South Korea’s financial watchdog is facing renewed criticism from lawmakers after a major glitch at cryptocurrency exchange Bithumb erroneously credited users with Bitcoin it didn’t actually hold and a regulatory investigation into the incident has now been pushed back.

In a promotional event on February 6 2026, Bithumb mistakenly issued 2,000 BTC to each qualifying user instead of the intended 2,000 Korean won (~$1.40), resulting in a phantom total of 620,000 BTC appearing on user accounts. These balances were not backed by actual Bitcoin held by the exchange.

Probe Delayed, Lawmakers Upset

South Korea’s Financial Services Commission (FSC) launched an on-site inspection of Bithumb signaling it would take “stern legal actions against acts that harm market order.” The inquiry was initially expected to be completed by February 13 2026 but authorities have since extended the deadline to the end of February 2026 saying more time is needed to review the case.

Opposition lawmakers have sharply criticized the FSC’s handling of the matter arguing the episode highlights weaknesses in oversight of the country’s expanding digital asset markets. Some politicians say this isn’t just a technical error but a sign of deeper structural gaps in regulation and supervision.

REGULATION | End of an Era? – Cayman Islands Introduces Mandatory Licensing for Crypto Custody and Trading Firms

What Bithumb Says

During an emergency session at the National Assembly on February 11 2025, Bithumb CEO, Lee Jae-won, told lawmakers that the company has recovered most of the miscredited assets and that the inspection now covers two prior payout incidents as well. He said those earlier errors resulted in minimal losses and were fully reversed.

Of the phantom 620,000 BTC shown during the glitch, Bithumb reported that only 125 BTC (~$8.6 million) remain unrecovered.

MILESTONE | The World’s Largest Public Bitcoin Holder Now Owns Over 700,000 Bitcoins

“Not Your Keys, Not Your Coins”

Beyond regulatory scrutiny, the episode has reignited debate around centralized custody and the long-standing crypto maxim: “Not your keys, not your coins.”

When users hold Bitcoin on centralized exchanges, they do not control the private keys to those assets. Instead, they rely entirely on the exchange’s internal accounting systems and operational integrity.

As the Bithumb incident demonstrates, balances displayed on a platform can be altered by technical errors, internal processes, or even accounting discrepancies. While this case involved an over-credit rather than a loss, it highlights a core vulnerability: users ultimately depend on the custodian’s systems functioning correctly.

Custodial Wallets: Pros and Cons

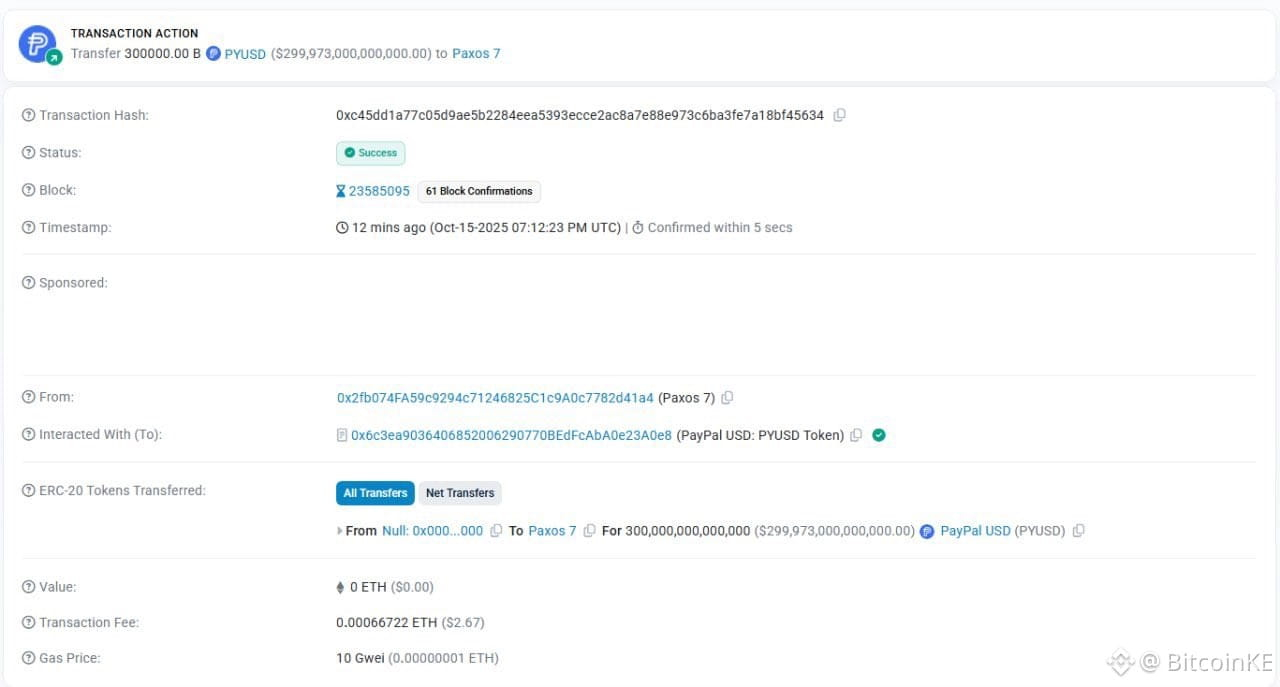

The risks extend beyond exchanges. In October 2025, payments giant, PayPal, accidentally minted approximately $300 trillion worth of its stablecoin PayPal USD (PYUSD) due to a contract or administrative error. Although the tokens were quickly identified as mistakenly created and did not represent real circulating supply, the incident underscored how centralized digital asset issuers retain unilateral control over minting and supply mechanics.

Together, these episodes illustrate a broader structural reality: in centralized systems, whether exchanges or corporate-issued stablecoins, users must trust operators to manage supply, accounting, and custody accurately. While regulation may mitigate some risks, it does not eliminate the underlying dependency model.

For Bitcoin purists, the takeaway remains unchanged – true ownership requires self-custody.

As regulators continue their investigation, the incident serves not only as a compliance case study but also as a reminder of why decentralization and private key control remain foundational principles in crypto.

[EXPLAINER GUIDE] How to Keep Your Self Custodial Wallet Safe

Stay tuned to BitKE for global crypto and regulatory developments.

Join our WhatsApp channel here.

Follow us on X for the latest posts and updates

Join and interact with our Telegram community

_________________________________________