The Digital Asset Market Structure and Investor Protection Act (CLARITY Act) is poised to transform U.S. crypto regulation. It aims to clearly split oversight: SEC for security-like assets, CFTC for commodities. Ripple CEO Brad Garlinghouse now gives it a 90% chance of passing by April 2026 after productive White House talks resolved stablecoin disputes.

So Why this is huge for Ripple and XRP?

After years of #SEC battles labeling $XRP XRP an unregistered security, the bill would officially classify “network tokens” like XRP as commodities. That removes SEC enforcement risk and opens the door wide for institutional adoption—especially for Ripple’s On-Demand Liquidity (ODL), already used by banks in over 100 countries.

Clear rules would accelerate XRP’s role in cross-border payments, potentially freeing up trillions currently locked in traditional systems like SWIFT. Analysts see this as a major demand driver for XRP once institutions gain confidence.

Ripple may have to sell billions of XRP

Some drafts cap any single entity’s control at 20% of a token’s supply. Ripple currently holds ~36% (~14 billion XRP). They could use blind trusts or ecosystem funds to comply, which might cause short-term selling pressure but ultimately improve liquidity and decentralization.

With Price potential and ETF momentum

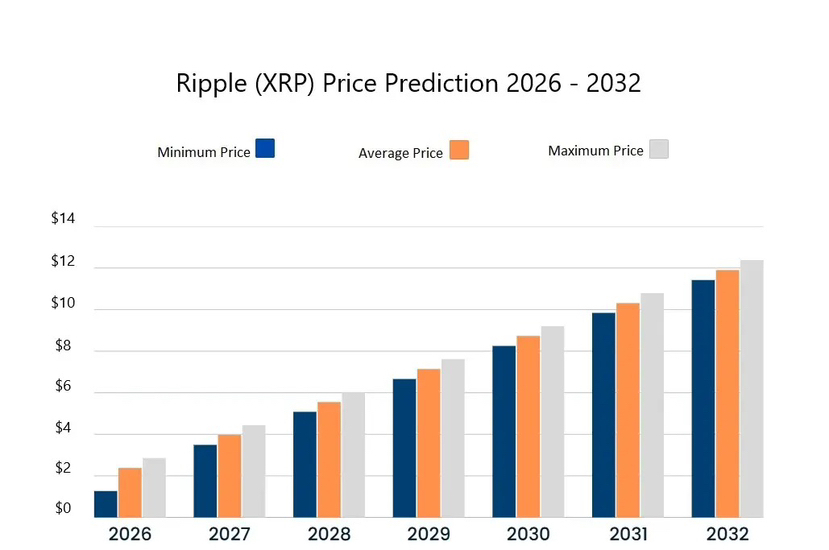

With regulatory clarity, XRP ETFs (already at $1.3B inflows in first 50 days) could explode. Community sentiment recalls 2017’s 36,000% run, with short-term targets ranging from $2–$10 as pension funds and insurers enter. Ripple’s RLUSD stablecoin and potential U.S. banking license add further upside.

Risks and the bigger picture

Passage still requires Senate compromise. Delays could let Europe or Asia gain ground. For XRP holders, this is high-stakes: clarity = moonshot potential.

Bottom line

In a world desperate for fast, borderless finance, the #CLARITYAct could position Ripple and XRP at the center of tomorrow’s economy. The only question left: will Washington deliver before it’s too late?