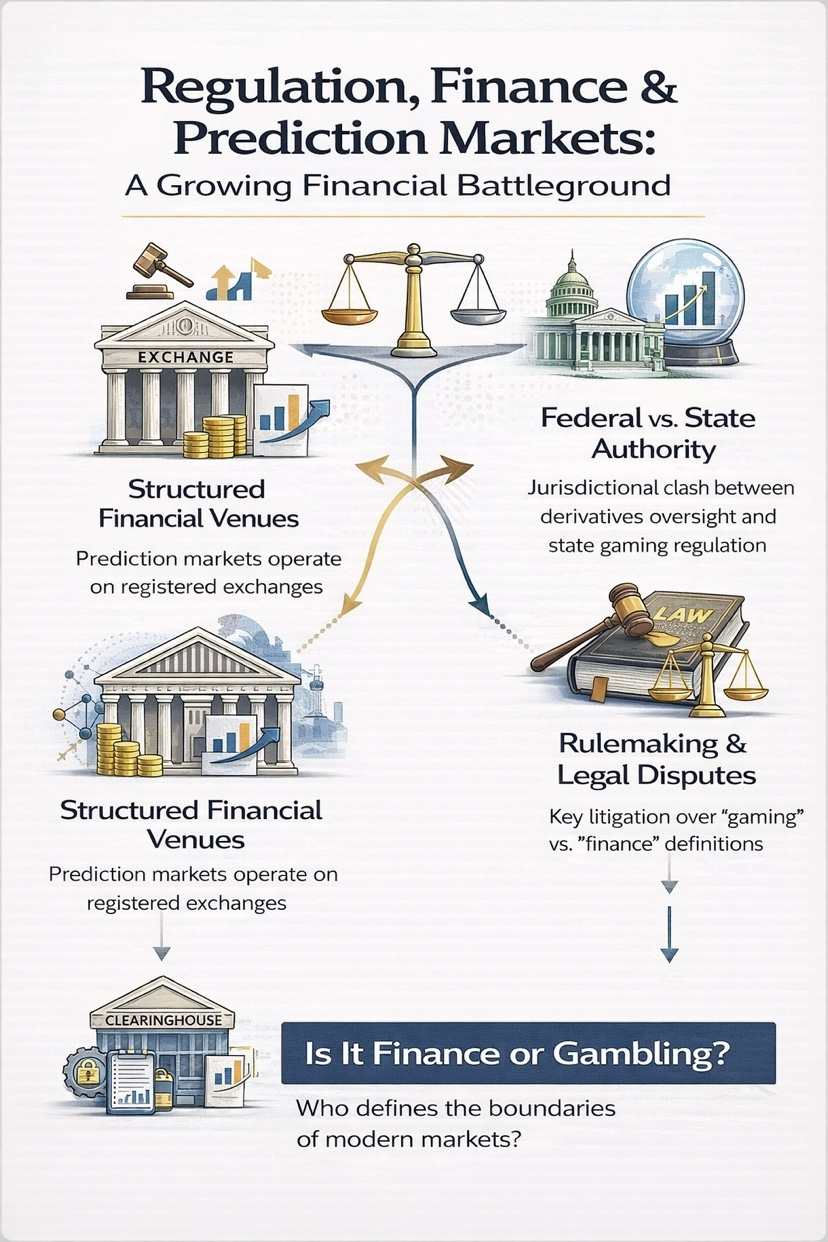

Prediction markets are no longer niche experiments about collective intelligence. They are becoming structured financial venues operating inside real regulatory infrastructure, and that shift is forcing regulators to confront a question they have avoided for years: when does speculation become finance, and when does finance become something else entirely?

Prediction markets are no longer niche experiments about collective intelligence. They are becoming structured financial venues operating inside real regulatory infrastructure, and that shift is forcing regulators to confront a question they have avoided for years: when does speculation become finance, and when does finance become something else entirely?

At the surface level, prediction markets appear simple. Participants trade contracts tied to future outcomes, creating prices that reflect probabilities. But structurally, these instruments resemble derivatives because their value is derived from events rather than physical assets. That single design choice pushes them toward federal oversight, where derivatives law begins to shape what is allowed, what is restricted, and who ultimately controls the rules.

The growing tension between federal regulators and state authorities reveals that this is not simply about prediction markets themselves. It is about jurisdiction. Federal agencies aim to preserve consistent national derivatives markets, while states view certain event contracts — especially those tied to sports or politics — through the lens of gaming regulation. Both perspectives carry valid concerns, and both see the other as potentially overreaching.

What makes this moment different is that prediction markets are no longer theoretical. Clearinghouses, reporting systems, and compliance infrastructure are now interacting with event-based contracts. Once market plumbing becomes real, regulators can no longer treat these products as edge cases. They become part of the financial system whether policymakers fully agree or not.

The deeper challenge lies in intent. A contract designed to hedge risk can look structurally similar to one designed purely for speculation. Yet regulators are being asked to draw a line between those purposes using legal language written long before modern event trading existed. Terms like “gaming” suddenly carry enormous weight because their interpretation determines which markets survive and which disappear.

This battle will likely be decided gradually, through rulemaking and litigation rather than dramatic reform. Some event contracts may find a durable place within federally regulated exchanges, while others will continue facing resistance from state systems built around traditional wagering frameworks.

The real question is not whether prediction markets belong to finance or gambling. It is whether modern financial infrastructure can adapt quickly enough to products that blur that line entirely. The answer will shape how innovation fits into regulation — and who gets to define the boundaries of market design moving forward.