Bitcoin market structure is quietly shifting — and the size of the flows makes it hard to ignore.

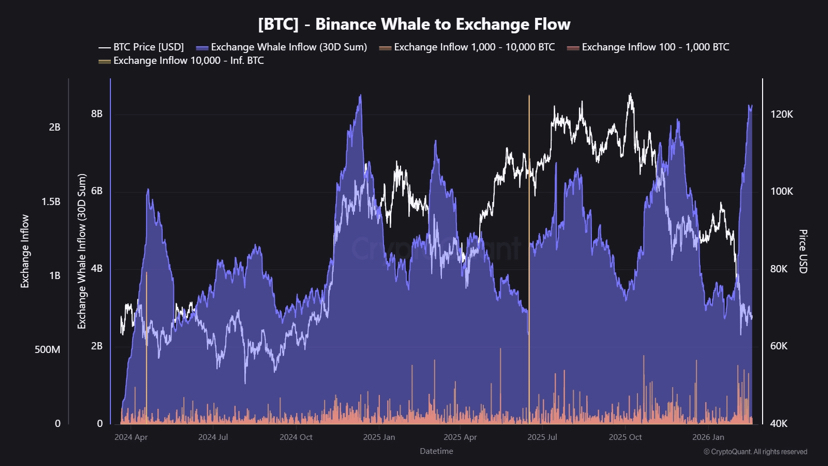

Over the past 30 days, roughly $8.24 billion in whale BTC has moved into Binance. That’s the highest whale inflow level in 14 months. When capital of that magnitude becomes active, it signals positioning — not noise.

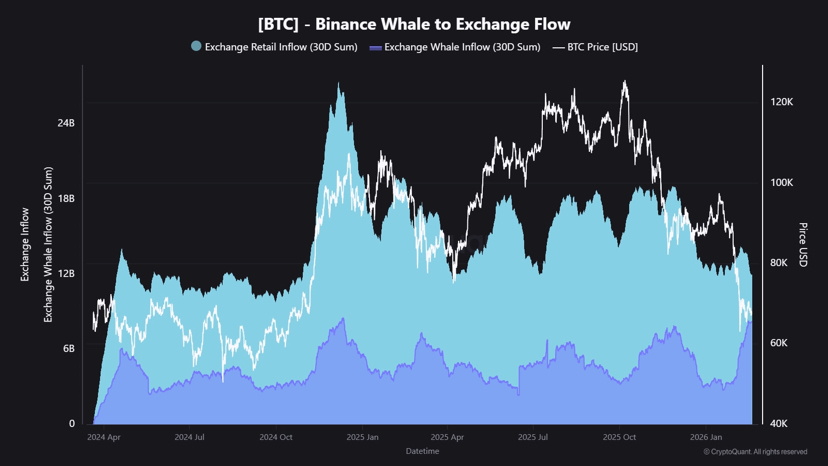

30-Day Flow Snapshot

• Whale Flow: $8.24B (accelerating)

• Retail Flow: $11.91B (flattening)

• Retail-to-Whale Ratio: 1.45 → compressing

Retail volume is still larger in absolute terms, but momentum tells the real story. Retail activity has plateaued. Whale deposits, meanwhile, continue climbing.

The ratio is narrowing.

And narrowing dominance shifts matter.

What Does This Mean?

Whales don’t move billions casually. When large holders transfer BTC onto Binance — the deepest liquidity venue — it typically signals one of three intentions:

1. Preparing to distribute into strength

2. Positioning for derivatives exposure

3. Strategically reallocating capital

The key is not the deposit alone — it’s how price reacts to it.

If price holds firm despite heavy whale inflows, that implies absorption.

If volatility expands after deposits spike, distribution may be underway.

Structural Implication

The dominance dynamic is changing.

Retail momentum is cooling.

Whale participation is increasing.

That shift means market direction may be increasingly influenced by fewer, larger hands.

Historically, when whale flows surge while retail flattens, volatility often follows. Not immediately — but once positioning resolves.

Liquidity doesn’t disappear.

It concentrates.

And when concentration increases, moves become sharper.

The question now isn’t whether whales are active.

It’s whether they’re preparing to sell strength — or build structure for the next expansion.