Every few months another major brand announces a blockchain initiative. The press release sounds impressive. Innovation teams get quoted talking about transforming customer engagement. Technology publications write optimistic coverage. Then nothing happens. Eighteen months later if you ask about the project, you get vague responses about learnings and pivots and evolving strategies. The initiative died quietly and nobody wants to talk about why.

I’ve watched this pattern repeat enough times to recognize what’s actually happening underneath the announcements. It’s not that the use cases were wrong or that brands lost interest. It’s that the blockchain infrastructure couldn’t actually deliver what the project required when evaluated honestly against enterprise standards. And rather than admitting this publicly, everyone quietly moves on.

Vanar exists because someone finally built infrastructure that survives the evaluation process that kills most blockchain projects internally.

Let me walk through what that evaluation actually looks like because it’s different from how crypto projects think about technical requirements.

When a brand evaluates blockchain infrastructure, the first real question isn’t about transaction speed or decentralization philosophy. It’s about what happens when things go catastrophically wrong. Not if things go wrong. When. Because in enterprise technology, failures are inevitable and what matters is how systems handle failure rather than whether they fail.

Brand technology leaders need concrete answers to disaster scenarios. If your blockchain platform experiences critical failure during our major product launch, who can intervene? How quickly can they intervene? What authority do they have? What’s the communication plan? How do we protect customer data? When can we resume normal operations? What’s the post-mortem process?

Most blockchain platforms respond to these questions with ideology about immutability and decentralization and code-as-law. These answers are completely unsatisfying to people responsible for customer relationships and brand reputation. Vanar responds with actual runbooks for different failure scenarios, documented escalation procedures, redundant infrastructure across regions, and post-mortem processes that mirror what brands expect from any critical infrastructure.

The support model reveals similar disconnects between crypto thinking and enterprise requirements.

Crypto platforms provide community forums, documentation, and maybe Discord channels where developers help each other. This works fine for crypto-native teams comfortable with asynchronous community support and figuring things out themselves. It fails completely for brands who need responsive support from people understanding their specific implementation and capable of making decisions quickly when problems occur.

Vanar provides enterprise support that brands actually recognize as support. Dedicated account managers for significant partners. Response time commitments based on issue severity. Escalation paths involving engineers who understand the full stack rather than community volunteers. Post-incident analysis when problems occur. This isn’t exciting but it’s the difference between infrastructure brands will trust with customer relationships versus infrastructure they’ll only use for isolated experiments.

Cost predictability matters more than absolute cost levels for enterprise budget planning.

Most blockchain platforms charge based on gas or computational resources consumed with prices that fluctuate based on network congestion and crypto market dynamics. This creates fundamentally unpredictable costs. A brand running a customer loyalty program cannot budget for infrastructure where costs might triple unexpectedly because unrelated crypto activity congested the network.

Vanar offers pricing that finance teams can actually budget for. Fixed monthly costs based on expected usage tiers. Annual contracts with volume discounts. Clear overage policies if usage exceeds plans. No surprise expenses from crypto market volatility affecting operational costs. This boring predictability matters more for enterprise adoption than exciting features that come with cost uncertainty.

Integration requirements kill blockchain projects that look great in demos but can’t connect to systems brands actually use.

Brands don’t build greenfield applications. They have massive existing infrastructure for customer data, marketing automation, payment processing, inventory management, analytics, and everything else their business depends on. Blockchain features need to integrate with these existing systems rather than requiring complete rebuilds or isolated implementations that don’t connect to anything.

Vanar provides integration architecture designed specifically for enterprise middleware. Standard REST APIs that integration teams recognize immediately. Webhook support for event-driven architectures. Compatibility with enterprise authentication systems rather than only supporting wallet authentication. Message queue integration for asynchronous processing. Database replication options for analytical workloads. These technical details enable blockchain features to actually connect to the systems brands depend on rather than existing as demonstrations that never integrate with real operations.

Compliance capabilities determine whether blockchain is even possible for regulated industries.

Financial services face specific regulatory requirements. Healthcare has data handling rules. European operations need GDPR compliance. Geographic restrictions apply based on where customers are located. None of this maps to blockchain ideology about permissionless systems and censorship resistance. Most blockchain platforms respond to compliance questions by saying regulations shouldn’t apply or will change eventually. These responses make blockchain unusable for entire industry categories regardless of technical merit.

Vanar built compliance tooling directly into the platform. Geographic restrictions when regulations require them. Transaction monitoring for audit requirements. Configurable data retention policies. Identity verification integration for contexts requiring it. These features represent centralized control that blockchain purists criticize, but they’re absolutely mandatory for regulated industries to use blockchain infrastructure at all.

Developer experience determines how quickly brands can actually ship features after making adoption decisions.

Most blockchain platforms expect developers to learn Solidity or other specialized smart contract languages, understand gas optimization, think about MEV and front-running, and generally become blockchain experts before building anything useful. Brand technology teams don’t employ blockchain specialists and won’t hire them just to experiment with Web3 features.

Vanar’s tools work within normal development workflows. SDKs integrate with standard programming environments. APIs follow patterns familiar to anyone who has integrated third-party services. Documentation focuses on accomplishing specific tasks rather than explaining protocol internals. A developer who has built consumer applications can implement blockchain features without understanding what’s happening underneath. This accessibility expands who can build on the platform from blockchain specialists to the much larger pool of normal developers that brands actually employ.

Testing and staging environments matter because brands cannot experiment on production systems serving real customers.

Crypto platforms often provide minimal testing infrastructure assuming developers will test on testnets that don’t mirror production behavior. Brands need staging environments that exactly mirror production architecture so they can validate implementations thoroughly before exposing customers to new features. They need to simulate load scenarios, test failure recovery, validate integration with existing systems, and train support teams on new features all without risking actual customer data or experiences.

Vanar provides comprehensive staging infrastructure that behaves like production. Brands can test extensively before launch. They can run load simulations. They can validate disaster recovery procedures. They can ensure everything works correctly before customers see anything. This de-risks blockchain adoption by making validation possible rather than requiring faith that production will work as expected.

Training programs address organizational adoption challenges that kill technically sound initiatives.

New technology affects multiple teams with different concerns and expertise levels. Marketing needs to understand what’s possible. Technology teams need implementation guidance. Support teams need to handle customer questions. Legal needs to understand compliance implications. Finance needs cost models. Most blockchain platforms provide technical documentation and assume that’s sufficient. It isn’t.

Vanar provides structured onboarding matching how enterprises actually adopt new technology. Initial workshops establishing shared understanding across teams. Hands-on labs using realistic scenarios. Office hours where teams can ask questions while building. Certification programs giving individuals credentials their employers value. This educational infrastructure helps organizations build internal capability rather than remaining dependent on external consultants indefinitely.

Migration support recognizes that brands have existing systems they need to transition gradually rather than replacing completely.

Most enterprise adoption involves moving existing functionality onto new infrastructure rather than building new applications from scratch. Brands with existing loyalty programs need to migrate customer points. Brands with existing digital collectibles need to transition to blockchain ownership. These migrations require tools and expertise that most blockchain platforms don’t provide because they assume greenfield implementations.

Vanar provides specific migration tools and services. Data migration utilities. Gradual rollout capabilities. Dual-operation modes where old and new systems run parallel during transition. Rollback procedures if problems occur. This practical support for messy real-world migrations matters more for actual adoption than elegant architectures assuming clean starts.

The partnerships Vanar has secured validate that this enterprise-focused approach actually works.

Luxury brands don’t sign technology partnerships casually. They conduct intensive evaluation processes examining technical architecture, security practices, financial stability, support quality, and long-term viability. Their legal teams review contracts thoroughly. Their security teams test extensively. Their compliance teams verify claims independently. When luxury brands built production applications on Vanar, they completed evaluation processes designed specifically to find reasons to say no. The fact they said yes after those evaluations carries weight that crypto project partnerships cannot replicate.

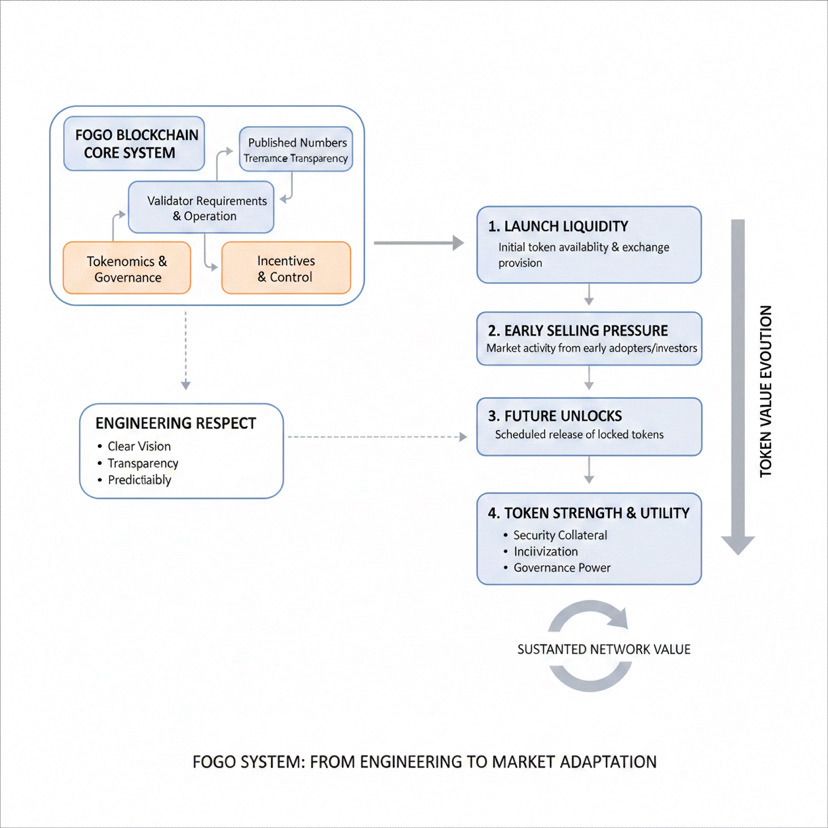

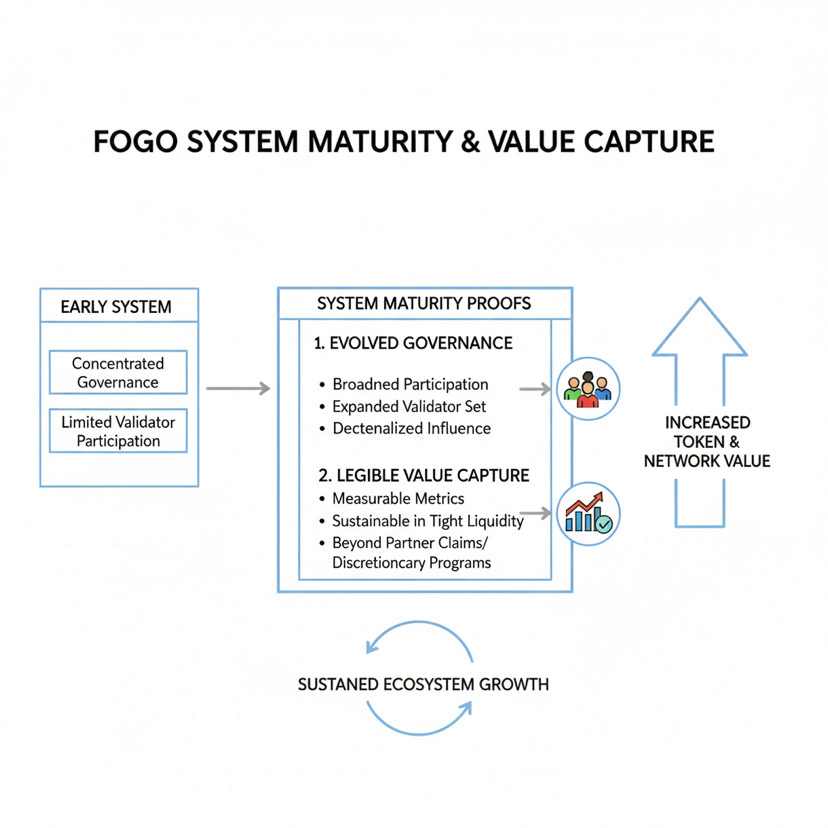

The VANRY token economics were designed for enterprise usage patterns rather than imported from DeFi models.

Demand comes from transaction fees accumulated through actual application usage rather than speculative trading. When brand applications serve millions of customers, those interactions generate substantial fee consumption that doesn’t depend on crypto market sentiment. Validators stake tokens to secure infrastructure and face financial consequences for poor performance. This creates alignment between network security and token value through actual utility rather than speculation.

I keep noticing how different Vanar’s growth trajectory looks compared to typical blockchain infrastructure. Most platforms optimize for metrics that impress crypto investors. Daily active addresses. Transaction volume from DeFi protocols. Total value locked. Vanar optimizes for mainstream consumers using blockchain features without knowing blockchain is involved. That’s harder to measure and harder to market but it’s the actual goal if mainstream adoption matters more than crypto metrics.

The next few years test whether brands actually embrace Web3 at meaningful scale or whether it remains perpetually experimental. Vanar positioned itself to benefit enormously if brands do adopt by building infrastructure that solves actual problems brands face rather than problems blockchain platforms think they should face. Whether this produces the mainstream adoption everyone discusses depends on execution and factors beyond any single platform’s control. But if blockchain becomes standard infrastructure for consumer brands, the infrastructure underneath will need to look very much like what Vanar built. And that makes their trajectory over the next few years genuinely worth watching regardless of your broader views on crypto adoption timelines.