Governance in blockchain is often treated as a technical checkbox, token holders vote, proposals pass, changes are implemented. But real governance is more than voting mechanisms. It’s about how communities coordinate, adapt and evolve over time. From my perspective, Vanry Coin is entering a phase where governance design could become one of its defining strengths.

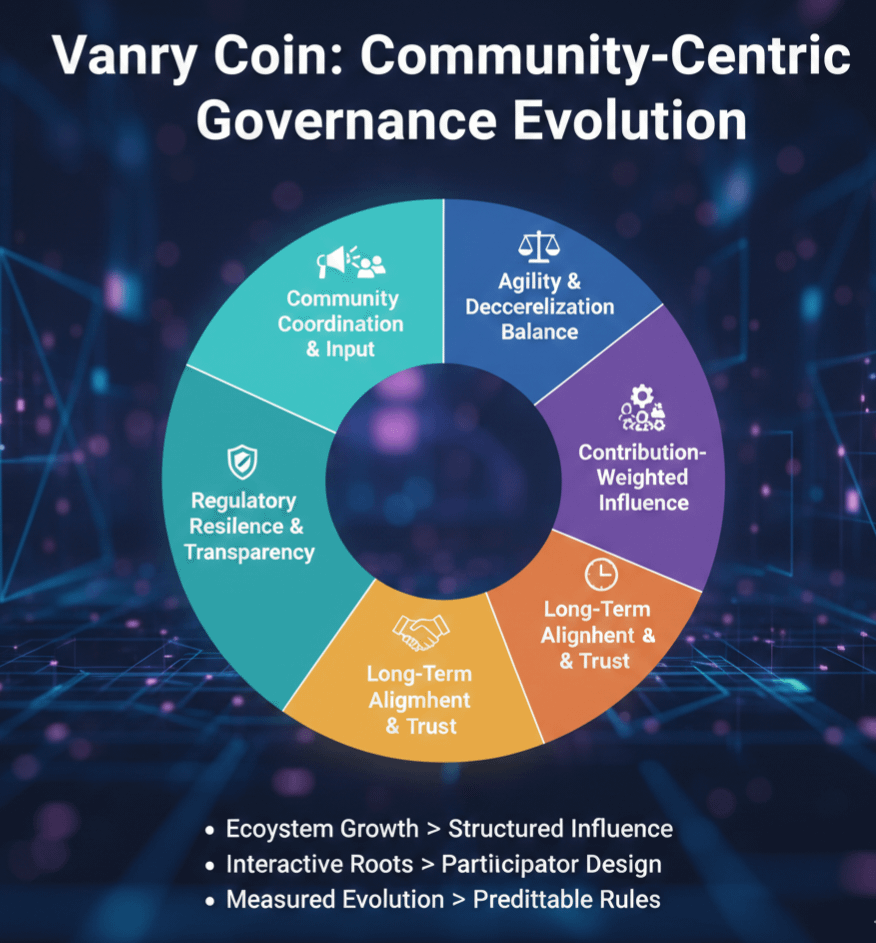

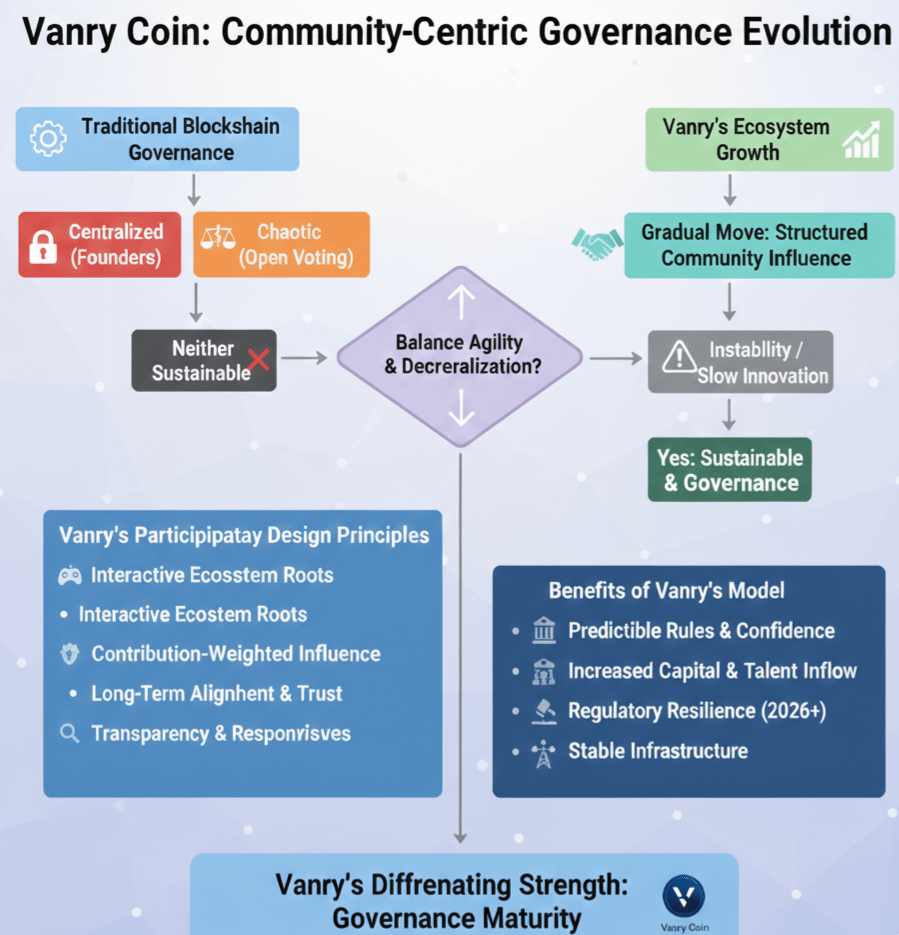

In earlier blockchain generations, governance was either fully centralized or completely chaotic. Founding teams made all decisions, or open voting systems were exploited by short-term actors. Neither model proved sustainable. What the market is now realizing is that governance must balance agility with decentralization.

Vanry’s ecosystem growth suggests a gradual move toward more structured community influence without destabilizing the core protocol.

That balance matters.

As interactive and digital entertainment ecosystems expand, decisions around token standards, reward allocation, ecosystem grants and validator parameters become increasingly important. If governance is too rigid, innovation slows. If it’s too loose, instability follows.

What I find compelling is the possibility that Vanry Coin could leverage its interactive ecosystem roots to design governance that feels participatory rather than purely procedural.

Community engagement within digital economies often goes beyond voting. It includes content creation, asset development, ecosystem feedback and collaborative building. When governance mechanisms align with active contributors rather than passive holders, decision-making becomes more meaningful.

In my opinion, this shift toward contribution-weighted influence is where many Web3 ecosystems are heading.

Another aspect to consider is long-term alignment. Governance models that reward short-term token movements tend to produce volatility in decision-making. More mature systems incorporate vesting logic, reputation layers or time-based voting weight to stabilize participation.

Vanry Coin’s steady development approach suggests it may favor structured evolution over abrupt policy shifts. That kind of pacing is not always exciting in the short term, but it builds trust.

Trust is underrated in crypto.

We often focus on innovation speed, but users and developers ultimately choose ecosystems where rules feel predictable. If governance is transparent and responsive, confidence increases. And confidence supports long-term capital and talent inflow.

There’s also a broader industry trend worth noting. Regulatory landscapes in 2026 are becoming more nuanced. Decentralized governance structures that demonstrate accountability and transparency may have advantages in navigating global compliance discussions.

Vanry’s alignment with digital property and interactive economies could position its governance framework as both community-driven and structurally resilient.

Personally, I believe governance maturity is one of the final frontiers of blockchain evolution. Technical scalability can be engineered. Liquidity can be incentivized. But community coordination requires cultural design.

Vanry Coin, in my view, has an opportunity to refine this layer thoughtfully.

If its ecosystem continues to grow in a measured way, governance could transition from being a background mechanism to a visible strength, one that differentiates it from chains where decision-making remains fragmented or opaque.

I see Vanry as moving toward a model where community input shapes direction without destabilizing infrastructure.

And in an industry where volatility often undermines long-term planning, that balance might become one of its most powerful assets.