If you missed the early days of ETH or SOL, you cannot afford to ignore what’s happening with the Vanar Intelligence Economy.

you’ve been following the L1 wars, you know the drill: everyone claims to be the fastest. But as we settle into 2026, the market has realized that speed is a commodity. The real value isn't in how fast you can move data, but in how much of that data your AI can actually remember.

Enter the "Amnesia Problem." Most blockchains are stateless. When an AI agent interacts with a dApp on a standard chain, it’s like it has goldfish memory. Every new transaction is a clean slate. To give an AI context, developers have to pull data off-chain, which is slow, expensive, and centralized.

This is exactly why Vanar Chain ($VANRY) is currently the most undervalued L1 in the intelligence economy. Their secret weapon? myNeutron.

1. Neutron: The End of Blockchain Amnesia

Vanar’s Neutron Layer isn't just another storage solution. It is a Semantic Memory layer. Think of it as a decentralized brain that doesn't just store files, but understands the meaning and relationships between them.

While other chains struggle to store a single PDF on-chain due to gas costs, Neutron uses a proprietary neural structuring technique to compress data by up to 500x. A 25MB legal contract or medical record is shrunk into a 50KB "Seed." This Seed is permanent, immutable, and most importantly queryable by AI in real-time.

Why this matters for your bags: In 2026, the most successful dApps will be those powered by AI agents. These agents need a "home base" where their memory is stored. Vanar is the only chain providing that native memory.

2. The Kayon Reasoning Engine: Adding a "Brain" to the Ledger

Data without logic is useless. That’s where Kayon comes in. If Neutron is the memory, Kayon is the pre-frontal cortex. It is a decentralized reasoning engine that allows smart contracts to perform "inference" on-chain.

Instead of a smart contract just saying "If A happens, do B," a Kayon-powered contract can ask: "Is this invoice consistent with the previous 10 transactions stored in Neutron?" This capability has already opened the doors to $800 million in cross-border trade volume from new energy vehicle companies using Vanar to tokenize real-world assets (RWA). They aren't just moving money; they are moving intelligent data.

3. The $VANRY Value Flywheel: From Hype to Utility

As a long-term researcher, I look for "Buy Pressure." In 2026, $VANRY has successfully transitioned into a Usage-Driven Asset.

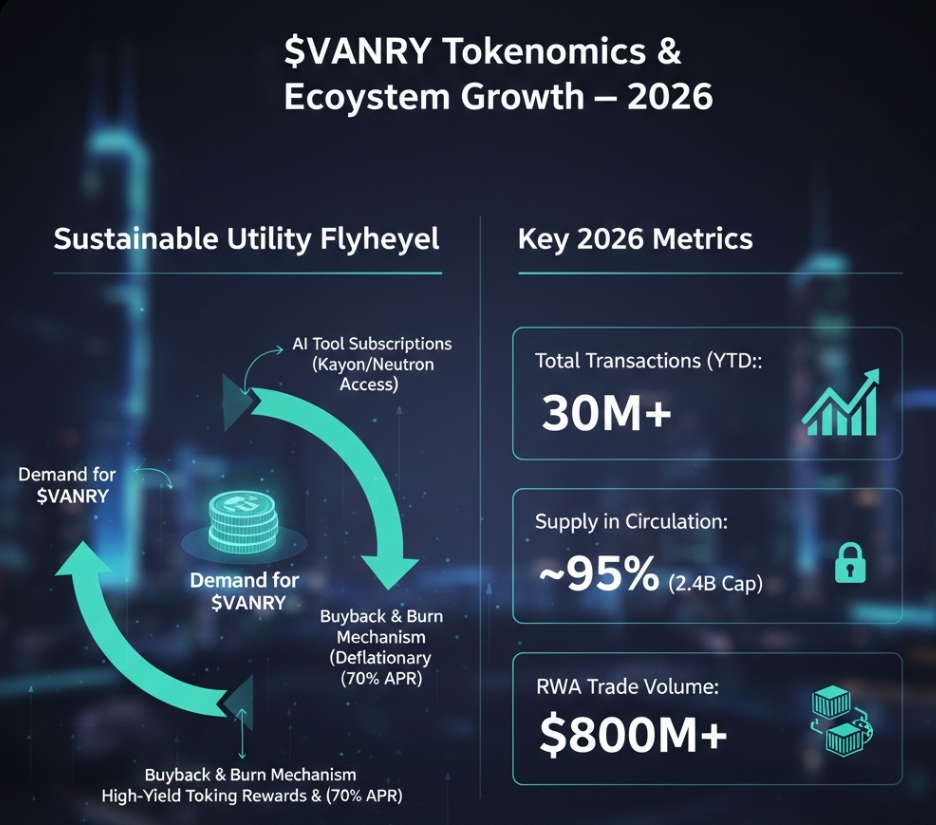

The Q1 rollout of the AI Tool Subscription Model was the turning point. Developers and enterprises no longer just pay one-off gas fees; they pay recurring subscriptions in $VANRY to access the Neutron and Kayon layers.

Scarcity: With ~95% of the supply in circulation, there is no "VC dump" coming to save the bears.

Deflation: A portion of these subscription fees is tied to a buy-back and burn mechanism, effectively making $VANRY a "triple-point" asset (Store of Value, Capital Asset, and Consumable Utility).

4. ESG: The Institutional "Must-Have"

We can't ignore the climate. In 2026, institutional funds are legally bound by ESG (Environmental, Social, and Governance) mandates. They cannot buy into chains with high carbon footprints.

Vanar’s Zero-Carbon status isn't just a marketing gimmick; it’s a business requirement. It’s the reason why global giants and national-level digital wallets are choosing Vanar for their RWA pilots. It is the "compliant" choice for the trillion-dollar institutional migration.

Final Verdict: The Execution Year

The "L1 Narrative" is dead. The "Intelligence Narrative" is the only thing that matters in 2026. While other chains are trying to figure out how to bridge to AI, Vanar is the bridge.

With its unique 5-layer stack and a tokenomics model that actually rewards holders through ecosystem usage, $VANRY is no longer a "speculative moonshot" it’s foundational infrastructure.

Where do you see $VANRY by the end of 2026? Are we looking at a Top 20 flip? Let me know your technical analysis in the comments below! 👇