Bitcoin remains stuck below the $70,000 mark as traders lean defensive, stacking bearish options while steady spot BTC ETF outflows increase the odds of another test of yearly lows.

Key takeaways:

• Pros are paying a 13% premium for downside hedges as BTC struggles to hold support above $66,000.

• Despite strength in equities and gold, $910 million exiting Bitcoin ETFs signals growing institutional caution.

After failing to break past $71,000, Bitcoin slid into a broader pullback. Although $66,000 has held for now, derivatives data shows traders preparing for further weakness. Instead of buying dips, many are positioning for a possible move back toward $60,000.

Bitcoin put sell options traded at a 13% premium relative to call (buy) instruments on Thursday. Under neutral conditions, the delta skew metric typically ranges between -6% and +6%, indicating balanced demand for upside and downside strategies. The fact that these levels have been sustained over the past four weeks shows that professional sentiment is leaning heavily toward caution.

This cautious sentiment is also reflected in the neutral-to-bearish setups dominating Bitcoin’s options market. Data from Laevitas shows that bear diagonal spreads, short straddles and short risk reversals ranked among the most popular trades on Deribit over the last 48 hours.

The bear diagonal spread cuts the cost of a downside play since near-term options decay faster. A short straddle benefits most if Bitcoin barely moves, capturing premium from low volatility. Meanwhile, the short risk reversal aims to profit from declines with minimal upfront expense, though it exposes traders to unlimited losses if price suddenly surges.

Weak institutional demand for Bitcoin ETFs fuels discontent

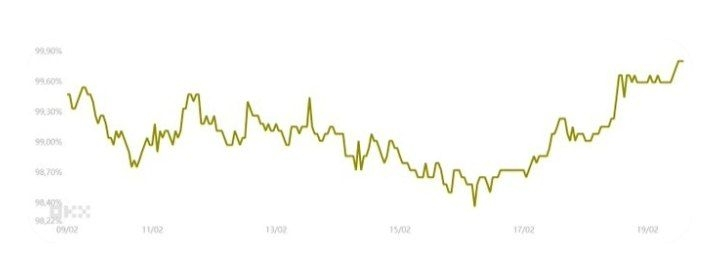

To better gauge the risk appetite of traders, analysts often look at stablecoin demand in China. When investors rush to exit the cryptocurrency market, this indicator usually drops below parity.

Under neutral conditions, stablecoins should trade at a 0.5% to 1% premium relative to the US dollar/Yuan exchange rate. This premium compensates for the high costs of traditional FX conversion, remittance fees and the regulatory friction caused by China's capital controls. The current 0.2% discount suggests moderate outflows, though this is an improvement from the 1.4% discount seen on Monday.

Part of the current discontent among traders can be explained by the lackluster flows in Bitcoin exchange-traded funds (ETFs), which serve as a proxy for institutional demand.

US-listed Bitcoin ETFs have seen $910 million in total outflow since Feb. 11, which likely caught bulls off balance, especially as Bitcoin traded 47% below its all-time high while gold prices hovered near $5,000, up 15% in just two months. Similarly, the S&P 500 index sat only 2% below its own all-time high, indicating that this risk-aversion is largely restricted to the cryptocurrency sector.

While Bitcoin options signal a fear of further downside, traders are likely staying extremely cautious until a clear rationale for the crash to $60,200 on Feb. 6 finally emerges.