I opened CoinGecko this morning and saw FOGO up more than 10% in 24 hours, trading around the $0.0259 area.

My first thought wasn’t excitement. It was: what am I missing?

A 10% move in crypto isn’t exactly rare. It happens to dozens of coins every single day. Most of them give it all back within 48 hours. The question isn’t whether something moved. It’s whether the move means anything.

The Trending Narrative

FOGO is trending on CoinGecko. It’s trending on CoinMarketCap. It’s active on Binance. And immediately the narrative forms around this.

“When you see the same coin on all the big platforms, attention is growing. Attention is liquidity. Liquidity is movement.”

That’s true. It’s also incomplete.

Attention creates short-term price action. What it doesn’t necessarily create is sustainable demand. I’ve watched hundreds of coins trend across all these platforms, pump for three days, then bleed for three months.

The trending itself doesn’t tell you whether real accumulation is happening or whether it’s just coordinated excitement that evaporates once the first sellers show up.

What 10% Actually Tells Us

A 10% move in 24 hours means buying pressure exceeded selling pressure for that period. That’s it.

It could mean whales are accumulating quietly. It could mean a few medium holders decided to buy. It could mean retail FOMO kicked in after seeing the green number. It could mean someone with a large position decided to push price to trigger stop losses and liquidations.

Without on-chain data showing where the volume is actually coming from, the 10% is just a number on a screen.

I went looking for that data. Wanted to see if wallet distribution changed. Whether large holders were adding or reducing. Whether new addresses were entering or existing holders were just trading among themselves.

Found some metrics. Not enough to draw clean conclusions. Which means I’m back to watching behavior rather than trusting narratives.

The Early Strength Theory

The argument I keep seeing is: “Smart positioning happens when the market is still doubting. FOGO is showing early strength.”

I understand the logic. Get in before everyone else realizes what’s happening. Position before the obvious momentum attracts attention.

But here’s the thing I’ve learned from actually trading this pattern. For every coin that showed “early strength” and then rallied sustainably, there are ten that showed early strength, attracted exactly this kind of attention, and then collapsed when the early buyers took profits.

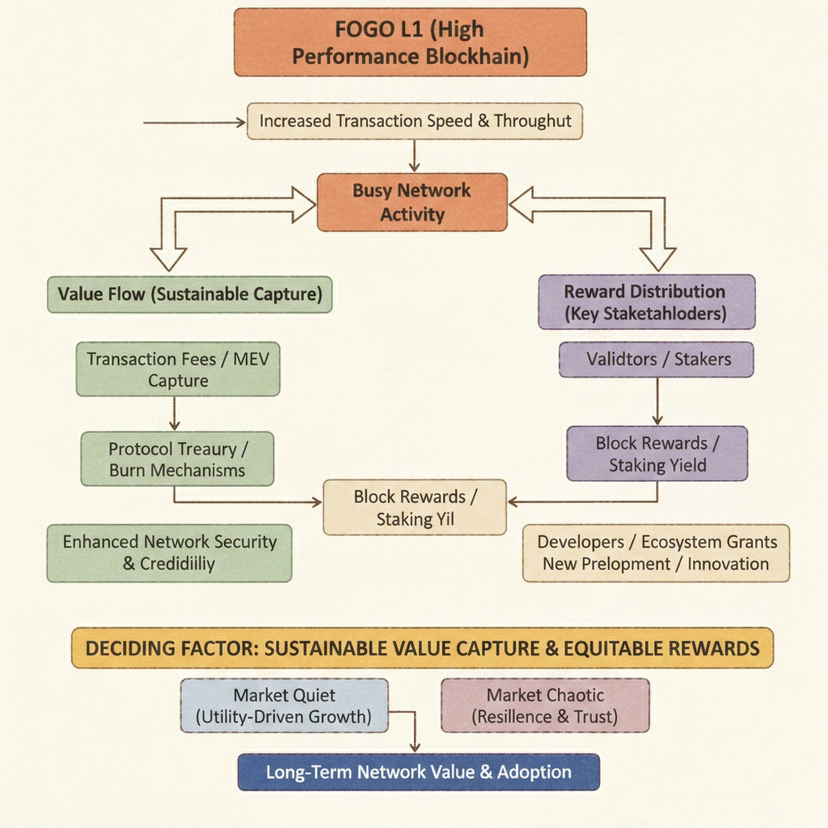

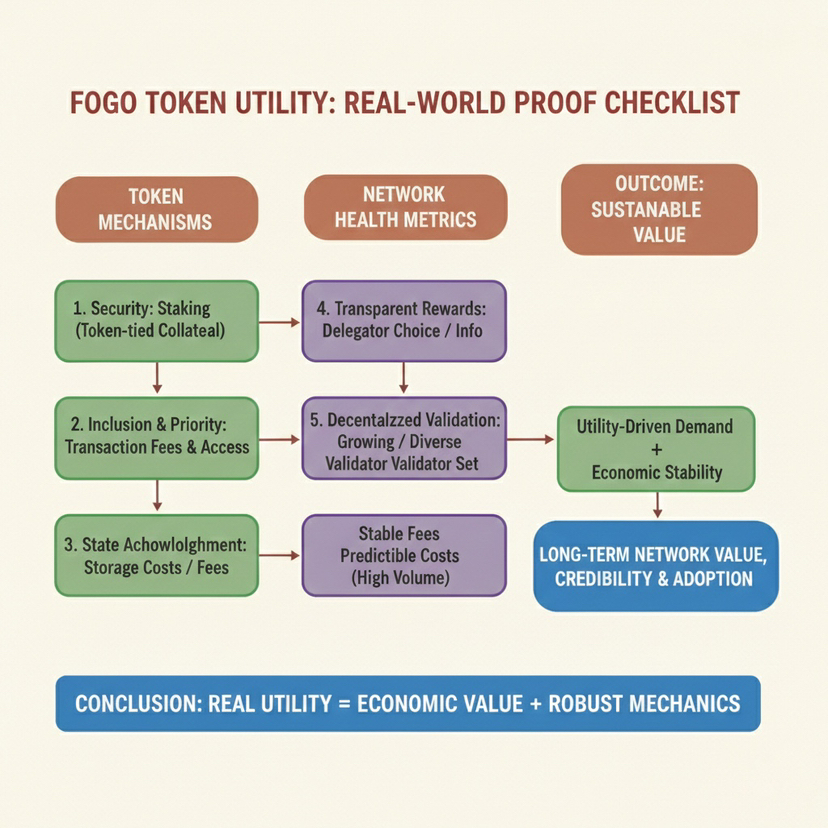

Early strength is only meaningful if something fundamental changed to support higher prices. A new partnership that creates real demand. A product launch that drives usage. A token burn that reduces supply. Technical improvements that make the chain more valuable.

Otherwise it’s just price moving because price moved, and that’s not a foundation for anything.

The Rally Pattern Everyone Knows

“Look at history. Coins don’t just wake up and do 100%. First small pump. Then small correction. Then stronger pump. Then breakout.”

This gets repeated so often it feels like wisdom. It’s actually just pattern recognition bias.

Yes, some coins follow this pattern. I can also show you fifty coins that did the small pump, small correction, then died. Or did small pump, massive correction, then never recovered.

Describing a pattern that worked in hindsight doesn’t mean you can identify it in real-time before it completes. That’s the gambler’s fallacy dressed up as technical analysis.

The Psychology Play

The psychological argument is more interesting. When a coin trends on major platforms, new investors search it. Curiosity brings buyers. New buyers create demand.

That’s absolutely real. I’ve seen it work dozens of times.

But it’s also extremely time-limited. The window between “trending creates curiosity” and “curiosity becomes exit liquidity for early holders” is shorter than most people think.

If you’re buying because something is trending, you’re often buying exactly when the people who positioned earlier are looking for someone to sell to. That doesn’t mean you can’t make money. It means your timing has to be sharper than theirs.

The Binance Confidence Factor

“Listing exposure on Binance gives confidence to retail traders. People trust big exchanges.”

True. Binance listing legitimizes a project in the eyes of retail. That confidence can absolutely fuel short-term price action.

It can also create a false sense of security. Binance lists hundreds of coins. Most of them don’t do well long-term. The listing proves the project met minimum requirements. It doesn’t prove the project will succeed.

I’ve held coins listed on Binance that went to zero. The listing didn’t save them.

What I Actually See in the Chart

I pulled up the FOGO chart and looked at the structure. The 10% move happened. Volume increased during the move. Those are facts.

What I can’t see clearly is whether this is accumulation or distribution disguised as accumulation. Whether the move is supported by new capital entering or existing holders rotating positions.

The chart shows higher lows recently. That’s mildly constructive. But it’s also coming off a period of significant drawdown, so “higher lows” might just mean “less intense selling” rather than “strong buying.”

Support levels exist. Resistance levels exist. Price is between them doing what price does. None of that tells me whether the next major move is up or down.

The Waiting Game Nobody Talks About

“Some people are waiting for a deep dip that maybe never comes. Price is slowly climbing step by step.”

This is the argument designed to create urgency. Don’t wait. Buy now. You’ll miss it.

And sometimes that’s correct. Sometimes the dip you’re waiting for doesn’t come and you watch price run away from you.

Other times you wait, the dip comes, and you enter at much better levels while the people who bought the “early strength” are underwater hoping for recovery.

Neither strategy is automatically wrong. They’re just different risk profiles. One optimizes for not missing moves. The other optimizes for not buying tops.

What Should Actually Happen

The advice at the end is the same advice everyone gives. Study the chart. Watch volume. Don’t invest what you can’t afford to lose. DCA to reduce risk.

All good advice. All generic.

Here’s what I’d add specifically for FOGO right now.

If you believe in the technology thesis, the 10% move doesn’t change anything. The chain either solves real problems or it doesn’t. Price noise is just noise.

If you’re trading momentum, then yes, this could be the start of a run. But you need to define your exit before you enter. What’s your profit target? What’s your stop loss? At what point do you admit the momentum trade failed?

If you’re hoping to catch the next 100x, a 10% pump on established exchanges probably isn’t the signal you think it is. Those massive returns typically come from much earlier positions with much higher risk.

The Honest Assessment

FOGO moved 10%. It’s trending on major platforms. Volume picked up. Social buzz increased.

None of that tells me whether this is the beginning of a sustainable rally or a short-term spike that fades in two weeks.

What would tell me? Continued accumulation by large holders. Sustained volume above recent averages. Clean technical breakout with follow-through. On-chain metrics showing new addresses entering and staying rather than just flipping quickly.

I haven’t seen enough of that data yet to have conviction either way.

So my position right now is the same as it was last week. FOGO has interesting technology. The tokenomics concern me. The short-term price action is noise until proven otherwise.

If you bought the move, congrats. Set a stop loss. If you’re watching from the sideline, there’s no shame in waiting for more confirmation. And if you’re not interested at all, there are 15,000 other coins doing exactly the same thing today.

The market doesn’t reward you for buying every pump. It rewards you for being right about the ones that matter.