💰 The Largest Theft: The Bybit Hack (2025)

If "number one" means the single biggest dollar amount stolen, the Bybit hack is the current record-holder. On February 21, 2025, the cryptocurrency exchange lost approximately $1.5 billion in Ethereum and related tokens .

How It Happened: The attack was highly sophisticated. Hackers manipulated a wallet signature during a routine transfer from Bybit's cold wallet (an offline storage system). They tricked the system into approving a transaction that altered the smart contract logic, effectively giving them control over the cold wallet and allowing them to drain its funds. The transaction was "musked" to appear legitimate to the exchange's team .

The Perpetrators: Blockchain security firms quickly identified the culprit as the Lazarus Group, a notorious state-backed hacking organization from North Korea. This group has a long history of massive cyber heists, including the $625 million Ronin Bridge hack in 2022 .

Aftermath and Response: Despite the scale of the theft, Bybit assured users it remained solvent, as the stolen funds represented only about 7.5% of its total assets under management. The broader crypto industry rallied to support Bybit, with security firms like ZachXBT and Arkham Intelligence tracing funds, and Tether freezing some stolen assets. Bybit was able to replenish its Ethereum reserves within days through loans and purchases .

🎯 The Most Symbolic Target: The Nasdaq Hack (2013)

If "number one" is defined by the prestige and critical nature of the target, the intrusion into the Nasdaq stock exchange stands alone. While no direct financial theft was reported, the psychological and systemic impact was immense .

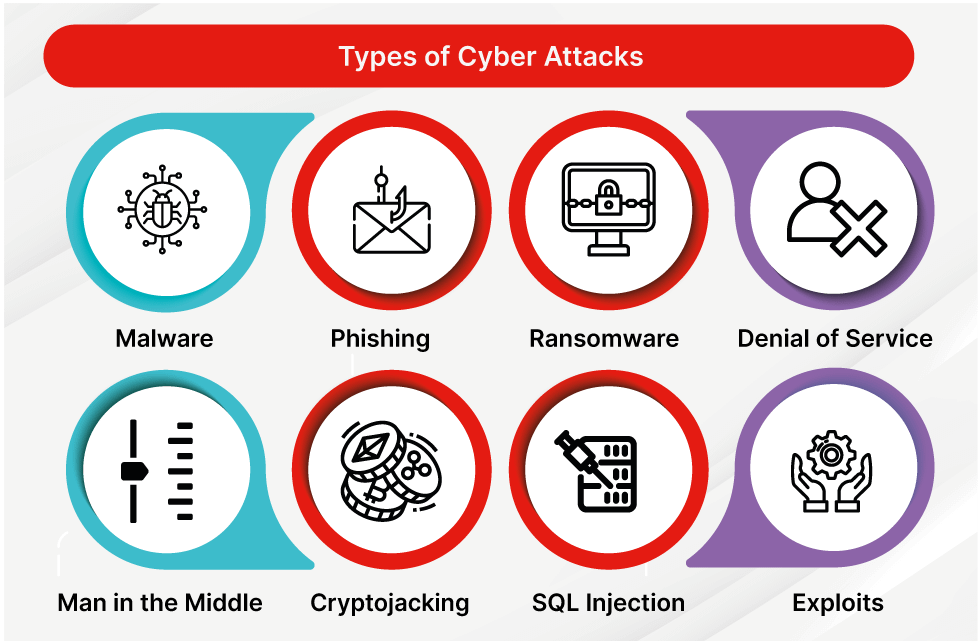

How It Happened: From 2005 to 2012, a global hacking ring led by four Russians and a Ukrainian methodically infiltrated the networks of major institutions, including Nasdaq, Citibank, and 7-Eleven. They exploited SQL injection vulnerabilities to steal login credentials and installed malware for persistent backdoor access .

The "NASDAQ is Owned" Moment: The gravity of the breach was captured in a chilling instant message from January 2008. After months of slowly escalating his access, hacker Aleksandr Kalinin reported to an accomplice: "NASDAQ is owned." He had gained administrative access to the stock exchange's network .

The Goal: Unlike the Bybit hack, the goal here wasn't necessarily to immediately steal funds from the exchange itself. The scheme involved stealing over 160 million credit card numbers from various companies, which were then sold or used to create clone cards for ATM withdrawals. The Nasdaq compromise gave them a powerful and trusted foothold .

🌐 Other Major Attacks That Shaped the Landscape

While the two above are primary contenders, other attacks have redefined the scale of cyber threats in finance:

The JPMorgan Chase Attack (2014): This breach affected approximately 83 million households and small businesses, making it one of the largest data breaches of a US bank in history. The stolen contact information was allegedly used in stock manipulation schemes and other crimes .

The ICBC Ransomware Attack (2023): A ransomware attack on the Industrial and Commercial Bank of China's financial services unit disrupted the US Treasury market, forcing trades to be rerouted and highlighting the systemic risk posed by cyberattacks on critical financial infrastructure .

The Japanese Brokerage Account Takeover (2025): Adversaries compromised thousands of online brokerage accounts, executing over $700 million in fraudulent "pump-and-dump" trades. This case is notable for its use of adversary-in-the-middle (AiTM) attacks and infostealer malware to bypass traditional security .

I hope this overview of the largest and most significant attacks is helpful. Are you interested in the specific security failures that allowed any of these hacks to occur?