Everyone obsesses over speed when a new chain launches. Fast blocks. High throughput. Low fees.

But after spending five years watching traders struggle with DEXs, I’ve realized something most people miss.

Speed alone doesn’t fix trading. Speed doesn’t stop you from getting front-run. Speed doesn’t make pricing fair. Speed doesn’t give you the execution quality you’d expect from serious infrastructure.

Fogo feels different to me, and it took a week of testing to understand why.

The Speed Is a Side Effect

The performance is there. Blocks are fast. Fees are low. But those numbers feel like results rather than goals.

What actually caught my attention is that Fogo seems designed by people who understand what breaks when you try to trade on-chain. Not people optimizing benchmarks. People fixing real problems.

The first signal was the VM choice. Fogo runs on the Solana Virtual Machine.

If you’re already building on Solana, you’re not starting from zero. Same programming patterns. Same development tools. Same mental models.

You don’t rewrite your entire codebase. You point your deployment scripts at a Fogo RPC endpoint. Make small adjustments. Keep building.

That continuity matters more than it sounds. When you’re not relearning infrastructure basics, you can focus on actual market behavior instead of fighting with unfamiliar tooling.

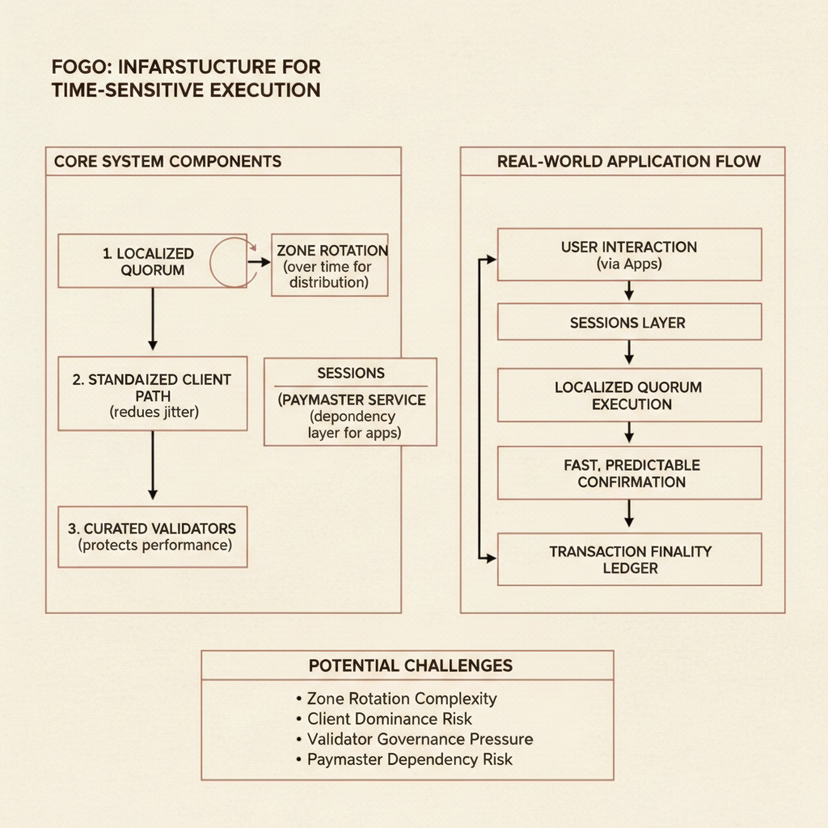

The Validator Rotation Nobody’s Talking About

Here’s something I completely missed on first read. Fogo doesn’t run one static global validator set.

It rotates validators across three eight-hour windows that literally follow the sun.

Asian trading hours. European and US overlap. US afternoon sessions.

Validators are physically located near major financial centers during their active window. The first validator deployments went into high-speed data centers in Asia, positioned close to major exchange servers.

When I first saw this I thought it was over-engineered. Then I thought about what it actually means for execution.

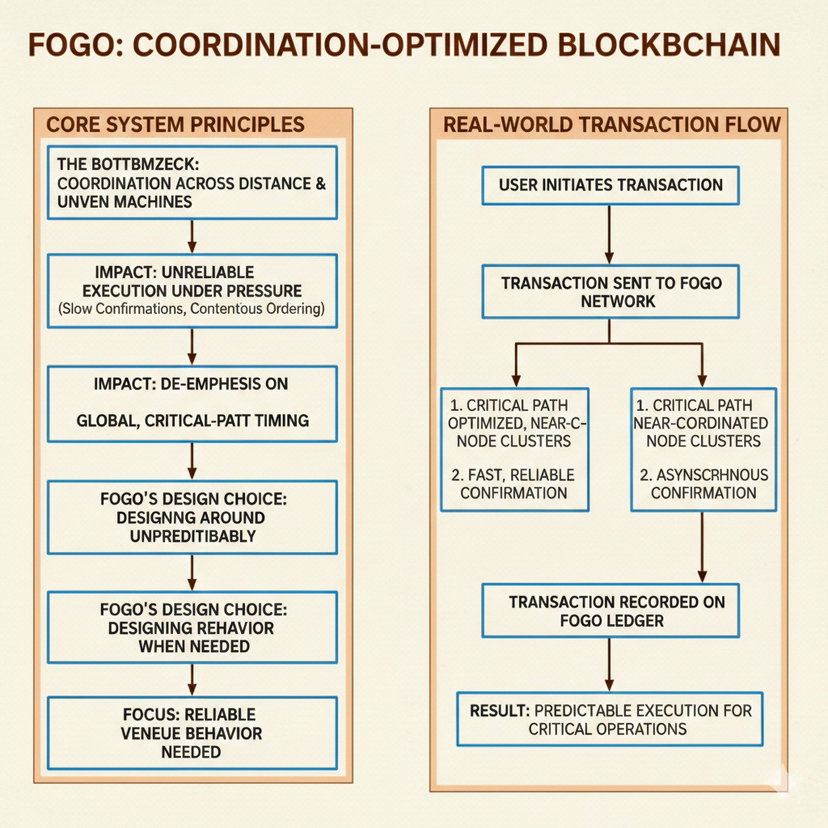

Why Geography Is an Execution Problem

Latency matters in trading. Distance equals delay. Delay equals worse fills.

A validator in Singapore processes your transaction faster than a validator in Frankfurt if you’re trading during Asian hours. That’s just physics.

Most chains pretend geography doesn’t matter because acknowledging it feels like admitting centralization. Fogo acknowledges it explicitly and designs around it.

During each window, the active validators are concentrated near the markets that are actually awake and trading. The network optimizes for the users who are active right now, not for theoretical global participation in every single block.

That’s honest engineering. Whether you like the trade-off depends on whether you care more about symbolic decentralization or actual execution quality.

The Auction Model That Changes the Game

Now we get to the part that actually made me stop and reconsider how on-chain trading could work.

Fogo has a perpetual DEX called Ambient that uses something called Dual Flow Batch Auctions.

The model is clever. Instead of copying centralized exchange order books or standard AMM pools, it combines ideas from both.

Here’s how it works in practice. All trades within a block get grouped together. At the end of the block, they clear at an oracle price. Everyone in that batch gets the same execution price.

The race stops being about who submits fastest. It becomes about who offers the best price.

Why This Kills Most MEV Strategies

MEV on most chains works because validators can reorder transactions for profit. Front-running, sandwich attacks, all that predatory behavior happens because transaction ordering is valuable.

In a batch auction where everyone gets the same price, reordering transactions within the batch gives you almost no edge.

The MEV extraction strategies that work on Ethereum or even Solana become much harder to execute profitably.

And here’s the part that surprised me: sometimes traders actually get price improvement if the market moves in their favor during the batch window.

You submit an order. Market moves slightly. You clear at the better oracle price instead of the worse price you would’ve gotten in a traditional DEX.

That almost never happens in DeFi. Usually the design is fighting against you. Here it occasionally works in your favor.

Because the VM Can Actually Handle It

This batch auction model only works if the chain can process it fast enough that batches stay short.

On a slow chain with 12-second blocks, batching would introduce unacceptable execution delay. On Fogo running SVM with sub-second blocks, the batch window is tight enough that execution feels nearly instantaneous.

The whole design only makes sense because of the underlying performance. That’s what I meant earlier about speed being a result rather than the goal.

Sessions Fixed the Interaction Problem

Trading on most DEXs right now means signing transactions constantly. Approve token. Sign swap. Approve another token. Sign another swap.

If you’re actively trading, you’re clicking wallet popups every thirty seconds. It’s awful UX that makes DeFi feel like a chore instead of a tool.

Fogo introduces Sessions. You approve once when you open a session with an app. During that session you can trade without constant wallet interruptions.

You set limits upfront. Choose which tokens the app can access. Set spending caps. You can even allow unlimited access for apps you trust completely.

Some dApps can pay gas on your behalf during a session, so the whole experience starts feeling closer to using a centralized exchange. Login once. Trade smoothly. No constant friction breaking your flow.

I tested this for three days and the difference is noticeable. Not revolutionary. Just noticeably less annoying than the standard DeFi experience.

The Full Stack Approach

Fogo didn’t just build a chain and hope people figure out the rest.

They use FluxRPC as a high-performance RPC layer. Cross-chain transfers connect through Wormhole and Portal Bridge. Price feeds come from Pyth Lazer. Indexing support comes from Goldsky.

Users can verify everything using Fogoscan, the official block explorer.

It’s not just infrastructure. It’s bridges, oracles, indexing, RPC, all the components you actually need to build serious trading applications.

That integrated approach matters. Most chains launch with just the base layer and expect the ecosystem to fill in gaps over time. Fogo shipped with the stack mostly complete.

The Hardware Reality Check

Here’s where things get uncomfortable for decentralization purists.

Validator minimum requirements: 24-core CPU, 128GB RAM, high-speed NVMe storage.

Recommended specs: 32 cores, 512GB ECC memory.

That’s serious hardware. Enterprise-grade server equipment. Not something you run on a laptop or a cheap VPS.

Some people will immediately say this limits decentralization. And they’re right. It does.

But the logic is straightforward. If you want fast networking and heavy throughput, nodes must handle the load. Weak machines become bottlenecks that drag down everyone’s experience.

Fogo chose performance over accessibility. Validators get selected based on experience running high-performance SVM systems.

The network starts small and grows over time. That’s intentional. They’re not pretending you can run serious trading infrastructure on Raspberry Pis.

Token Economics Without the Hype

FOGO is used for gas, staking, and ecosystem grants. Same token fuels the network and secures it.

Commission is 10%. Inflation starts around 6%, drops to 4%, eventually reaches 2%. The goal is maintaining strong incentives while reducing long-term dilution.

There’s also Fogo Flames, a points system rewarding community participation. Flames are free. Can be adjusted or stopped. They’re explicitly not promised as tokens.

That last part matters. By not promising token conversion, they reduce legal risk and prevent unrealistic expectations from building up.

Partner projects also commit to revenue sharing. If the ecosystem grows, token value and network strength grow together.

None of this is exotic or revolutionary. It’s just straightforward tokenomics without the usual hype mechanics.

The Risks Are Real

I need to be clear about what could go wrong because it’s easy to get excited about clever design and ignore execution risk.

This is a new chain. Rapid updates will happen. Bugs might surface. Validator rotation improves performance but during each window, control is more geographically concentrated.

Bridges are always risky in DeFi. Moving large amounts across chains requires caution. Better to test with a dedicated wallet and small amounts first.

Sessions are convenient but they’re also permission grants. Set strict limits. Don’t give unlimited access unless you deeply trust the application.

Always verify transactions on Fogoscan before assuming they went through correctly.

Fogo is young. It’s evolving. It’s not risk-free. Anyone pretending otherwise is selling you something.

What They’re Actually Trying to Do

But despite those risks, the design is clear in a way most chains aren’t.

Fogo wants professional-level trading infrastructure on-chain. Not hobby projects. Not experiments. Real trading with execution quality that doesn’t make you embarrassed compared to centralized alternatives.

They’re not forcing developers to retrain on new languages. They’re aligning validator activity with global market cycles. They’re reducing MEV through batch auctions. They’re removing constant signing friction with Sessions.

The high hardware requirements show this isn’t a hobby experiment. It’s built for performance first.

The Question They’re Actually Asking

In a space obsessed with TPS numbers and speed records, Fogo is asking a deeper question.

How should on-chain markets actually work?

Not “how fast can we go?” but “what does fair execution look like when you can’t rely on centralized market makers?”

If the execution matches this vision, Fogo could push decentralized trading meaningfully closer to real global market standards.

Not just faster. Fairer. More structured. More aligned with how professional traders actually operate.

That’s ambitious. Whether they pull it off remains to be seen. But at least they’re asking the right question.