$XRP Influence drives crypto markets as much as technology does. A single viral post can shift sentiment, spark volatility, and redirect capital flows within hours. That power makes allegations of paid narrative manipulation especially serious in an industry already defined by intense rivalry and tribal loyalty.

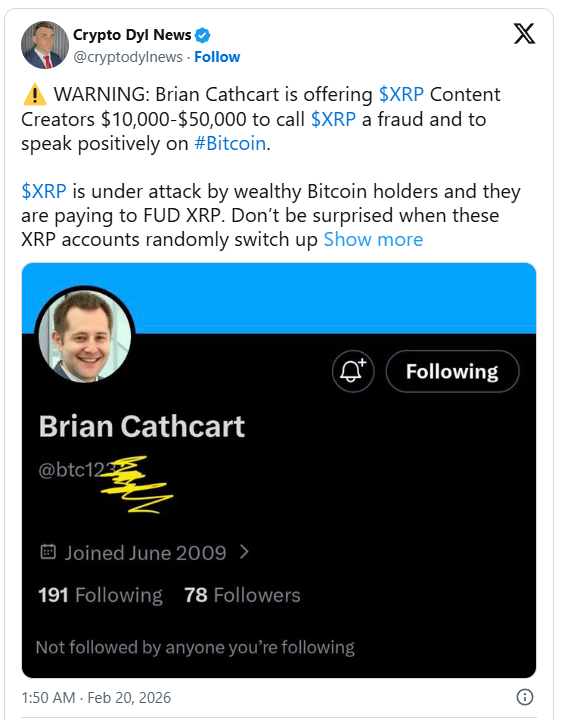

Crypto Dyl News stirred controversy this week after alleging that Brian Cathcart is offering XRP-focused content creators between $10,000 and $50,000 to publicly label XRP a fraud while promoting Bitcoin in a positive light.

The claim quickly gained traction across X, with some community members warning that certain XRP accounts could “switch sides” unexpectedly. Crypto Dyl News firmly rejected the idea of accepting payment to misrepresent XRP.

✨The Allegation and the Evidence Gap

As of this report, no independently verified documentation supports the allegation. No contracts, recorded communications, or financial proof have surfaced publicly to confirm that such offers were made or accepted. Brian Cathcart has not released a verified public statement addressing the claim.

In crypto markets, accusations of coordinated “FUD” campaigns frequently emerge during periods of heightened competition or price volatility. However, serious claims involving financial inducements require substantiated evidence before they can move beyond speculation. Without verifiable proof, the allegation remains unconfirmed.

The debate between XRP supporters and advocates of Bitcoin has persisted for years. XRP proponents emphasize cross-border payment utility and Ripple’s enterprise integrations, while Bitcoin supporters focus on decentralization, scarcity, and store-of-value positioning. These ideological differences often spill into aggressive social media campaigns and influencer commentary.

Competition between digital assets intensifies during bull cycles, when market share, narrative dominance, and investor attention carry significant financial implications. That competitive backdrop amplifies the impact of any claim involving paid influence.

✨Disclosure Rules and Regulatory Scrutiny

Regulators in multiple jurisdictions require influencers to disclose paid promotions clearly. Authorities have penalized crypto promoters in the United States and Europe for failing to reveal financial incentives behind endorsements. Undisclosed compensation for positive or negative asset coverage can violate advertising and consumer protection laws.

If verified, any coordinated effort to pay creators to disparage or promote a digital asset would raise ethical and regulatory concerns. However, markets must distinguish between confirmed misconduct and unverified social media claims.

✨What Investors Should Do

Investors should evaluate information through evidence, not emotion. Viral accusations can trigger reactionary trading and unnecessary volatility. Responsible market participants demand documentation before forming conclusions.

Until concrete proof emerges, the reported $10,000–$50,000 offers remain allegations circulating within online discourse. In sentiment-driven markets, clarity and discipline protect capital far better than outrage.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.