The question sounds straightforward: when will the CLARITY Act pass? But in reality, major financial legislation in the United States doesn’t move on a fixed calendar. It moves when politics, policy, and pressure line up at the same time. The CLARITY Act sits right in the middle of that alignment struggle.

To understand the timing, you first have to understand what the bill is trying to solve.

The core problem the CLARITY Act addresses

For years, the U.S. crypto market has operated in a gray zone. Regulators have relied heavily on enforcement actions rather than clear statutory definitions. Courts have been left to interpret whether a digital asset is a security or something else. Exchanges have operated under uncertainty. Investors have faced shifting interpretations.

The CLARITY Act is designed to change that.

At its foundation, the bill attempts to formally distinguish between digital assets that should be regulated as securities and those that should be treated more like commodities. That distinction determines whether oversight primarily falls to the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

This is not a minor technicality. It defines the compliance burden for exchanges, issuers, brokers, and even decentralized projects.

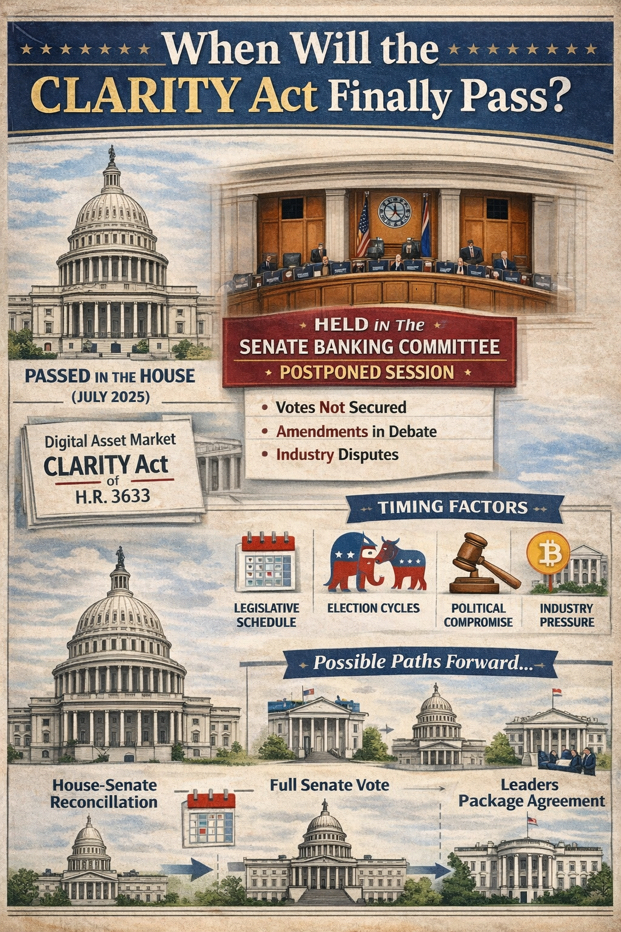

Current status of the bill

The bill already cleared the House of Representatives with bipartisan support. That was a significant milestone because it showed that digital asset regulation is no longer a fringe issue. Lawmakers across party lines agree that a framework is needed.

But Senate approval is required before it becomes law. And that is where progress has slowed.

In the Senate, committees must first review and amend the bill before sending it to the full chamber for a vote. Committee scheduling, political negotiations, and competing legislative priorities have delayed this stage.

Why it has slowed down

The primary friction point revolves around stablecoins — specifically whether stablecoin issuers can offer interest or rewards to holders.

Traditional banks are concerned that yield-bearing stablecoins could attract deposits away from the banking system. Crypto companies argue that restricting rewards would make U.S. stablecoin innovation less competitive globally.

That debate has become the pressure valve for the broader bill. Even if most of the framework is agreed upon, unresolved issues around stablecoins can stall the entire package.

This is common in Congress. A large structural bill can hinge on one politically sensitive clause.

What must happen before passage

Several steps remain:

First, Senate committees must formally mark up and approve a version of the bill.

Second, the full Senate must vote on it.

Third, if the Senate version differs from the House version, both chambers must reconcile differences.

Finally, the President must sign the final text into law.

Each of those steps requires time. None are automatic.

Possible timelines

Fast-track scenario

If negotiations over stablecoin provisions reach compromise quickly, Senate committees could advance the bill within weeks. In that case, passage in spring 2026 would be realistic.

Moderate-delay scenario

If negotiations continue but remain productive, Senate floor action could slip into summer 2026. Election season scheduling could complicate matters but would not necessarily kill momentum.

Extended delay scenario

If political tensions increase, or if crypto regulation becomes entangled in broader partisan disputes, the bill could stall until after the election cycle. Large financial reform bills often become strategic bargaining tools.

Signals to watch

If you want to gauge timing accurately, monitor:

Public announcements of Senate committee markup dates

Joint statements from key lawmakers indicating compromise

Updated draft language addressing stablecoin rewards

Placement on the Senate legislative calendar

When those signals appear together, movement is imminent.

Why timing matters

The longer regulatory uncertainty persists, the more companies and capital migrate to jurisdictions with clearer frameworks. Other regions have already implemented structured digital asset regimes. The United States risks falling behind if clarity remains delayed.

At the same time, lawmakers want to avoid unintended systemic risks. Financial market structure laws shape decades of regulatory behavior. Rushing them without alignment can create long-term complications.

The balance between speed and precision is delicate.

The realistic answer

There is no official date yet. The most credible window for passage is sometime in 2026, with spring being possible if negotiations solidify soon.

However, until Senate committees formally advance the bill, everything remains conditional.

Legislation does not pass because it is logical. It passes because enough stakeholders decide it is strategically necessary.

The CLARITY Act has momentum, bipartisan interest, and institutional pressure behind it. What it needs now is final political alignment.

When that alignment occurs, the bill will move quickly.

Until then, it remains close — but unfinished.