The American economy has reached a historic demographic tipping point. For decades, the primary engine of consumer spending has been the working-age population—young families and mid-career professionals. However, new data reveals a profound structural shift: the US economy is now heavily reliant on older Americans to drive growth, reflecting a rapidly accelerating wealth divide that heavily favors the 55-and-older demographic.

❍ A Historic Shift in Spending Power

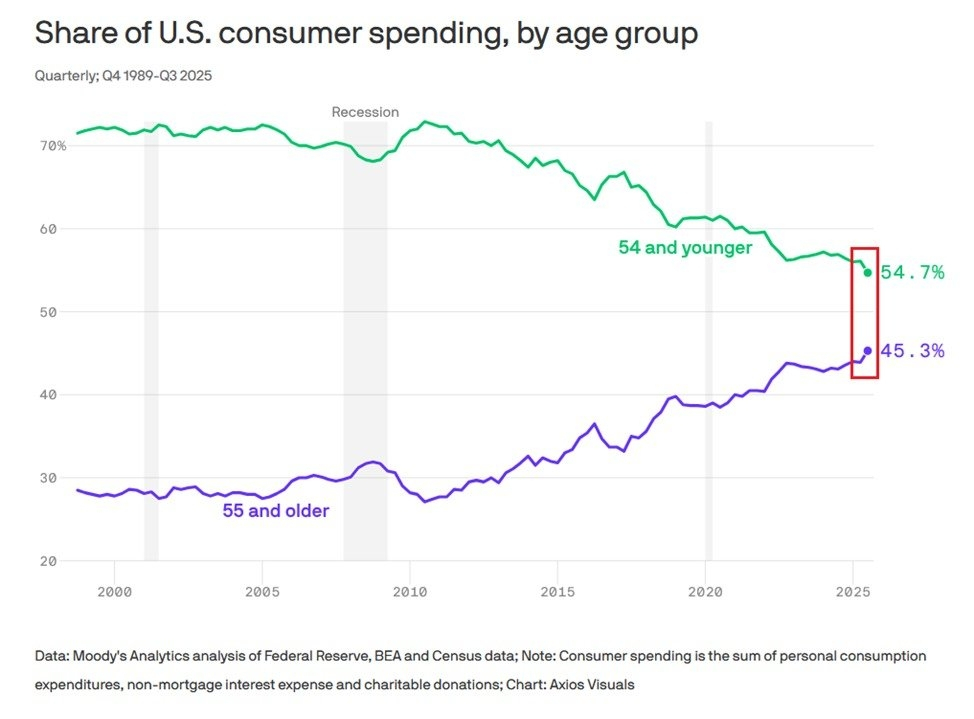

The gap in consumption between the old and the young is closing at an unprecedented rate.

45.3% of Spending: Americans aged 55 and older now account for a massive 45.3% of all US consumer spending. This marks the highest share for this demographic in at least 28 years.

Doubling the Early 2000s: To put this surge in perspective, this figure is nearly double the ~28.0% share this age group held in the early 2000s.

❍ The Shrinking Influence of the Under-54 Crowd

As older Americans expand their economic footprint, younger cohorts are rapidly losing ground.

Down to 54.7%: Consumers aged 54 and younger now represent just 54.7% of total expenditures.

A Steep Decline: This is a massive drop from the ~72.0% share they commanded in the year 2000.

On Track to Converge: The gap between these two groups has narrowed by approximately 35 percentage points over the last 25 years. If this trend continues, spending by those over 55 will soon surpass that of the under-54 demographic for the first time in history.

❍ The Root Cause: A Massive Asset Divide

This shift in spending is not due to a sudden change in consumption habits, but rather a drastic concentration of assets.

73.7% of All Wealth: According to Federal Reserve data, Americans over the age of 55 currently hold an astounding 73.7% of all US wealth.

Up from 56.2%: This represents a significant increase from the year 2000, when this age group held 56.2% of the nation's wealth. The wealth divide is no longer just about class; it is overwhelmingly about age.

Some Random Thoughts 💭

This data illustrates a fundamental transformation from a wage-driven economy to an asset-driven economy. Older Americans, who largely own their homes and hold massive equity portfolios, are heavily insulated from the high interest rates, high rents, and inflation that are currently squeezing younger generations. The under-54 crowd is spending less because a larger portion of their income is going toward basic survival and servicing debt, while the 55+ demographic is spending more because their accumulated assets are generating record yields and capital gains. If the American consumer is keeping the economy afloat, it is largely because older asset owners are paying the bill.