When people talk about FOGO, they usually start with performance. That’s fair, but it’s also incomplete. The part I find more revealing is how FOGO tries to grow a trading-first chain without letting ownership drift into the usual “few wallets, many followers” pattern. If the end goal is market-grade DeFi, then the beginning matters: who owns the token, who gets liquidity at launch, who gets rewarded for real usage, and how value comes back to the network after the first hype cycle.

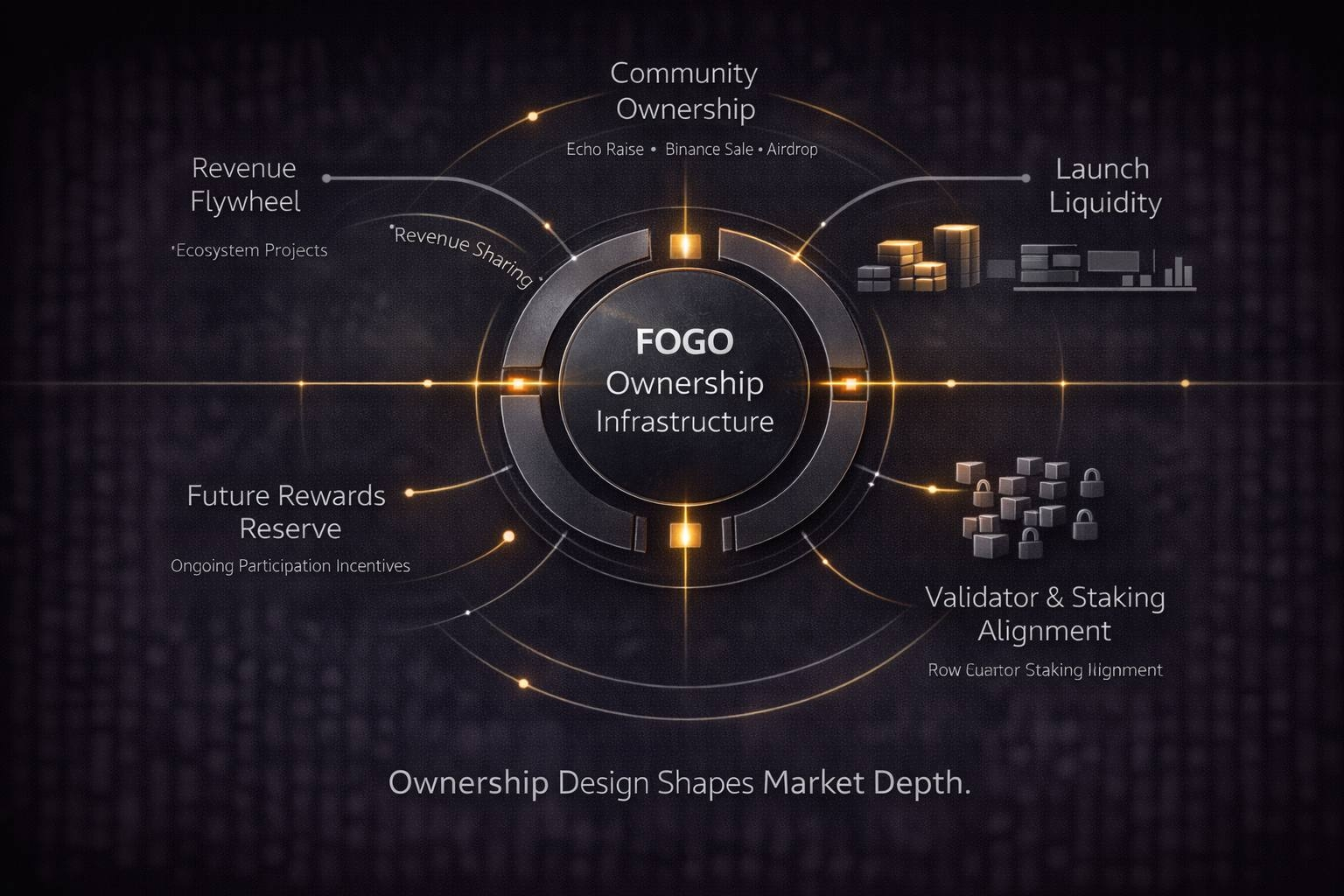

FOGO's token design reads like a deliberate attempt to make community ownership something measurable instead of a slogan. Not perfect, not magical, but structured.

The Core Thesis: A Trading Chain Needs Traders to Own It Early

A general-purpose chain can survive with developers and narratives. A trading chain cannot. Trading liquidity behaves like water: it flows to the place that feels deepest, safest, and most convenient. If you want that liquidity to stay, you need actual users to feel like stakeholders, not tourists.

FOGO's own framing is blunt: it calls itself community-first and explicitly contrasts that with heavy VC ownership. It also links its token to long-term participationstaking, gas sponsorship by apps, and a "flywheel where the foundation supports projects and partners commit to revenue-sharing back to Fogo. That last part is the real tell. It suggests FOGO is aiming for value return paths that don't rely only on token goes up.

Tokenomics as a Map of Behavior, Not a Spreadsheet

Here's the key: tokenomics is not just allocation charts. It's a map of expected behavior.

FOGO splits a meaningful chunk into Community Ownership and then tells you what that actually includes: the Echo raise, a Binance Prime Sale, and the airdrop combined under one category. That "combined bucket" is important because it signals a philosophy: ownership should be tied to participation channels, not just capital size.

Even the details are instructive. FOGO says two raises were completed on Echo $8M at a $100M FDV and $1.25M at a $200M FDV across ~3,200 participants and those Echo tokens are fully locked at TGE with a 4-year unlock and a 12-month cliff. That kind of lock structure is basically the chain saying: if you're here early, you're here for the build, not the flip.

The Airdrop Isn't Free Tokens, It's a Launch-Phase Governance Choice

FOGO allocates 6% of genesis supply to a community airdrop, and it's fully unlocked. But it doesn't treat it like a one-time marketing blast. It breaks it into a Jan 15 distribution (1.5%) at public mainnet launch and Future Rewards 4.5% reserved for continued campaigns. That is an explicit choice to keep distribution pressure and incentives alive after day one.

What I like here is the honesty: a trading chain needs ongoing liquidity and ongoing attention, so it plans for ongoing rewards. The risk, of course, is always emissions turning into mercenary farming. But the structure at least acknowledges the reality: adoption is a marathon, not a listing.

The Launch Liquidity Allocation Is a Quiet but Serious Move

Most retail readers ignore "Launch Liquidity" lines because it sounds boring. But launch liquidity is where a chain either gets a real market or a thin, jumpy market that feels unsafe.

FOGO sets aside 6.5% for launch liquidity provisioning (unlocked), specifically to support third-party liquidity at launch. In practical terms, this is how you reduce the first week is chaos problem. It's not a guarantee, but it's a serious attempt to make early markets tradable instead of fragile.

The Lock/Unlock Mix Tells You What FOGO Is Optimizing For

One of the cleanest summary lines in FOGO's tokenomics post is that at launch, 63.74% of genesis supply is locked, unlocking gradually over four years, while 36.26% is unlocked at launch, with 2% already burned. That's a very specific balance: keep long-term stakeholders committed, but still allow enough circulating supply for real markets, rewards, and liquidity programs.

A chain that wants serious trading volume can't have "everything locked forever." But a chain that wants durable credibility can't have everything liquid immediately. FOGO is clearly trying to sit in the uncomfortable middle, where both market function and long-term alignment are possible.

The Fogo Flywheel Is the Most Important Line in the Tokenomics

If you forced me to pick one concept that feels genuinely distinct here, it's the Fogo Flywheel.

The foundation supports high-impact projects through grants and investments, and in return partners commit to a revenue-sharing model that directs value back to Fogo, with several agreements already in place.

This is basically FOGO saying: "We don't only want apps; we want apps that pay back into the ecosystem." That is closer to how real platforms work. It's also a hedge against the common L1 problem where the chain funds apps, apps grow, and value accrues everywhere except back to the base layer.

Sessions and Gas Sponsorship: Adoption Is a UX Finance Problem

Now connect tokenomics to user behavior. FOGO explicitly says dApps can sponsor gas costs, offering a gas-free experience. That matters because the biggest barrier for normal users isn't "fees are high," it's "fees are annoying and unpredictable."

FOGO Sessions are built around account abstraction plus paymasters, and the docs are direct about two things: sessions can make exploration safer and smoother, and paymasters can let users transact without paying gas fees themselves. That's not a small feature for a trading-focused chain. That is how you get people to behave like they're on a venue rather than inside a wallet prompt simulator.

Incentives Under the Hood: Priority Fees and Why They Matter

Even though this article is about distribution, I can't ignore one key economic primitive from the MiCA whitepaper: validators can order transactions by priority fees, and those priority fees accrue directly to the validator producing the block. The network is explicitly creating a market for urgency.

Why does that matter for distribution? Because if you're rewarding real usage, you need the network to behave sensibly when usage spikes. Priority fees are one of the simplest ways to make urgent actions legible--liquidations, cancels, hedges without turning the whole chain into a fee war for everyone.

Airdrop Culture as Onboarding, Not Charity

FOGO's own airdrop post doesn't read like a corporate press release. It reads like a chain trying to build identity Don't just trade here. Belong here. It also points users directly into activities: claim, then liquid stake with Brasa, then put stFOGO to work in Pyron, or go trade elsewhere in the ecosystem. That flow is not random. It's onboarding design.

It's the chain nudging users from "I claimed" to "I'm actually participating." That transition is where most airdrops fail.

My Take: FOGO Is Testing Whether Ownership Can Be a Product Feature

Here's my clean thesis after reading the primary docs: FOGO is testing whether token distribution itself can be a product feature for a trading chain.

Not because community sounds good, but because ownership changes behavior. Owners stake. Owners provide liquidity. Owners show up during drawdowns. Owners build culture. And if the chain's goal is to compete with centralized venues on reliability and depth, then it needs participants who act like long-term venue stakeholders, not short-term liquidity renters.

FOGO isn't guaranteed to succeed--no chain is. But the combination of locked long-term allocations, meaningful unlocked community distribution, dedicated launch liquidity, ongoing reward reserves, and an explicit revenue-sharing flywheel is a more thoughtful playbook than the usual list token, pray for TVL.

If you want a trading-first chain, you have to build a trading-first ownership base. FOGO's distribution design is one of the few places in crypto where I can actually see that intent written into the blueprint.