Imagine trying to trade stocks in a world where every order takes minutes to clear, like mailing a check instead of tapping your phone. That's been DeFi's Achilles heel for years, slow settlements turning potential profits into missed opportunities amid volatile swings. But in 2026, as tokenized real world assets and on chain derivatives gain traction with institutions, Fogo emerges as the Layer 1 that finally delivers real time financial rails. Built for sub second executions, this SVM compatible chain isn't chasing vanity metrics like raw TPS; it's laser focused on enabling instant, reliable infrastructure for everything from high frequency trading to automated settlements. From my years digging into blockchain bottlenecks, Fogo feels like the missing link, bridging TradFi speed with DeFi's openness without the usual trade offs.

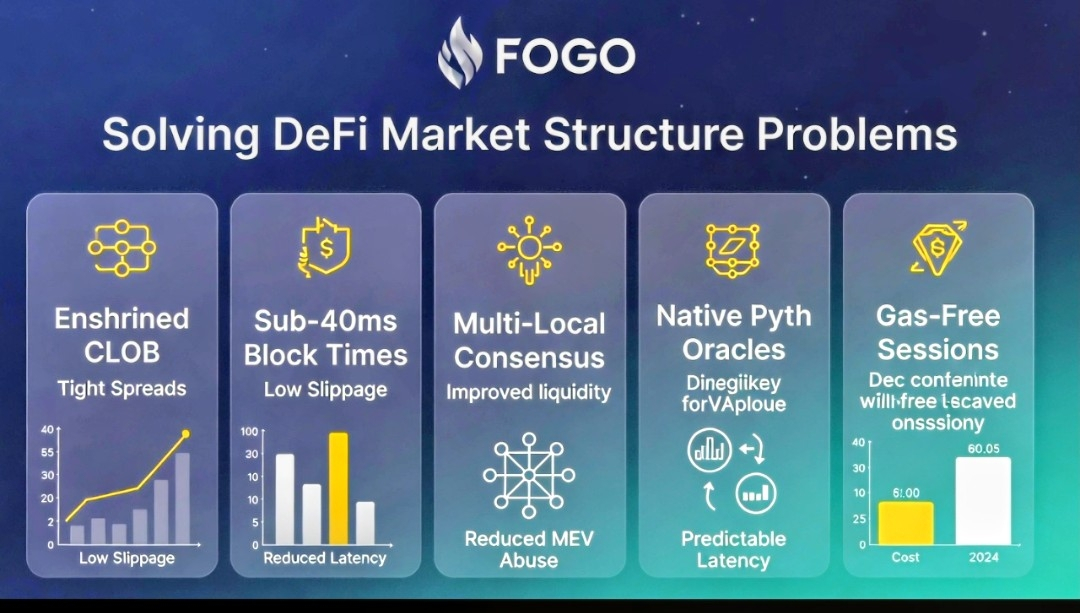

Real time finance on chain demands more than just fast blocks; it requires a symphony of low latency, accurate data, and seamless liquidity. Fogo orchestrates this through its pure Firedancer client, a battle tested validator engine that cranks out blocks in under 40 milliseconds, with finality hitting around 1.3 seconds. This speed stems from multi local consensus, grouping validators in tight regional hubs like Tokyo or New York to slash data travel times, achieving up to 80 percent faster propagation than scattered global networks. Picture a relay race where runners start side by side instead of continents apart, no dropped batons. In practical terms, this powers instant order matching on its enshrined central limit order book, where liquidity pools chain wide to avoid the fragmentation that dogs AMM heavy ecosystems. Native Pyth oracles pipe in sub second price feeds, ensuring settlements reflect live market conditions, not outdated snapshots. Early mainnet data since January 2026 shows Fogo handling peaks of 1000 TPS with negligible delays, far outstripping Solana's occasional congestion hiccups during similar loads.

This setup unlocks real time applications that were pipe dreams on slower chains. Take perpetual futures: Fogo's gas free sessions allow rapid position adjustments without fee erosion, while the CLOB ensures deep books for large trades, mimicking CEX efficiency but with self custody. Or consider tokenized bonds settling in milliseconds, aligning with 2026 trends like BlackRock's push into on chain treasuries, where every tick matters for yield optimization. In my view, having seen clunky DeFi interfaces firsthand, Fogo's wallet agnostic access and SVM compatibility make it a developer magnet, porting Solana apps seamlessly to this faster environment. Ecosystem traction backs this up, with dApps like Valiant DEX clocking over 600 million dollars in volume by late February 2026, demonstrating how real time rails boost user retention and capital efficiency in a market where DeFi TVL has surged past 200 billion dollars industry wide.

[Here, insert a line graph comparing Fogo's block production and finality times against Solana, Sui, and Ethereum L2s under varying loads, overlaid with real time settlement success rates to visually underscore the infrastructure advantages.]

No breakthrough comes without caveats. Fogo's single client reliance on Firedancer, while optimizing performance, heightens vulnerability to software flaws or targeted exploits, potentially disrupting the very real time flows it promises. Market wise, with a token price near 0.025 dollars and cap around 95 million dollars, volatility persists amid Q3 2026 unlocks that could dilute if adoption slows. Regulatory scrutiny on high speed protocols, especially in regions like the EU pushing for MEV curbs, adds external pressure. Yet opportunities eclipse these, as Fogo rides waves like renewed SVM interest and institutional DeFi inflows, positioning it to capture billions in migrating liquidity from laggy platforms.

Outlook wise, by 2027, Fogo could anchor hyperscaled financial hubs if parallel execution integrations land, fostering ecosystems for AI driven trading bots or instant cross chain settlements. Personally, I envision it outgrowing niche status to become essential plumbing for hybrid finance, though broader crypto winters could delay that.

[Here, insert a bar chart illustrating Fogo's projected TVL growth versus competitors in real time DeFi sectors, annotated with key catalysts like oracle expansions and developer grants for dynamic visual storytelling.]

Investors, here's the playbook: treat Fogo as a long term infrastructure bet, staking for 8 to 12 percent yields to weather dips while contributing to network resilience. Monitor metrics like daily transactions on Valiant DEX for organic growth signals, and diversify entries post unlock for better averages. Skip the hype chasing; focus on its role in maturing DeFi, where real time edges compound over cycles. In sum, Fogo isn't just faster, it's the enabler turning on chain dreams into everyday reality.