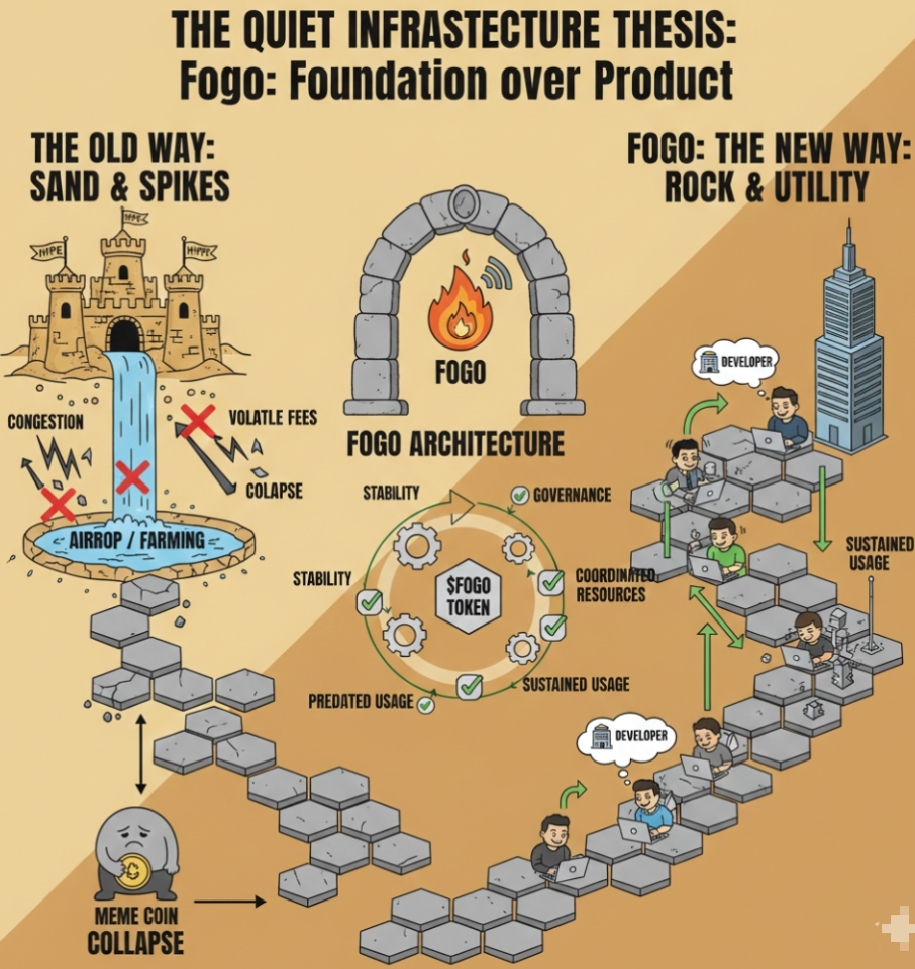

The crypto world can cause one to lose track of the show. Projects fail with tremendous hype, splashy headlines, memes, vows of lightning-fast things and tokens that become mooned on day one only to subside once the incentive runs out. The wallets get airdrop or farm the yield, the liquidity pumps, and the money all gushes out when the spout gets turned off. The surface appears busy, however, dig at it, and you find that it is constructed on sand: spikes that do not last but come and go.

That is the trend that is getting thin with many people. We are also already beginning to question it more: What will really survive the hype Pin? What does real and sustained usage when there are boom and bust cycles in a space which notoriously is big on boom and bust?

Enter Fogo. Firstly, one can imagine that it is a different Layer 1 blockchain, SVM-compatible, high throughput, a native token ($FOGO ), developer tools, and incentives to attract users. It ticks the familiar boxes. However, go a little deeper, and it is not the specs alone, but the way of thinking.

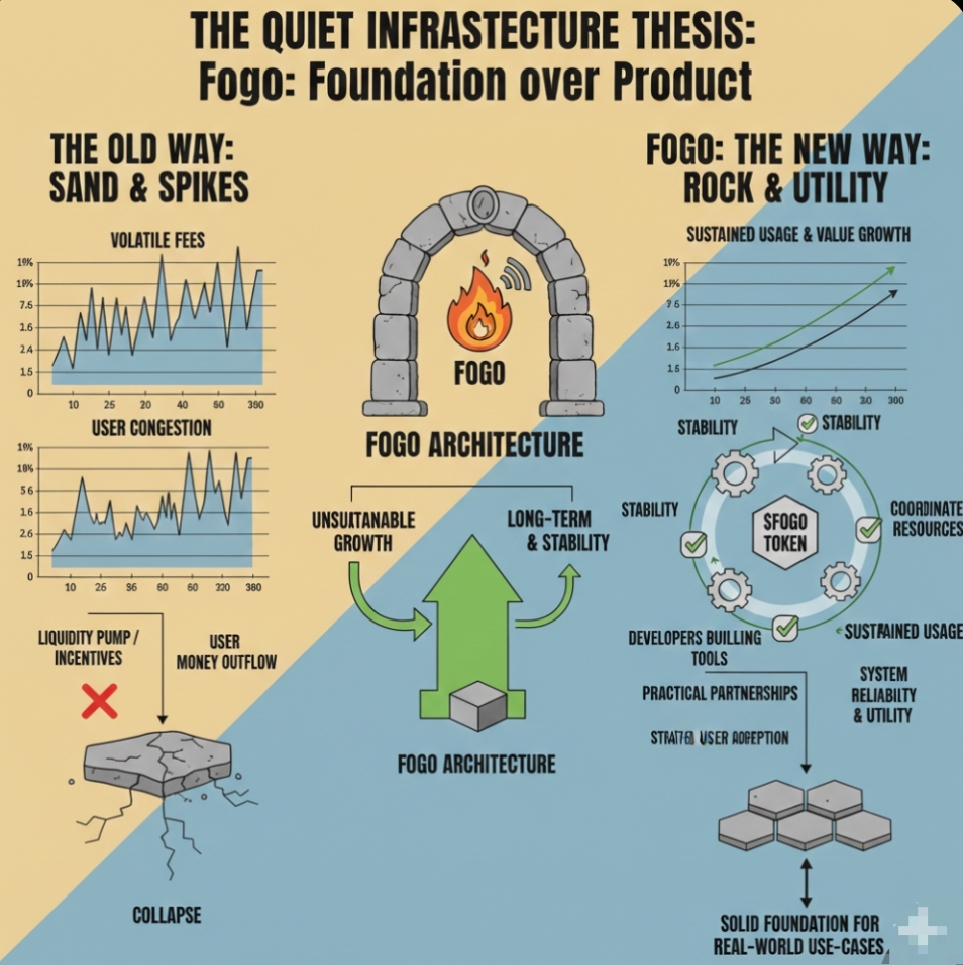

The majority of chains pursue the concept of scale as though it is the most important metric. They construct highways that accommodate traffic jams during peak hours yet most time the road is the empty one. The result? Unexpected volatility of fees, unpredictable congestion and a user experience collapsing when real pressure is involved. Fogo takes a different path. It does not focus on speed at the expense of thoughtful resource coordination and stability and predictability instead. Imagine more of a traffic jam than a freeway, designed to have some regularity, predictability, certain exceptions few and far between.

It is that little twist which makes all the difference. The developers do not have to keep an eye out on network meltdowns. Ordinary people do not get caught by unexpected spikes in gas that can make even a simple trade into a lottery. The validators and infrastructure providers are able to act with certain amount of foresight rather than always fighting fire. The network begins to seem like a real utility, whereas it is a reliable one as opposed to another, high-stakes experiment.

Such an approach is mirrored in the token of the $FOGO . It is not placed as a hypothetical toy that is not connected to the realities of the network. Rather, it gets embedded in the fabric: charged on transactions, pledged as a guarantee of the chain, governance, and co-ordinating incentives on actual participation. The supply and demand of the token should follow real network activity as opposed to a mere market sentiment or external pumps. As usage provides incentives and speculation comes afterward (instead of the other way around), incentives remain healthy and the entire system does not run into the well-known distortions that bedevil most projects.

There are good indicators of hope although they are not very loud. It seems like developer involvement is intentional and not a manic one, any tools and integrations are brought online, and then an aggressive push arises by user-acquisition. Partnerships seem to be practical, functional instead of headline driven. Growth is not a straight up rocket shot, but rather stratified and systematic. And that is a tacit which speaks. Quiet advancement in a market so addicted to noise is a statement by itself.

This is not only concerning Fogo but it is a part of a wider maturation of crypto. Following years of emphasis on big size by all possible means, other builders are now refocussing on load reliability. It is no longer a question of how rapidly we can move. the question would be Did this actually in any event hold water? The real world use cases, particularly institutional-quality trading, or anything that needs stability, cannot afford instability. A glitching chain at a time when it is needed the most is not only a problem, but it is costly.

The architecture of Fogo is inclined to that fact. It has a bespoke Firedancer client (designed to achieve the lowest possible latency (less than 40ms block times, less than instant finality)) and colocated validators (in Tokyo in order to coordinate the world more tightly, among other purposes), price feeds in native-around etc exchange format, and even an interred DEX itself at the protocol level. Such characteristics as gas-free sessions when active trading occurs eliminate friction without compromising security. It is not that glitzy in meme coin but the type of infrastructure that will slowly become irreplaceable.

Of course, there's a trade-off. Being patient may resemble staying still when everyone is willing to go volume and viral. Fogo may be left under the radar without the engine of hype rolling when it makes noises as noisier projects attract attention. Should the market again enter into a full manic state, the steady builders may find themselves left behind until things clear off. It is all about time, does the value be next wave put solid foundations over glittering experiments?

However the setting is changing. The largerści plays in (institutions, complex apps, actual economic activity) the more it relies on unreliable infrastructure, which is not at all something to be proud of. Strong, even sided begins to appear prophetic, rather than conservative.

Ecosystem psychology, too, there is the human part. Participants do not react the same when growth is expressed as measured and predictable. Constructors dedicate time to powerful tools and profound integrations. Users do not make short-term hops as they plan long term. Expectations are set on the first day and therefore make communities tight. Such alignment usually lasts longer than explosive growth that is superficial.

Think of urban development. Other cities are bursting with glittering tall buildings with loose groundwork, they shine a little up in the air and fight. The utilities, roads, and systems are laid in a systematic manner by others prior to population explosion. They do not achieve immediate publicity, but they last.

It appears that fogog is using the second playbook. No gimmick-ing of the stats or eye catching gimmick acts just a serious construction to those who will come slowly and stay on should the system perform as promised.

It will be tested when the usage will be soaring. Provided the network does not break under heavy load because of steady charges, no cascading failures, and efficient implementation, the thesis of the quiet infrastructure will be justified. In case it collapses the low-profile strategy might reveal the weaknesses.

At least, in the meantime what is notable is the lack of what many might call a frenzied attempt at buzz, no overstated metrics to pursue. Fogo is positioning itself as an option to people who place a lower premium on flash over functionality, who will embrace it without much ado, and will hang on because it just works.

When noise is so commonplace the content so slight, it is the projects that get built on behind computer or access that ultimately get status as something worthy. In case the foundation of Fogo is true, as it is consistent and predictable, designed to meet the real workload, its value may not be immediately obvious, which is exactly how a good infrastructure is to be expected.And in a space so cycle weary, such mute power might have more weight than any viral spot could.