When I look at the landscape of blockchain infrastructure in early 2026, what stands out to me is how few projects have truly shifted from retrofitting AI capabilities onto existing chains to building the entire stack with intelligence as a foundational requirement. Vanar Chain has done exactly that, and the deeper I dig into its design, the more it feels like a deliberate response to the growing pains of bringing real-world finance onto decentralized rails.

The core problem Vanar addresses is the tension between the need for intelligent, automated finance and the limitations of traditional blockchains. In PayFi payment finance and tokenized real-world assets (RWAs), we need systems that don't just execute transactions but reason over data, compress massive datasets for on-chain storage, enforce compliance without exposing sensitive details, and scale without prohibitive costs or central points of failure. Most Layer 1s handle basic settlement well enough, but they falter when you layer on AI agents that must query historical data, verify proofs in real time, or handle agentic payments where autonomous logic decides flows based on conditions. Vanar Chain positions itself as payment-grade infrastructure by embedding AI-native primitives directly into the protocol, turning what could be clunky add-ons into seamless, on-chain capabilities.

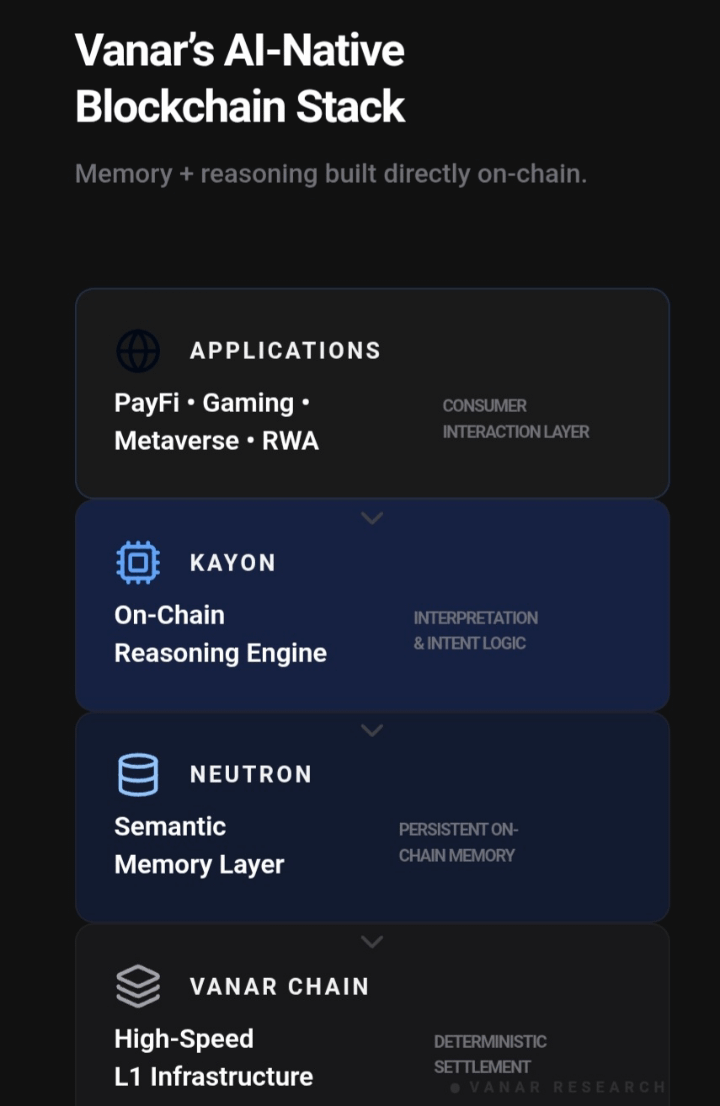

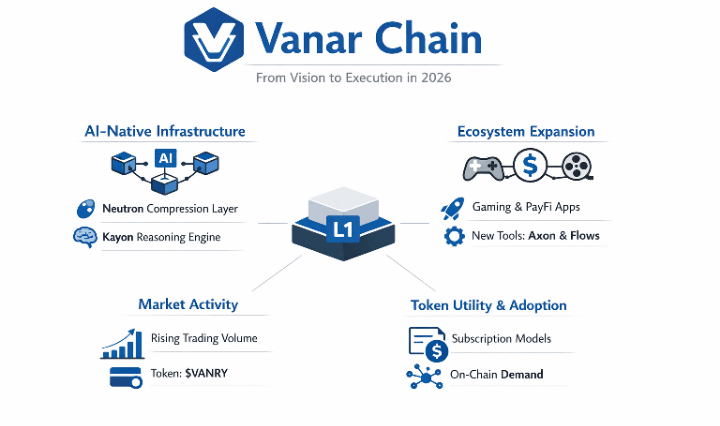

At the heart of this is Vanar's five-layer stack, a modular architecture that flows upward from the base blockchain to industry-specific applications. The foundation is the Vanar Chain itself: a scalable, EVM-compatible Layer 1 that provides the secure, high-throughput base layer. It's designed for low, predictable fees often fixed or near-fixed in models which matters enormously for finance use cases where cost volatility kills reliability. Unlike chains that chase TPS numbers at the expense of decentralization, Vanar balances speed with security, drawing from Ethereum's proven codebase while customizing for efficiency. Earlier iterations emphasized Proof of Reputation (PoR) enhancements on top of authority mechanisms to encourage transparent validator behavior, but by 2026 the focus has sharpened on hybrid proof-of-stake for sustainability and eco-friendliness, including integrations like Google's renewable energy alignment.

What truly differentiates it, though, are the upper layers built specifically for intelligence and finance. Neutron, the semantic memory and compression layer, tackles one of the biggest barriers in RWA tokenization and on-chain AI: data bloat. Traditional blockchains force reliance on external storage like IPFS, which introduces fragility links break, data vanishes, ownership illusions persist. Neutron changes that by using AI-powered compression to shrink large files (a 25MB document or video, for instance) into compact "seeds" stored directly on-chain. This isn't just efficiency; it enables true verifiability for regulated assets. When a tokenized bond or real estate title needs its full provenance audited, the compressed data lives immutably on the chain, not pointed to externally. For finance, this resolves the auditability vs. confidentiality tension: proofs can be verified without revealing underlying sensitive information unless selectively disclosed.

Layering on top is Kayon, the decentralized AI reasoning engine. This is where agentic finance becomes practical. Kayon allows on-chain querying, validation, and real-time reasoning over compressed data. Imagine an AI agent handling cross-border payments: it can check compliance rules, assess risk via on-chain signals, route through bridges, and execute all with logic executed transparently on the chain rather than in opaque off-chain servers. This matters for regulated environments where enforceability and traceability are non-negotiable. Axon (intelligent automation) and Flows (industry applications) build further, enabling automated workflows and vertical-specific tools for PayFi, where payments aren't dumb transfers but intelligent, condition-driven processes.

Recent developments underscore that Vanar isn't just conceptual it's accelerating into production maturity. Partnerships like the one with Worldpay at Abu Dhabi Finance Week in late 2025 highlighted agentic payments, showing real bridges to TradFi. Hiring key talent, such as a Head of Payments Infrastructure to connect traditional finance, crypto, and AI, signals intent to solve interoperability and compliance frictions head-on. Collaborations with entities like Nexera bring compliant RWA middleware, allowing secure tokenization of assets like real estate or commodities with cross-chain circulation (now spanning 20+ networks including Base). The ecosystem has seen listings on major platforms, steady developer tooling via docs and Kickstart programs, and active presence at events like AIBC Eurasia and Consensus Hong Kong in early 2026. GitHub activity remains consistent, with focus on Neutron and Kayon rollouts rather than hype-driven features. Operational signals are positive: no major incidents glossed over, transparent communication, and a shift from early gaming/entertainment roots to PayFi/RWA emphasis.

Grounding this in economics, $VANRY serves as the long-term engine. As the native utility token, it covers transaction fees (keeping them predictable), staking for network security, governance participation, and incentives across the stack. Total supply is capped (around 2.4 billion, with circulation managed thoughtfully post-rebrand from earlier iterations), avoiding endless inflation. Staking rewards validators who maintain reputation and uptime, while fees accrue value back to the ecosystem. This isn't designed for short bursts but for sustained participation: as PayFi volumes grow and RWAs settle on-chain, demand for $VANRY as gas and collateral should follow naturally. No flashy burns or gimmicks just boring reliability where utility drives demand.

Of course, nothing is proven until adoption scales. Forward checkpoints include demonstrating real-volume PayFi flows (agentic payments in production, not demos), more institutional RWA issuers choosing Vanar for compliance-friendly tokenization, broader bridge security validations (especially cross-chain), and measurable AI agent uptime without central dependencies. Privacy mechanisms selective disclosure in Neutron/Kayon need rigorous audits to satisfy regulators, while maintaining decentralization. If these materialize, Vanar could become irreplaceable rails for the next phase of on-chain finance: where intelligence isn't bolted on but intrinsic, payments are autonomous yet auditable, and RWAs move with the speed and reliability of TradFi but the openness of DeFi.

My personal takeaway is that Vanar Chain represents the kind of quiet, architectural ambition that endures. In a sea of narratives, it's building the boring-but-essential plumbing for when finance actually runs on intelligent, decentralized infrastructure. That's why, when I think about where real settlement and payment innovation will consolidate in the coming years, this stack keeps coming to mind.