Most blockchains still feel like a tool you have to “learn,” and that is exactly why they struggle outside crypto circles, because mainstream users do not want to learn a tool, they want an experience that behaves like the rest of the internet: fast, predictable, and quietly reliable.

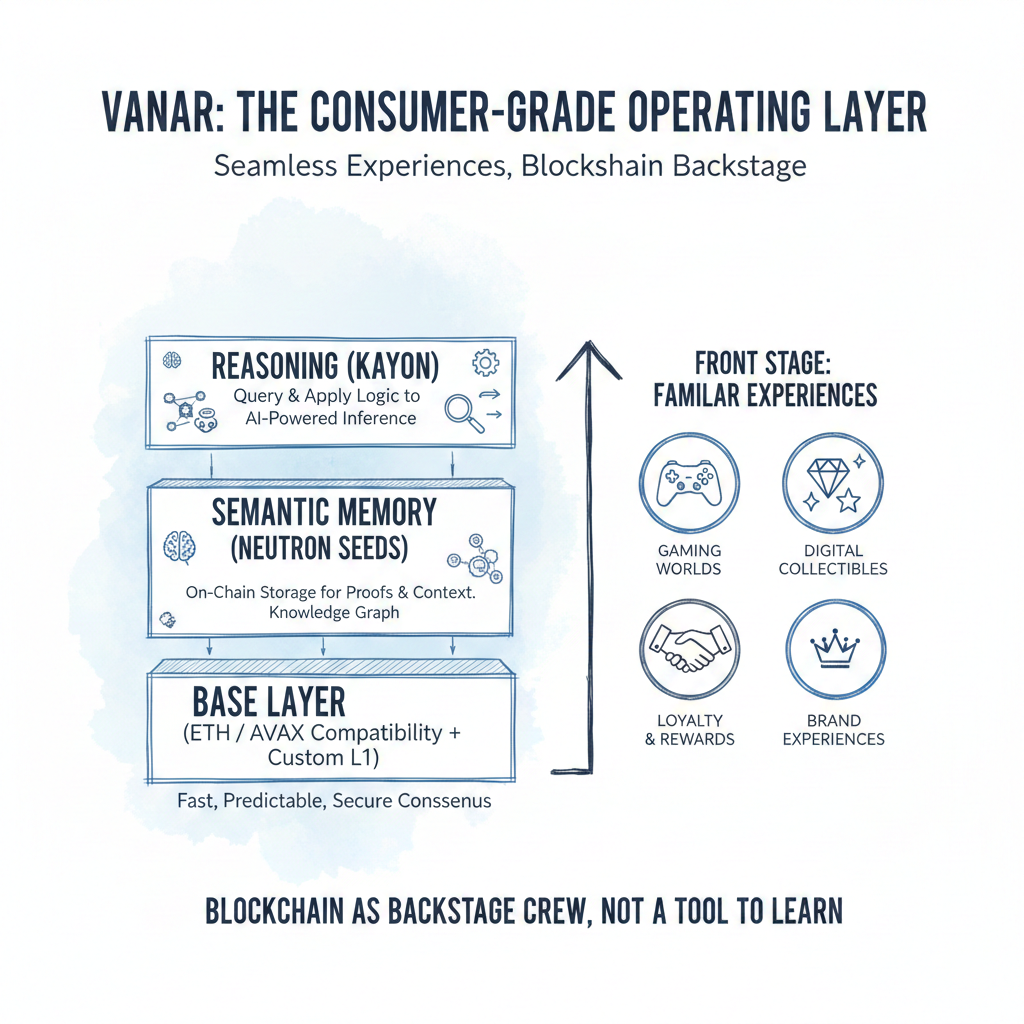

When I look at Vanar, the story that stands out is not “another Layer-1,” it is an attempt to build a consumer-grade operating layer where the chain is the backstage crew, and the front stage is familiar territory like gaming worlds, digital collectibles, loyalty, and brand experiences.

Vanar’s own positioning makes that intention explicit through a stack, not a single chain, where the base layer is paired with semantic memory (Neutron Seeds) and reasoning (Kayon) so applications can store proofs and context on-chain and then query and apply logic to that context without constantly outsourcing meaning to off-chain systems.

That matters because most chains are great at recording events and terrible at preserving meaning, which is the difference between a ledger that can show you a transaction and a system that can help an application understand what that transaction represents inside a real product journey.

The “AI-native” part is only useful if it reduces friction, not if it adds hype

A lot of projects bolt “AI” onto a chain like a sticker on a laptop, but Vanar’s framing is closer to something practical: memory that can be compressed into portable on-chain units, and reasoning that can interpret that memory in a way developers and enterprises can actually use.

Neutron is described as a compression and restructuring layer that produces programmable “Seeds,” and Vanar even gives a concrete target claim compressing 25MB into 50KB which signals an obsession with keeping rich data lightweight enough for consumer apps to move it around without turning every action into a cost problem.

Kayon is positioned as the reasoning layer, built to query, validate, and apply logic across on-chain and enterprise-style backends, which is the kind of capability that becomes important once you are dealing with tokenized assets, compliance constraints, or applications that need to make decisions that are auditable rather than magical.

Most chains store receipts, Vanar wants to store receipts plus the labeled folders, so a product can later ask, “What is this, why is it here, and what rules should apply,” without rebuilding the story from scratch.

The network numbers look like a chain that has been living, not only launching

Vanar’s mainnet explorer shows 193,823,272 total transactions, 8,940,150 total blocks, and 28,634,064 wallet addresses, and while those metrics do not automatically equal daily active users, they do suggest sustained operation and block production at a scale that is hard to fake for long periods without the system simply breaking under its own noise.

For a project that talks about onboarding mainstream users, “boring uptime” is not a detail, it is the core promise, because consumer trust is built through repetition, not through announcements.

Tokenomics and utility that match the consumer adoption thesis

Vanar’s token, $VANRY, becomes interesting when you judge it less like a trading instrument and more like a product primitive, because a consumer ecosystem needs the token to function as reliable fuel, reliable security, and a predictable cost layer that developers can design around.

Supply framing: public market data currently lists 2.4B max supply and 2.291B circulating supply (with live market cap and volume fluctuating with market conditions), which is useful context because a high-interaction ecosystem typically benefits from a token that can circulate widely without making basic participation feel scarce or fragile.

Utility that is actually used inside the system:

Gas for transactions: Vanar’s docs and stack positioning treat VANRY as the transaction fuel, which is the first and most durable form of utility because it scales with real usage rather than narratives.

Staking for network security and rewards: Vanar runs an official staking portal where VANRY can be staked to support the network while earning staking rewards, which is the second durable utility because it anchors token demand to security participation, not only to market sentiment.

Fixed-fee model designed for predictability: Vanar’s documentation describes a tiered fixed-fee approach, explicitly stating that common actions like transfers, swaps, minting, staking, and bridging are intended to remain in the lowest tier at around $0.0005 equivalent, and the docs emphasize predictability as the point, not just cheapness.

Protocol-level pricing support for fixed fees: Vanar also documents a mechanism that updates the VANRY price at the protocol level to keep the fixed-fee experience stable in fiat terms, which is exactly the kind of plumbing you build when your goal is “apps that feel normal” rather than “users who monitor gas all day.”

If you want one practical conclusion from this design, it is that Vanar is trying to give developers something mainstream software depends on: cost certainty, because consumer products cannot be built on a fee model that turns unpredictable during peak demand.

Latest update that matters: Vanar is showing up where execution gets tested

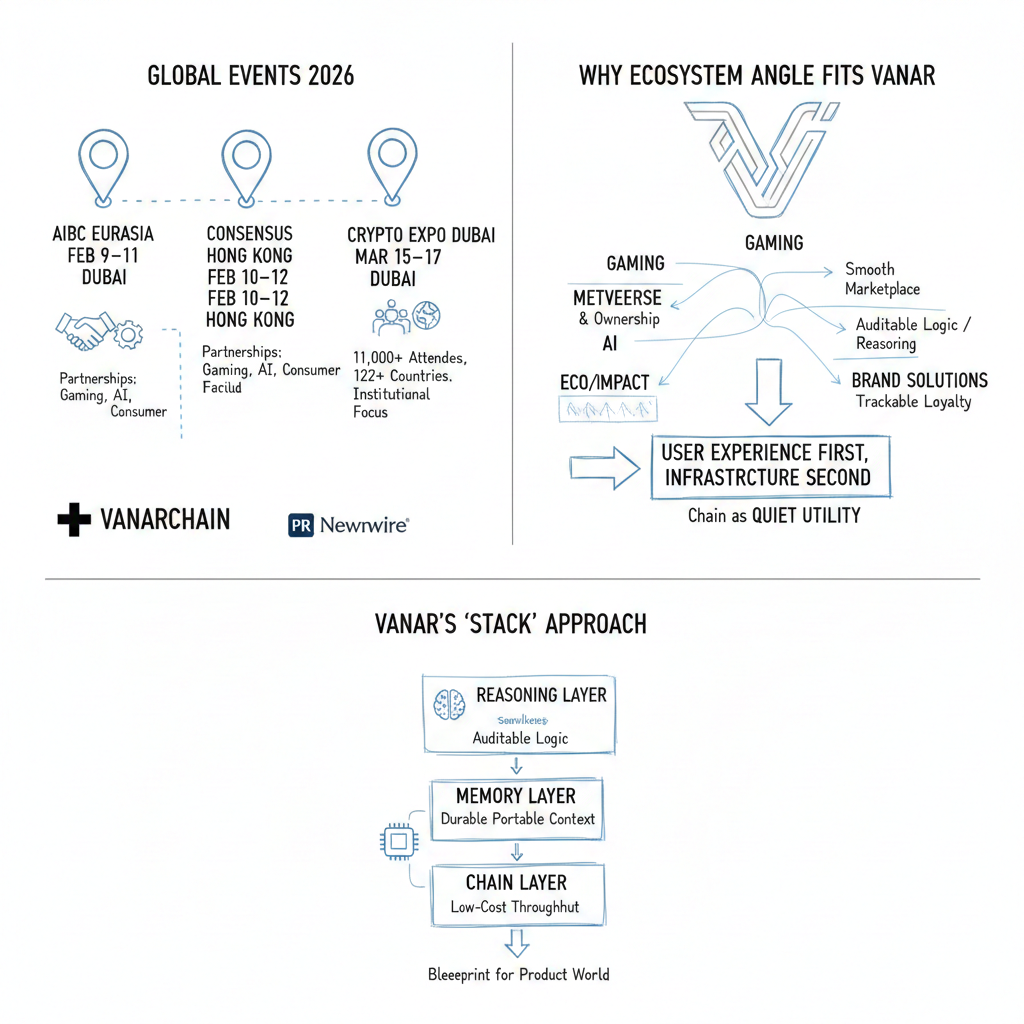

Instead of treating conferences like a trophy shelf, I look at them like a stress test: if your ecosystem story is real, you go stand in rooms where builders, capital, and policy collide, because that’s where “nice idea” turns into integrations, pilots, and distribution.

Vanar’s own events page lists AIBC Eurasia in Dubai (Feb 9–11, 2026) and Consensus Hong Kong (Feb 10–12, 2026), and it also lists Crypto Expo Dubai 2026 (Mar 15–17, 2026) as another scheduled appearance, which signals a deliberate push into regions that often act as distribution hubs for consumer and fintech narratives.

On the Consensus side, independent event reporting states the 2026 Hong Kong edition concluded with 11,000 registered attendees from over 122 countries and regions, which matters because it reinforces that this is not a small niche gathering, it is an arena where institutional-scale conversations happen and where projects get evaluated on clarity and readiness.

AIBC Eurasia’s own page confirms the 09–11 Feb 2026 Dubai dates and positions it as a deal- and networking-driven roadshow stop, which aligns with a project that wants partnerships across gaming, AI infrastructure, and consumer-facing distribution.

Why the ecosystem angle fits Vanar’s identity

You described Vanar as spanning gaming, metaverse, AI, eco, and brand solutions, and the reason this feels coherent is that those are all categories where users care about experience first and infrastructure second.

A gaming user wants a smooth marketplace, a metaverse user wants persistence and ownership, a brand wants trackable loyalty mechanics, and an eco or impact mechanic needs verifiable records, which means the chain has to behave like a quiet utility that never interrupts the user’s flow.

Vanar’s “stack” approach chain for low-cost throughput, memory for durable portable context, reasoning for auditable logic reads like a blueprint for exactly that style of product world.

If Vanar succeeds, it will not be because it sounded louder than other L1s, it will be because it built the unglamorous things that mainstream products require: predictable fees, operational continuity, and a way to store meaning that software can reuse without constantly asking users to babysit complexity.