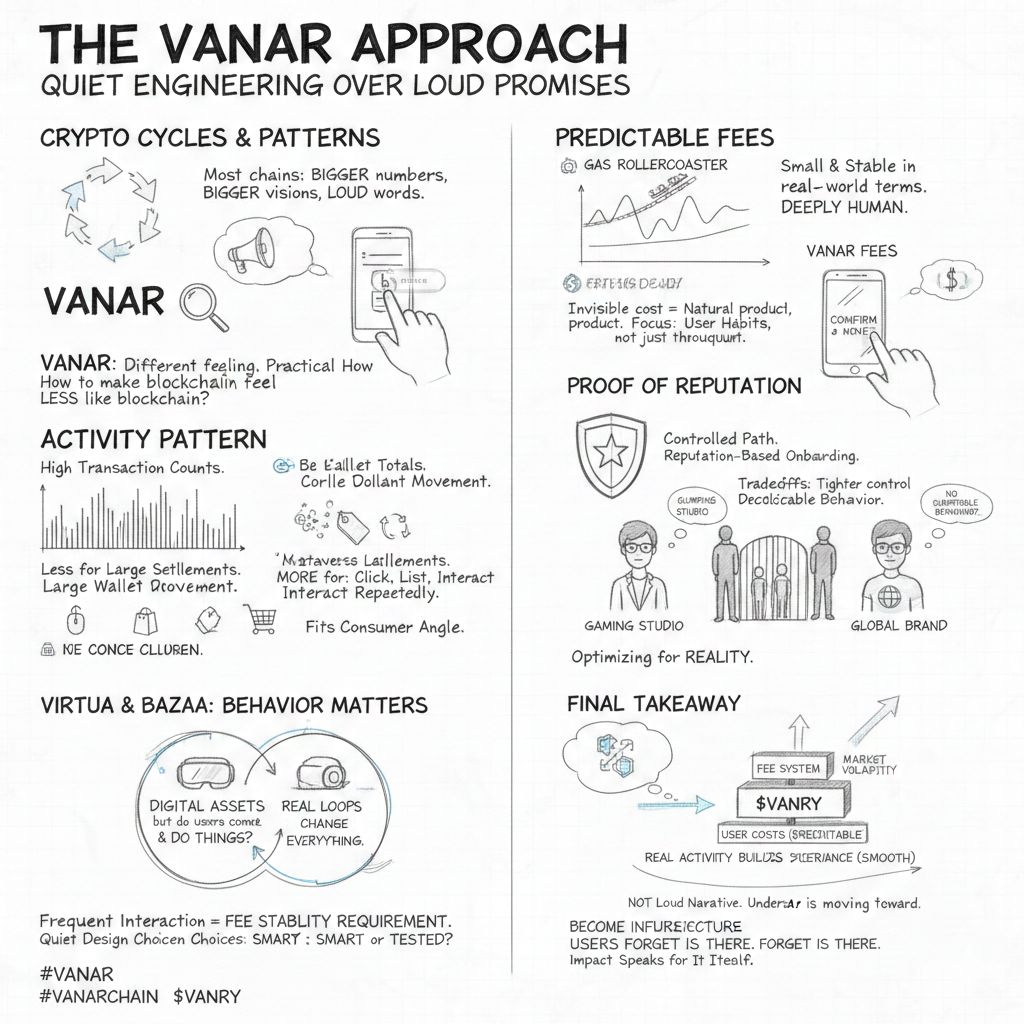

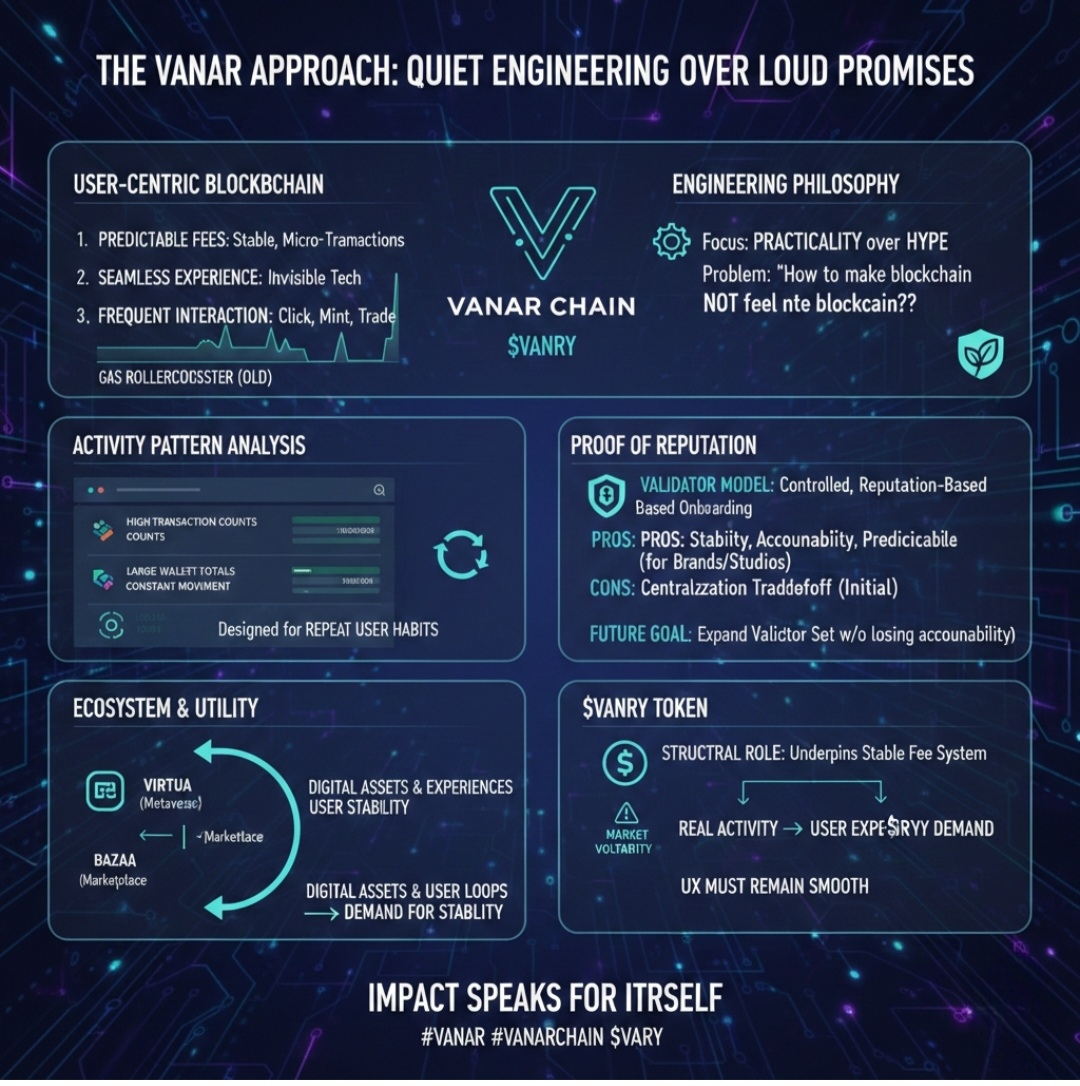

I’ve been around enough crypto cycles to notice a pattern. Most chains try very hard to sound important. Bigger speed numbers. Bigger visions. Bigger words.

Vanar gives me a different feeling. It doesn’t come across like it’s trying to impress the room. It feels more like a team asking a very practical question: how do we make blockchain stop feeling like blockchain for normal users?

And honestly, that’s a harder problem than most people admit.

Where the thinking feels different

One small detail that stood out to me is Vanar’s focus on predictable fees. In crypto, we’ve all gotten used to the gas rollercoaster — cheap one day, annoying the next. Traders tolerate that. Regular users don’t.

Vanar’s approach leans toward keeping fees extremely small and stable in real-world terms. On paper, that sounds technical. In practice, it’s deeply human.

If someone is buying a digital collectible in a game or redeeming a brand reward, they shouldn’t have to wonder what the network mood is today. They should tap confirm and move on. The more invisible the cost feels, the more natural the product feels.

That tells me the team isn’t just thinking about throughput. They’re thinking about user habits.

The activity pattern tells its own story

When I look at Vanar’s public explorer numbers, what I see is a network shaped for frequent interaction. High transaction counts. Large wallet totals. Constant movement.

Of course, in crypto we always have to be careful — addresses are not the same as people. But the pattern matters. It looks less like a chain built only for large settlements and more like one expecting users to click, mint, list, and interact repeatedly.

That fits the consumer angle they keep pointing toward.

Proof of Reputation: a practical tradeoff

Vanar’s validator model is where the philosophy becomes clearer. Instead of going fully permissionless from day one, they’ve taken a more controlled path through a reputation-based onboarding process.

Some purists won’t love that. And to be fair, tighter control always comes with decentralization tradeoffs.

But if you step into the shoes of a gaming studio or a global brand, the priorities look different. Those teams don’t want surprise downtime or validator drama. They want to know who is running the infrastructure and whether it will behave predictably.

Vanar seems to be optimizing for that reality first.

The real test will be whether the validator set can expand over time without losing accountability. That balance is never easy, and it’s something worth watching closely.

Virtua and Bazaa only matter if behavior follows

There’s a lot of “metaverse” language across the industry, but what actually matters is simple: do users come back and do things again?

If Virtua becomes a place where digital assets are actually used across experiences, and Bazaa keeps assets circulating instead of just sitting idle, then the ecosystem starts to form real loops.

And loops change everything.

Once users are listing, redeeming, trading, and interacting frequently, fee stability stops being a nice feature and becomes a requirement. People don’t tolerate friction inside repeat behavior.

That’s where Vanar’s quiet design choices could either prove smart… or get seriously tested.

Where $VANRY fits in

From my perspective, $VANRY isn’t just positioned as fuel. It sits underneath the fee system that’s trying to keep user costs predictable in real terms.

That gives the token a structural role — but structure only matters if real activity continues to build on top of it. Markets will always be volatile. The real question is whether the user experience stays smooth when conditions aren’t.

That’s the phase Vanar is gradually moving toward.

Final takeaway

Vanar isn’t trying to win the loudest narrative — it’s trying to become the kind of infrastructure users forget is even there, and if it succeeds at that, the impact will speak for itself.