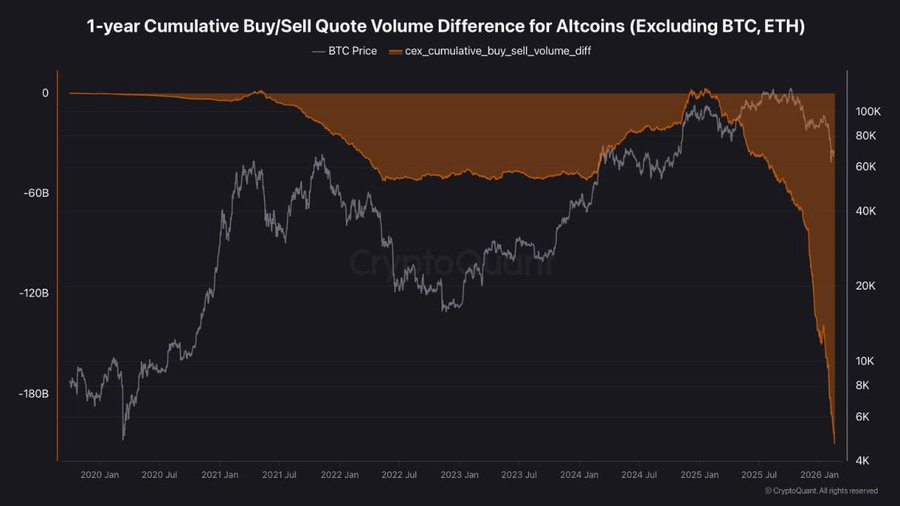

Altcoins Face Five-Year Sell-Off Peak with $209 Billion ImbalanceAs of February 19, 2026, altcoins (excluding Bitcoin and Ethereum) are enduring their most severe selling pressure in five years!

Key Factors:

Extreme Net Selling, Cumulative buy/sell volume difference reached negative $209 billion over the past 13 months (since January 2025), with 13 consecutive months of nonstop net selling on centralized exchanges, three times worse than the 2022 FTX collapse levels.

Retail Exit & Institutional Absence, Heavy retail investor outflows dominate, while institutional buying in altcoins remains minimal or absent, creating a significant demand vacuum.

Capital Rotation to Bitcoin, Liquidity shifts toward Bitcoin, pushing Bitcoin dominance to around 58-60%; altcoin trading volumes (e.g., on Binance) have halved from late 2025 peaks, with BTC consolidating near $68,000.

Bearish Warning, Prolonged imbalance signals exhausted sellers but no fresh buyers yet, bears note further downside risk without renewed demand or broader market recovery.

Bullish Technical Hope, Some traders highlight early reversal signs on the ALT/BTC ratio, including the first sustained green MACD for two consecutive months in 5.8 years, plus a recent bullish MACD crossover. A green monthly close for February could spark an altcoin rally in coming months.

The market shows clear Bitcoin preference amid volatility, but select technical indicators offer tentative optimism for altcoins if momentum builds...