In 2026, the narrative around Vanar Chain has matured from emerging concept to real infrastructure with tangible ecosystem momentum. Vanar isn’t just another Layer-1 in the crowded blockchain landscape — it is positioning itself as a true AI-native Web3 compute and payment infrastructure stack that integrates intelligence into core protocol layers rather than bolting on superficial AI features. This shift from conceptual narrative to measurable deployment and market engagement is one of 2026’s most significant developments for next-generation blockchains.

Intelligence as Infrastructure — Not Just a Buzzword

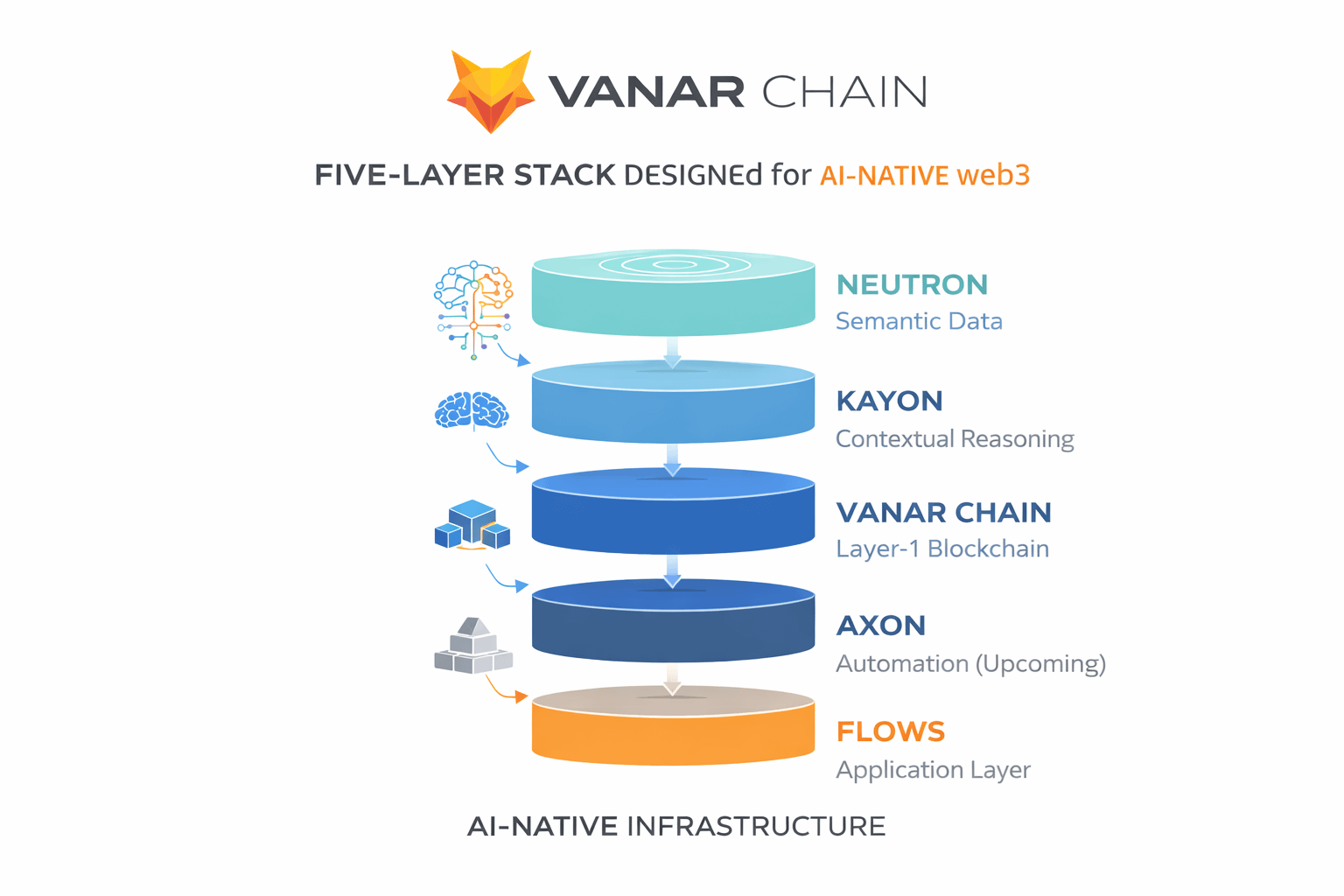

At a time when most public chains compete on throughput, fees, or EVM compatibility, Vanar’s architectural thesis is fundamentally different: embed AI semantics and reasoning into the blockchain stack itself. Its five-layer stack — consisting of the foundational modular Vanar Chain layer, semantic data persistence (Neutron), on-chain contextual reasoning (Kayon), and forthcoming automation and application layers (Axon and Flows) — reframes what “Web3 application logic” can mean.

Unlike projects that add AI tooling on the periphery, Vanar’s base protocol is explicitly designed for AI workloads with optimized data flows, semantic memory, and machine reasoning at the protocol level — a rare architectural commitment that makes applications not just programmable but capable of adaptation and contextual decision-making.

Real Execution Signals: Semantic AI + Persistent Memory

A recent advancement exemplifying Vanar’s intelligent infrastructure is the integration of persistent semantic memory for OpenClaw agents through Neutron, enabling AI agents to retain and recall contextual state across sessions and platforms. This is a foundational building block for true autonomous agent behavior on-chain — something conventional blockchains cannot deliver without off-chain systems.

These developments are more than theoretical. They mark a concrete progression from conceptual AI integration toward systems that can actually maintain knowledge and context persistently on a decentralized chain. That property alone has broad implications for automation, dApps that evolve over time, and agent-driven workflows.

Payments + Real-World Assets: A Threefold Strategic Drive

Beyond internal technology, Vanar’s external integrations are unusually consequential for an AI-native blockchain:

Traditional Payment Integration: Deep collaboration with Worldpay showcased at Abu Dhabi Financial Week connects Vanar directly to fiat rails across 146 countries. This bridges the often-segregated worlds of on-chain assets and real-world currencies — a critical step toward mass adoption beyond crypto native audiences.

AI-Native PayFi Vision: Vanar’s base layer is purpose-built for PayFi, a class of applications that marry payment systems with financial infrastructure in a compliant and user-centric way. This extends beyond mere token swaps to enable real settlements with global currency systems on-chain.

Market Recognition & Capital Movement: Broader market sentiment around Vanar and AI blockchain specialization is intensifying, with traders and institutional capital increasingly orienting toward projects with practical infrastructure execution.

Together, these signals show Vanar isn’t just tech talking points — it’s ecosystem actions that lower barriers for mainstream usage.

Execution in Practice — Operational Progress, Not Empty Narratives

What sets Vanar’s 2026 journey apart is a clear shift from promise toward operational rollout:

Leadership commentary and strategic messaging emphasize live deployment of its AI stack components and ecosystem tools, rather than hypothetical future capabilities.

Developer and onchain tool expansion continues — with Axon and Flows pre-listed on the official roadmap — indicating a staged rollout of more advanced AI-oriented developer environments.

Programmatic efforts like the AI Excellence Internship engage next-generation talent and help build a deeper developer base for long-term ecosystem growth.

These milestones matter because execution at the infrastructure layer sets the conditions for real dApp activity and user demand, beyond mere conceptual positioning.

Strategic Ecosystem Expansion

In parallel with technical maturation, Vanar has joined strategic innovation networks like the NVIDIA Inception program, which supports deep tech ventures revolutionizing their industries. Such inclusion highlights Vanar’s positioning not just as another chain but as a platform at the intersection of AI and blockchain infrastructure development.

Market Context and Token Utility

While Vanar’s token, $VANRY, remains subject to market dynamics typical of early-stage chains, its utility model is evolving through product usage, subscription-driven AI services (e.g., myNeutron), and settlement roles across potential multi-chain semantic logic layers. This shift from speculative trading narratives toward usage-driven demand loops is a key structural indicator for 2026.

The Real Test Ahead — Adoption, Usage, and Meaningful Demand

Vanar’s 2026 position places it at a pivotal transition — from architectural promise to practical execution. The true measure of success will depend on:

Developer uptake and real AI-native dApp creation using Neutron, Kayon, Axon, and Flows.

Ubiquity of integrated PayFi systems that connect on-chain assets with real payments in everyday use.

Sustainable economic loops that convert usage into token demand via subscriptions and on-chain services.

Execution in these dimensions — not just surface engagement or price speculation — will determine whether Vanar becomes a foundational intelligent blockchain infrastructure or another underutilized platform.

Conclusion — Intelligent Web3 Infrastructure, Not Just Another Chain

Vanar’s development curve through 2026 reflects a deliberate shift in focus: from theoretical AI claims to real, system-level implementation and integration with global financial infrastructure. Its architecture, strategic partnerships, ecosystem actions, and utility models signal that this project is building infrastructure that anticipates future demand instead of chasing ephemeral metrics.

If the next chapters of adoption — from on-chain autonomous agents to global PayFi rails — materialize at scale, Vanar could help redefine how blockchains are engineered and used: not merely as transactional layers, but as intelligent systems capable of reasoning, adapting, and connecting Web3 with the real world.