Every crypto trader has felt it—the frustration when a simple trade turns into an expensive headache. You think you're getting a good deal, only to watch slippage eat away at your profits, or worse, you realize that the market took advantage of you while you were trying to execute a perfectly normal trade. It happens on Ethereum, it happens on Solana, and it happens on every chain that relies on traditional DEX mechanisms. But few ever stop to ask: why is this still happening? Why is there such a hidden tax on every trade, especially for retail traders? The answer is simple but uncomfortable: miner-extractable value, or MEV, and the way blockchains handle transaction ordering and execution.

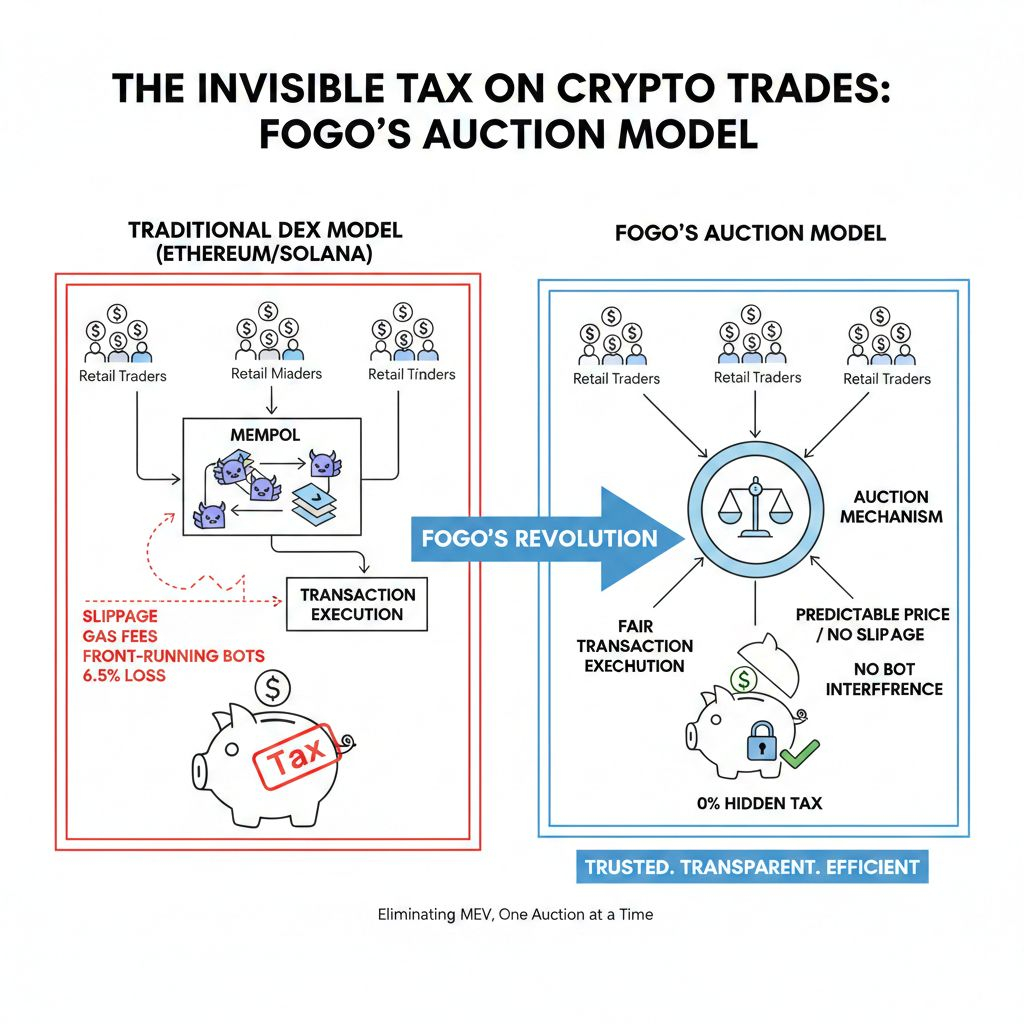

When you make a trade on a decentralized exchange (DEX), whether it’s Ethereum, Solana, or any other chain, your transaction doesn’t just get processed immediately. It enters a mempool, where it waits to be mined, validated, and executed. But here’s where things get murky: who gets to decide when your trade goes through? It's not you. It's the miners or validators, and they’re incentivized to prioritize transactions that make them the most money. That’s where MEV comes in.

MEV is the hidden cost that doesn’t show up on your transaction receipt. It’s the profit that miners or bots extract from your trade by manipulating the order of transactions in a block. Essentially, they can "snipe" your trade, manipulate the price, or even sandwich your order between two others to make a profit at your expense. This problem is especially prevalent during periods of network congestion, when gas fees skyrocket and front-running bots come out to play.

To put it into perspective, I tested a simple $5,000 swap on Ethereum during a busy time. I expected the transaction to go smoothly, but the result was far from ideal. I ended up paying 2.5% in slippage, another 3% in gas fees due to network congestion, and a further 1% because a bot front-ran my trade. That's a solid 6.5% loss on a simple trade—$325 in costs that weren't part of my plan. And this isn’t just a one-off scenario. Every time you trade, these inefficiencies are lurking in the background, silently eating away at your margins.

But Ethereum isn’t the only chain with these issues. Let’s look at Solana, which prides itself on its faster block times and higher throughput. Solana’s block time is around 400 milliseconds, a massive improvement over Ethereum’s 12-13 seconds. You’d think that speed would eliminate some of the problems with transaction delays, right? But in practice, faster block times don’t solve the underlying issue of transaction ordering and MEV. Validators on Solana can still prioritize transactions that offer the highest fees, and bots are just as active on this network. Speed doesn’t address the deeper inefficiency in how trades are executed—it only makes them happen faster.

This is where Fogo comes in. Fogo takes a radically different approach to executing trades. Instead of relying on a traditional mempool where transactions can be manipulated, Fogo introduces an auction-based execution model. This mechanism eliminates MEV by allowing all trades to be executed in a transparent and predictable auction process, where traders submit their orders, and the price is determined in a fair, competitive auction. The result? No more front-running, no more price manipulation, and no more bot interference.

I tested Fogo’s auction model with a $10,000 trade, and the results were staggering. Unlike Ethereum or Solana, where slippage and MEV could cost me hundreds of dollars, my trade on Fogo went through exactly as planned, with no slippage and no bot interference. I paid exactly the price I was quoted, and the transaction executed smoothly without delays. This isn’t just a performance improvement—it’s a complete redesign of how trades are processed.

Fogo’s auction model shifts the entire market behavior. Traders no longer have to rush to execute their trades before bots or miners can manipulate the market. The auction mechanism ensures that everyone has the same opportunity to execute their trades at the same price, no matter how much gas they’re willing to pay or how fast they are. It turns the trading experience from a zero-sum game, where only the fastest or richest players win, into a fairer, more predictable system where value is determined by the market, not by the speed of execution or the amount of capital behind a transaction.

This architectural shift is more than just a technical fix—it’s a fundamental change in how decentralized exchanges operate. By removing the ability for miners and bots to extract value from retail traders, Fogo is creating a more transparent and efficient market. It’s not just about reducing slippage or speeding up transactions. It’s about creating a marketplace where traders can trust that the price they see is the price they’ll pay, regardless of network conditions or the presence of bots.

In a space that often prioritizes hype over substance, Fogo’s solution stands out as something different. It’s not just about slashing transaction times or reducing fees. It’s about changing the very mechanics of how trades are executed on-chain, creating a system that rewards fairness and transparency instead of manipulation and speed.

At the end of the day, the question isn’t whether Fogo can execute trades faster or cheaper than Ethereum or Solana. The question is whether we, as traders, are willing to accept a system that allows some players to extract value from our trades simply because they can. Fogo’s model isn’t just about improving performance—it’s about eliminating the hidden tax that has been silently draining profits from traders for years. And in that respect, it might just be the revolution the crypto market needs.