.

Key takeaways:

XRP supply on exchanges fell to a five-year low, hinting at lower selling pressure.

Funding rates hit extreme lows, pointing to a potential bottom.

Positive spot CVD and steady ETF inflows show growing buyer and institutional demand.

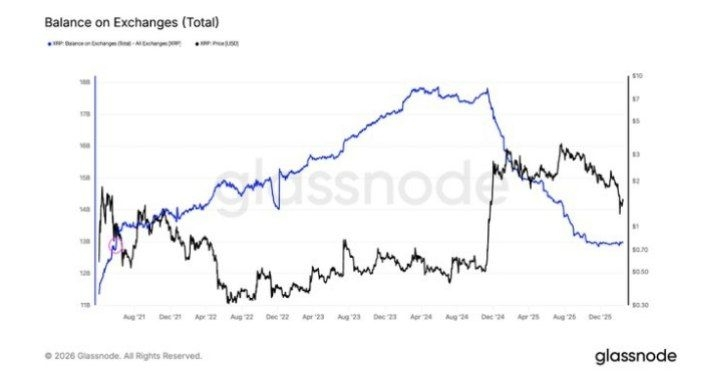

Falling XRP supply on exchanges is bullish

There has been a notable decline in the XRP supply held on exchanges over the past two years, as indicated by data from Glassnode. The XRP balance on exchanges dropped to 12.9 billion XRP on Tuesday, matching with levels last seen in May 2021.

A falling token balance on exchanges suggests a lack of intention to sell by holders, possibly reinforcing the future upside potential for XRP.

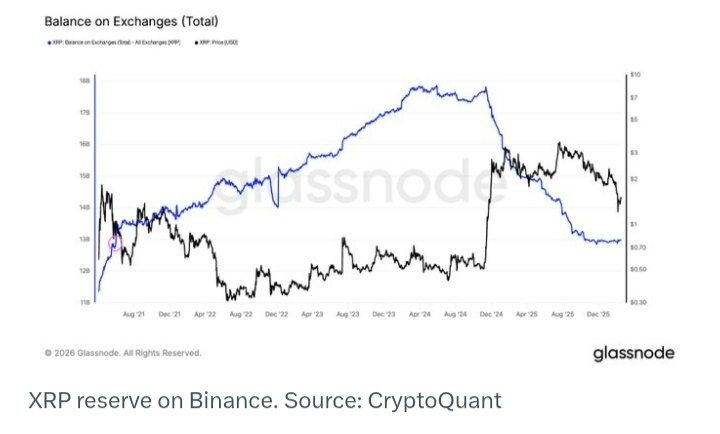

Additional data from CryptoQuant reveals that Binance’s XRP reserve has dropped sharply to around 2.57 billion XRP, with both the SMA(50) and SMA(100) sloping downward.

“Technically, reserves are declining while price remains near the lows,” said CryptoQuant contributor PelinayPA in a Monday Quicktake analysis.

This structure increases the probability of a potential short squeeze scenario ahead.

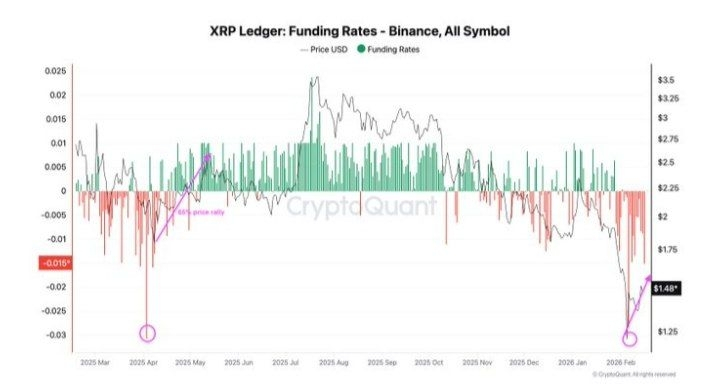

XRP funding rates fall to extreme lows

Binance funding rates fell to -0.028% as the price dropped to $1.12 on Feb. 6, the lowest level since April 2025. Combined with falling spot prices, negative funding rates reflect overcrowded shorts and capitulation among leveraged longs.

Historically, extreme negative funding often signals a potential bottom or short squeeze, as the market becomes oversold.

Similar funding conditions in April 2025 preceded a 65% rally to $2.65, from $1.60, as shorts were squeezed out.

Comparable setups toward the end of last year led to sharp upside rallies as traders scrambled to unwind short positions.

Meanwhile, Ripple Labs’s XRP futures open interest has dropped to about $2.53 billion, down 55% from the $4.55 billion peak in early January, according to CoinGlass. The decline shows leverage traders are cutting exposure instead of adding new bets, hinting that bearish pressure is fading and leaving room for a rebound if demand returns.

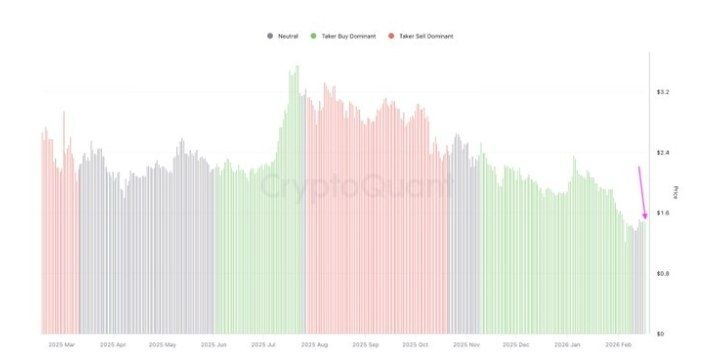

At the same time, the 90-day spot taker CVD has turned positive, with buy-side volume overtaking sells after days of neutral activity. This shift signals stronger buyer control, and sustained green readings could support accumulation at lower levels and fuel another upward move, similar to past recoveries.

Spot XRP ETFs inflows continue despite crash

US-based spot XRP exchange-traded funds (ETFs) continued to attract investor interest, with these investment products recording inflows 53 days out of 59, underscoring persistent institutional demand since their launch in November 2025 Spot XRP ETFs added $4.5 million on Friday, bringing cumulative inflows to $1.23 billion and total net assets under management to over $1.01 billion, according to SoSoValue data.

Similarly, while global crypto investment products logged the fourth week of outflows totalling $173 billion, XRP ETPs bucked the trend, emerging as the top performer with inflows of $33.4 million during the week ending Feb.13.

This reinforced the steady institutional demand for XRP-based ETPs, even as the market price weakened.

This article does not contain investment advice or recommendations.