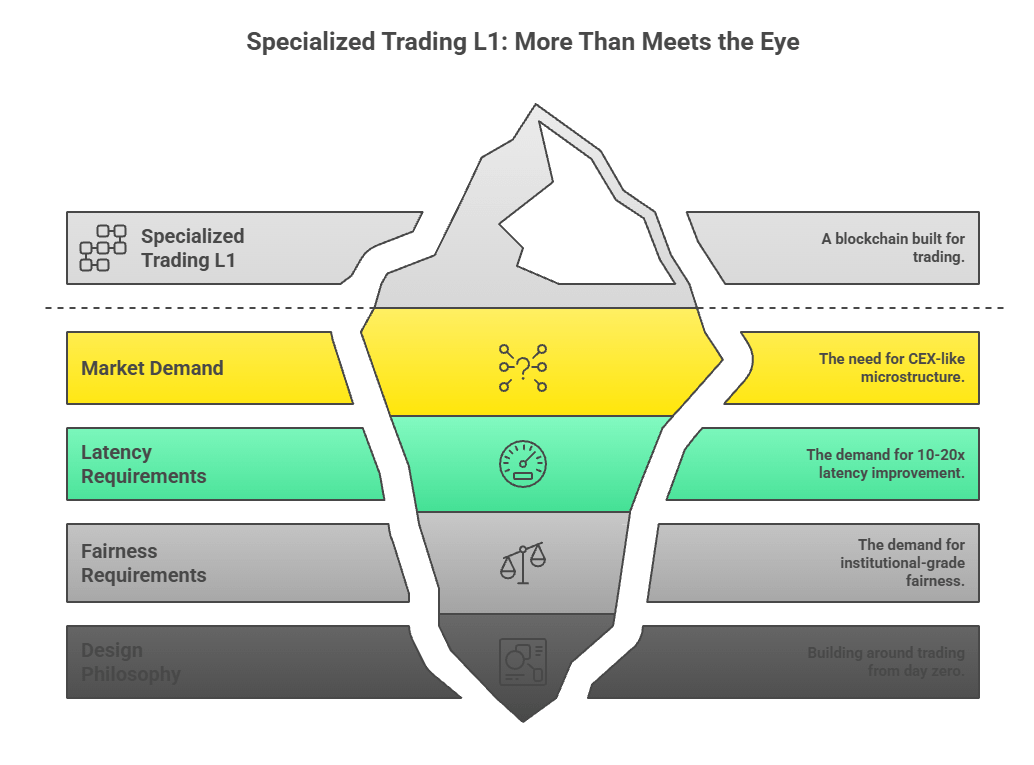

Because Fogo’s core argument is that if you want true exchange‑grade, real‑time trading on‑chain, you have to redesign the whole pipeline around that one job, not just bolt optimizations onto a general‑purpose L1.

1. General‑purpose L1s hit a structural latency floor

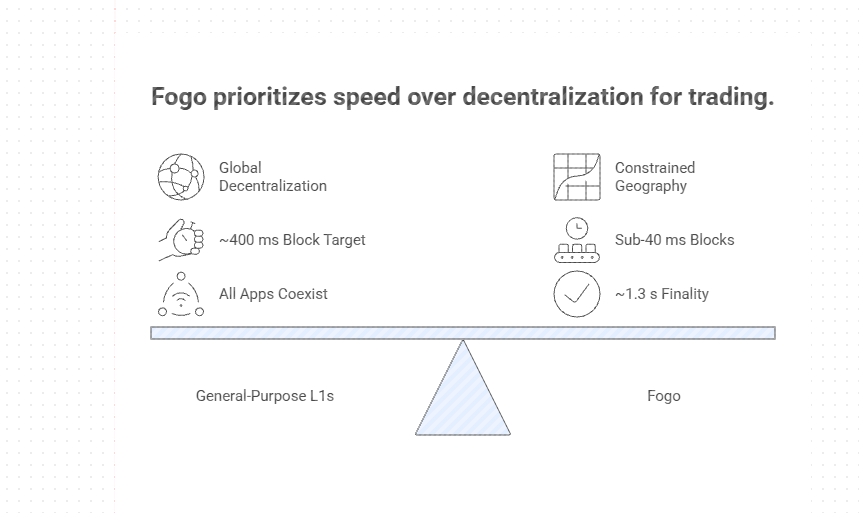

Solana, Ethereum L2s, etc. can keep getting faster, but they’re still designed as broad platforms serving NFTs, games, memecoins, perps, and everything in between.

They optimize for global decentralization and heterogeneous workloads, which means:

Validators are spread worldwide, so you pay a “speed of light around the planet” tax.

Block times and confirmation are tuned so all apps can coexist, not just orderbooks.

Even with Firedancer, Solana’s “comfortable” block target is still ~400 ms; Fogo is explicitly built around sub‑40 ms blocks and ~1.3 s finality by constraining geography and validator design.

Fogo’s thesis: that last 10–20× latency improvement isn’t just a better client; it requires changing the rules of the chain (who validates, where they sit, how consensus runs).

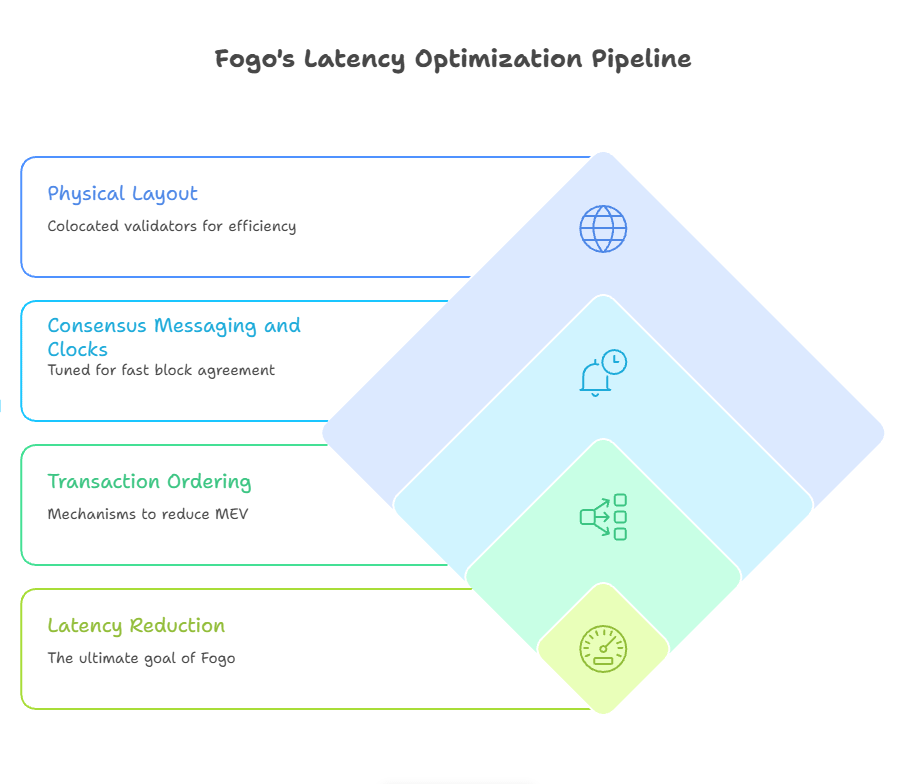

2. Latency is a system problem, not just an execution problem

The Fogo docs and research posts hammer this point: “when you require on‑chain order books, real‑time auctions, accurate liquidations and reduced MEV, you can’t just optimize the execution engine; you have to optimize the entire pipeline.”

That pipeline includes:

Physical layout: validators colocated in a few financial hubs, not evenly scattered worldwide.

Consensus messaging and clocks: multi‑local consensus tuned so blocks are proposed and agreed within tens of milliseconds, not hundreds.

Transaction ordering: mechanisms like DFBA/fair auctions to reduce toxic MEV windows around stale quotes and liquidations.

A general L1 cannot easily adopt those constraints without breaking its own decentralization and “serve everything” mandate, which is why Fogo exists as a separate, specialized chain.

3. Trading use cases have very different requirements

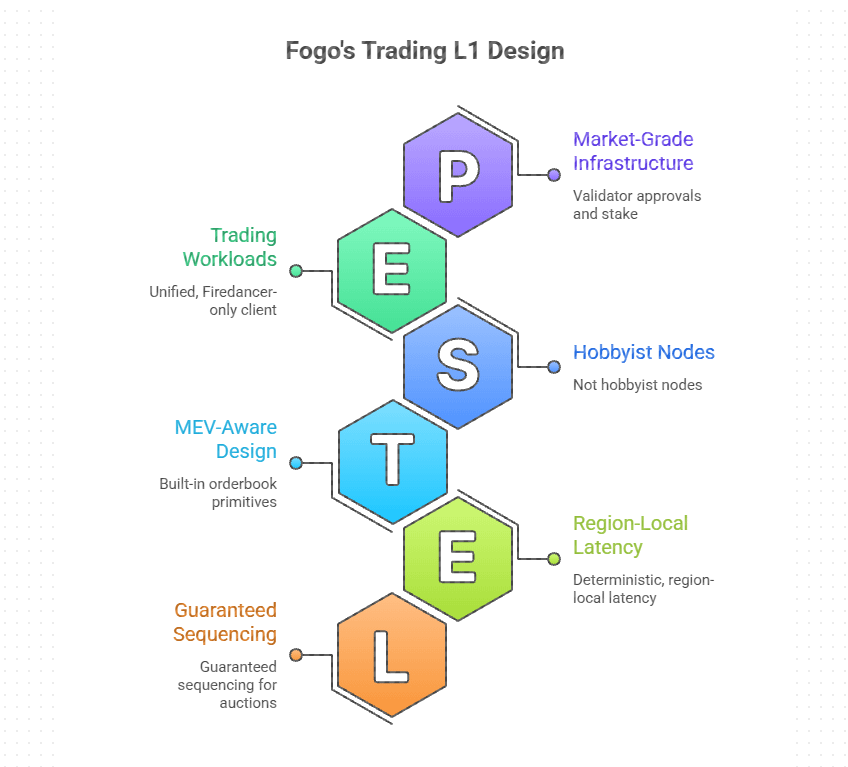

Orderbook perps, HFT strategies, and institutional RFQ flows care about things most other apps don’t:

Deterministic, region‑local latency (e.g., 20–40 ms jitter instead of 200–800 ms variability).

Tight windows for updating quotes so LPs aren’t constantly picked off on stale prices.

Guaranteed sequencing for auctions, liquidations, and batch executions.

Fogo’s design explicitly trades off breadth for those guarantees:

Unified, Firedancer‑only client tuned for trading workloads.

Built‑in orderbook/auction primitives and MEV‑aware design.

Validator approvals and stake thresholds shaped around “market‑grade” infra, not hobbyist nodes.

In other words: you could try to bend a general L1 to this shape, but you’d end up making it resemble… a specialized trading L1.

4. Why “just improve Solana” isn’t the same

Solana is already improving: Firedancer, better schedulers, local fee markets. But there are hard trade‑offs:

Pushing Solana to Fogo’s latency regime would likely mean:

Fewer, more curated validators.

More geographic concentration.

Tighter constraints on what apps run and how noisy they can be.

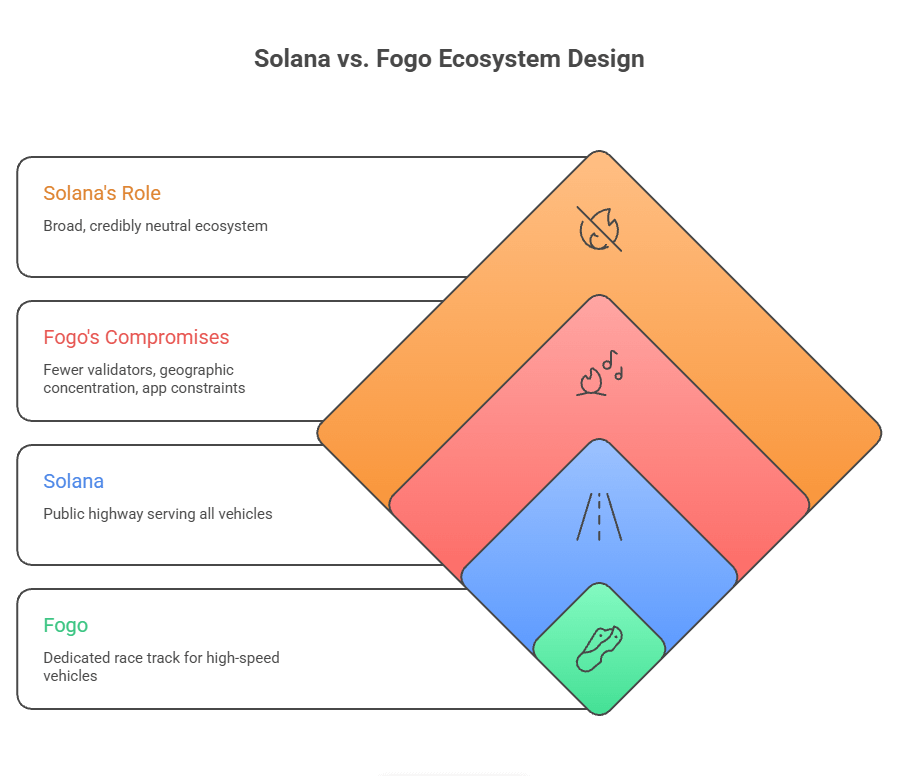

That would undermine Solana’s role as a broad, credibly neutral ecosystem. So instead, the market experiments with a parallel design where those compromises are explicit and opt‑in: Fogo.

Think of it like this:

Solana = a big, high‑speed public highway serving every vehicle.

Fogo = a dedicated race track, engineered only for cars going 300 km/h in one direction, with rules tailored for racing.

You don’t “upgrade the highway” into a racetrack without breaking its original purpose; you build the racetrack separately.

5. Does the market really need that?

That’s the open bet:

If institutional/HFT and serious on‑chain trading stay niche, Fogo remains a specialized tool with a small but real audience.

If large flows (RWA, institutional perps, serious market makers) really do move on‑chain, they will demand CEX‑like microstructure, and a highly specialized chain might be the only way to deliver it without bending a general L1 out of shape.

So the short answer:

The “specialized trading L1” exists because Fogo’s designers believe the last 10–20× of latency and fairness required for institutional‑grade, HFT‑style DeFi cannot be achieved by simply tuning a general‑purpose chain—you have to build one around trading from day zero.