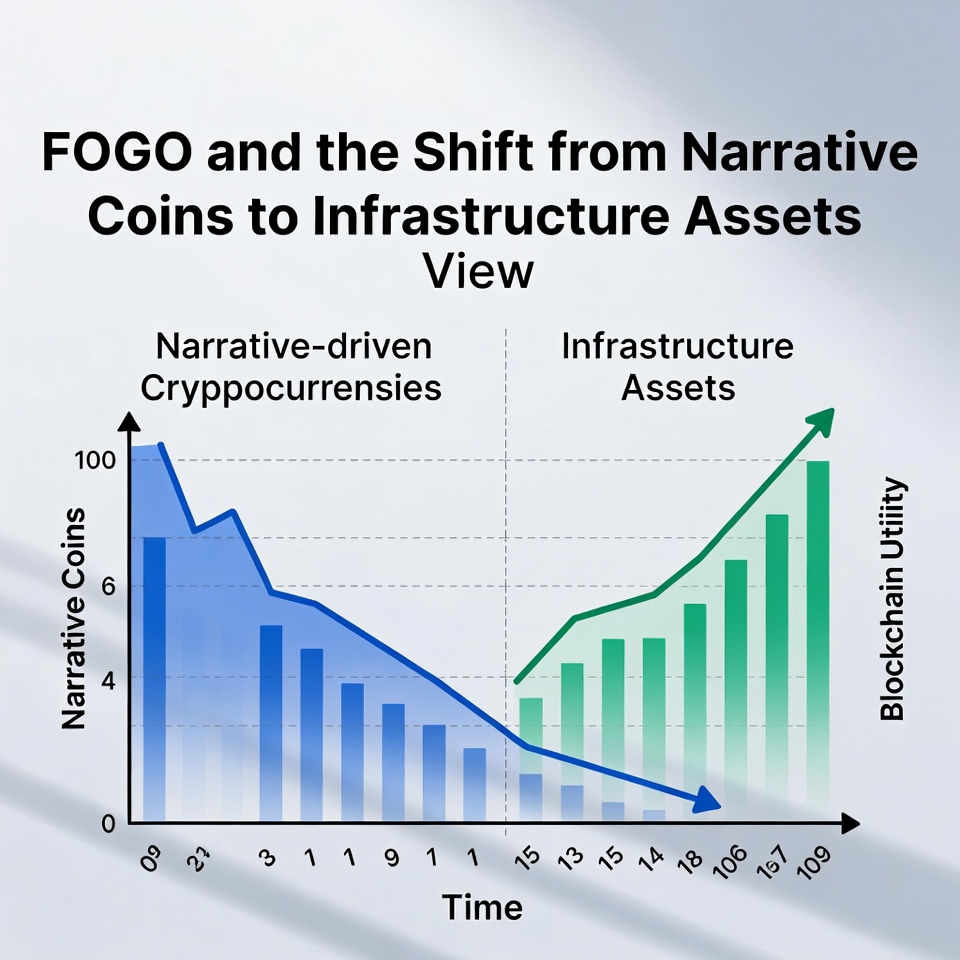

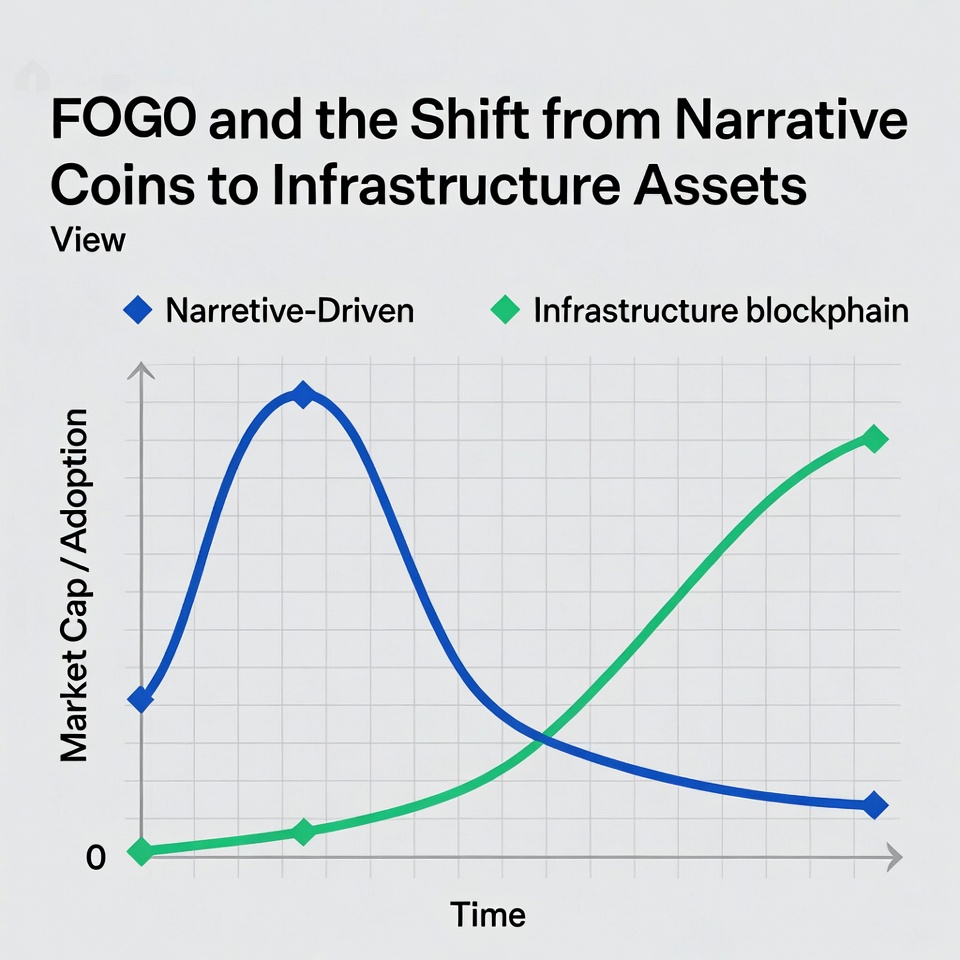

@Fogo Official For most of crypto’s history, stories have driven its value. One year, everyone’s obsessed with DeFi. The next, it’s all about NFTs or AI tokens or meme coins. Money doesn’t chase the best setup—it chases the hottest story.

But that’s changing. The market’s shifting from chasing story coins to building up infrastructure assets. People are starting to care more about the blockchains and protocols that run real systems, not just speculation. FOGO is a good example of this shift.

The question used to be: “What’s the next big story?” Now, it’s: “Which networks still matter after the hype dies down?”

Story coins thrive on attention. They rise and fall on social buzz, influencer hype, short-lived liquidity, and wild market swings. It’s all emotion.

Infrastructure assets are different. Their value comes from real things—networks that actually work, fast transactions, deep integrations, developers building real stuff, and actual economic activity. They don’t spike because of a joke or a meme. They grow slowly as more systems depend on them.

This is where FOGO wants to go. It’s not trying to be the next trend. It’s aiming to be a payment layer—something people actually use.

So, what makes something a true infrastructure asset? Just look at Ethereum. Its value isn’t just a story. Ethereum powers stablecoins, DeFi protocols, NFTs, tokenized real-world assets, and all those layer-2 scaling networks. Sure, some of its value is still speculative, but it’s also serious infrastructure. Billions of dollars move across it.

Real infrastructure assets share three things: Apps and businesses rely on them. They’re hard to replace once integrated. And they hold up under pressure.

The market’s finally starting to reward this.

FOGO’s message is moving in that direction. It’s all about simple blockchain payments, easy onboarding, local adoption, and user-friendly experiences. That’s a big shift from just trying to be “the next big token.”

If FOGO can actually build out payment systems, help merchants, support transactions through tough times, and keep things running smoothly, it stops being just a tradable token. It becomes real economic infrastructure.

And hype is easy to replace. Infrastructure isn’t.

Why now? The crypto market in 2026 is a different animal compared to 2021. A few things have changed how people think:

1. Liquidity got smarter. Big players care about predictability, clear rules, and real usage numbers.

2. Retail investors are tired. After so many hype cycles that crashed, people are more careful.

3. Regulations are clearer. Governments and regulators are starting to tell the difference between pure tokens and networks that actually do stuff.

All of this pushes money toward systems that prove they can last.

So, let’s look at the difference: Narrative tokens live and die by trends. Infrastructure assets depend on usage. Story coins burn bright and fast; infrastructure is sticky and lasts. One is all marketing. The other is all engineering.

FOGO’s best move? Keep building infrastructure. Focus on payments, onboarding, and real-world use. That’s how you survive in a market that’s finally growing up.

Payments, by the way, are the gateway to becoming infrastructure. Payments mean repeat transactions, actual merchant relationships, real usage, and economic activity that keeps cycling. If FOGO becomes a payment layer for everyday business in a region, it’s not just a token anymore. It’s a rail. And financial rails don’t go out of style every season.

But making the shift isn’t easy. Real infrastructure needs uptime, hard data, developer docs, ecosystem tools, and—most importantly—community trust. Anyone can say they’re infrastructure. Most are just running on hype. The market will sort them out. Infrastructure can’t be faked. It has to work.

When a token really becomes infrastructure, its value gets measured differently. It’s not about hype, influencer cycles, or exchange pumps anymore. Now it’s about transaction volume, active wallets, fee revenue, and network growth. Investors stop asking, “When will it pump?” and start asking, “Is this thing actually expanding?” That’s maturity.

FOGO is at a decision point. It can chase stories like everyone else or go all-in on building real payment infrastructure. The second path is slower, but it’s how you build lasting value.

If FOGO can show real merchant adoption, cross-border usability, steady transactions, and tight ecosystem integrations, then it stops being just another hype token. It becomes infrastructure. That changes everything—how analysts model it, how institutions look at it, and how the whole market treats it.

Crypto’s growing up. Speculation isn’t going anywhere, but real value finally has a shot.$FOGO #fogo