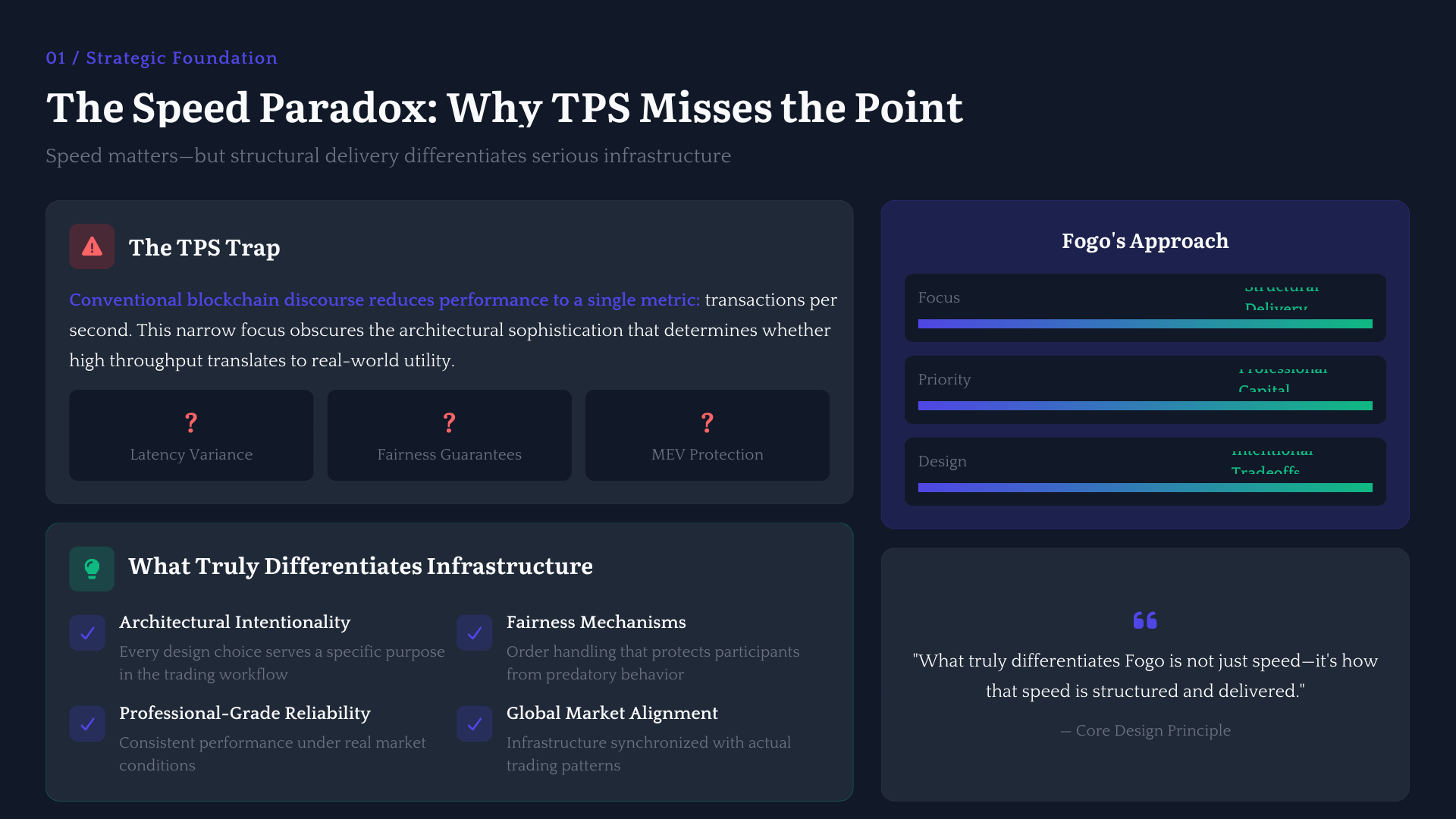

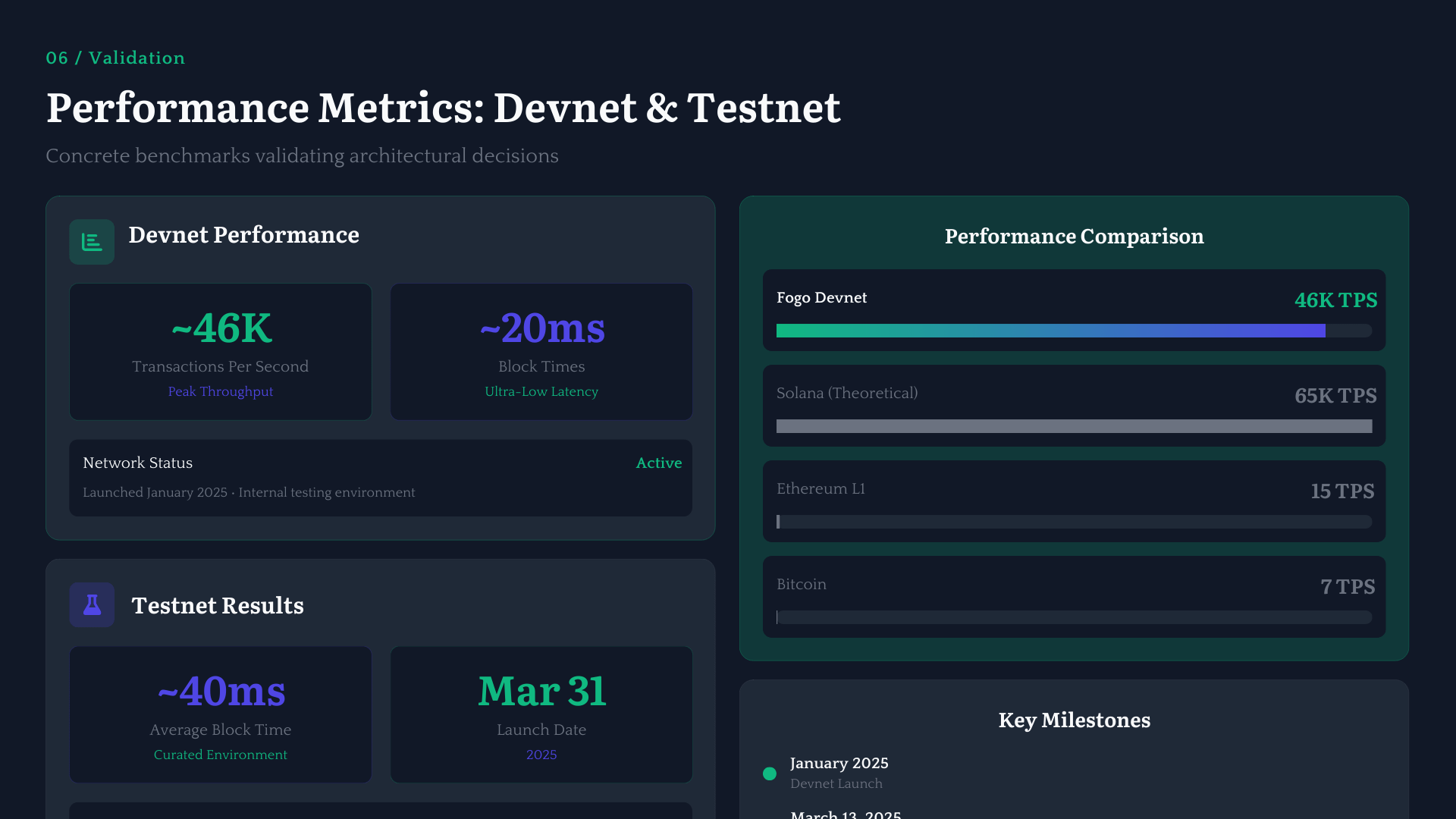

There is a growing narrative that Fogo is simply another high speed blockchain competing on transactions per second. That interpretation feels incomplete. Speed is important, but focusing only on raw throughput overlooks the deeper architectural decisions that define what Fogo is building. This is not a chain optimized for vanity metrics. It is a network engineered around real market structure.

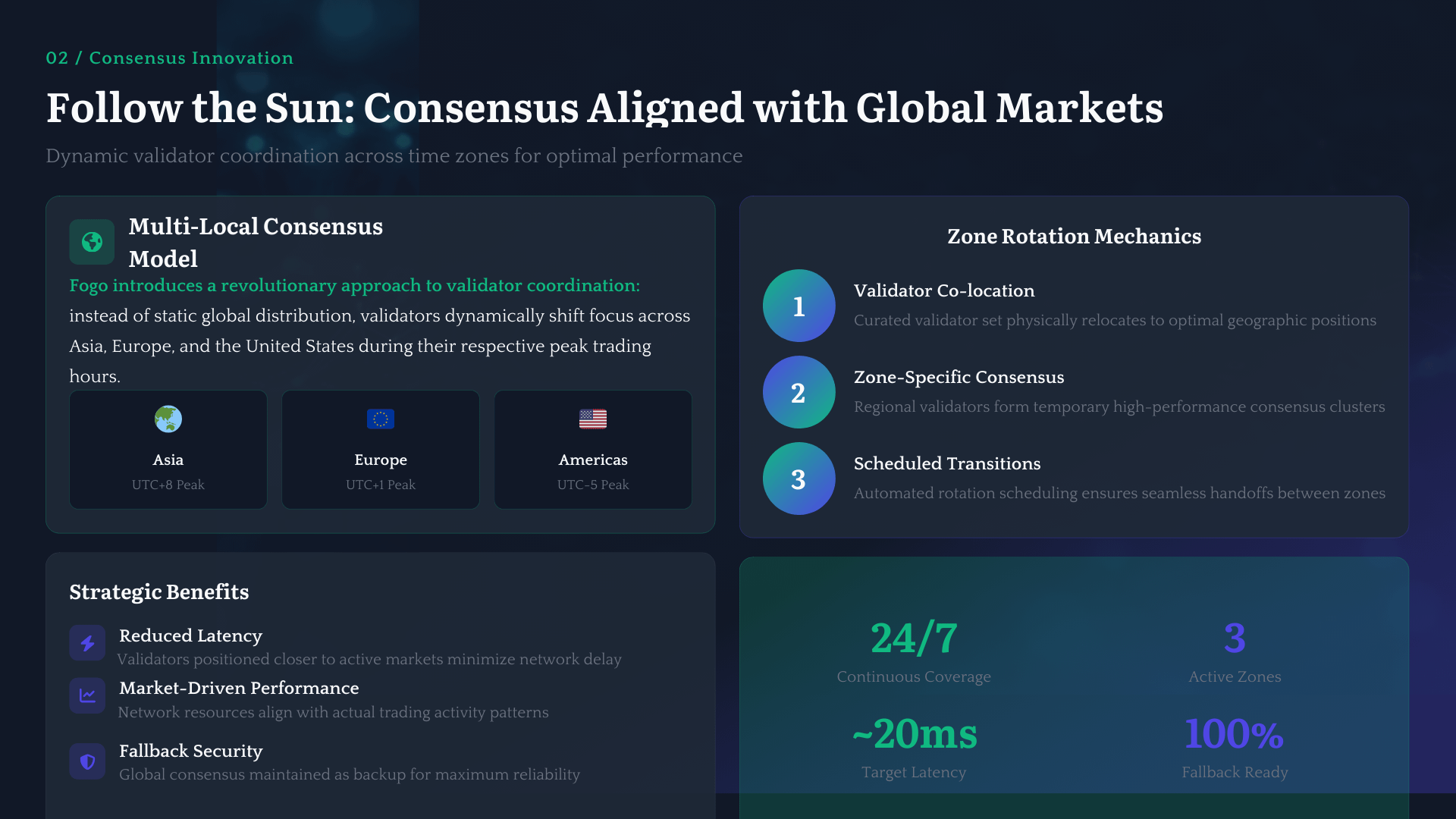

At the center of its design is the follow the sun consensus model. Instead of maintaining static validator dominance in one region, Fogo dynamically aligns validator activity with global trading hours across Asia, Europe, and the United States. This approach reflects a clear understanding of how capital markets function. Liquidity, volatility, and volume are not evenly distributed throughout the day. They move geographically. By rotating validator focus to match peak activity windows, Fogo attempts to synchronize infrastructure performance with where real demand exists.

That decision alone signals intent. It shows that Fogo is thinking in terms of global market microstructure rather than abstract decentralization narratives.

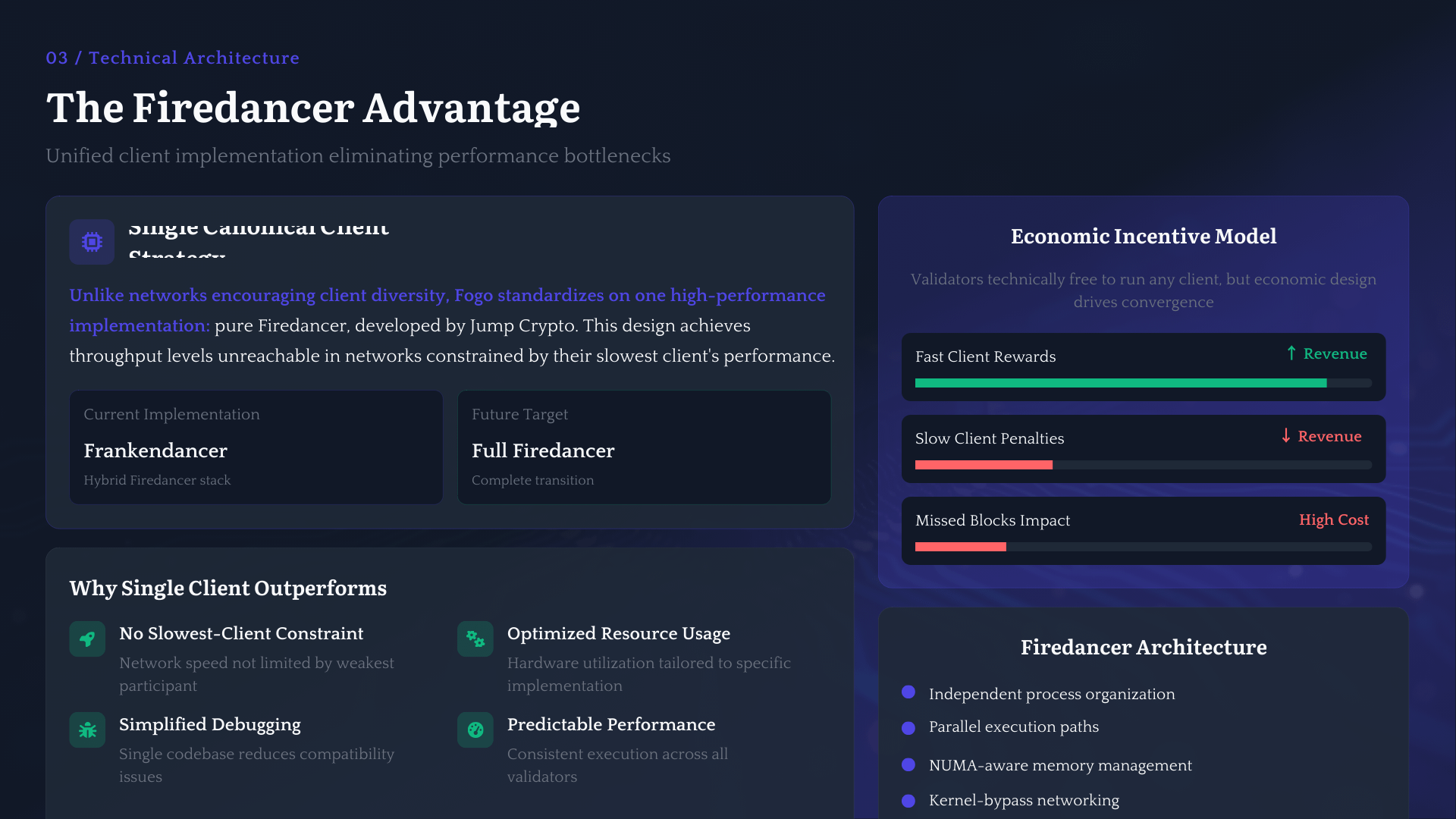

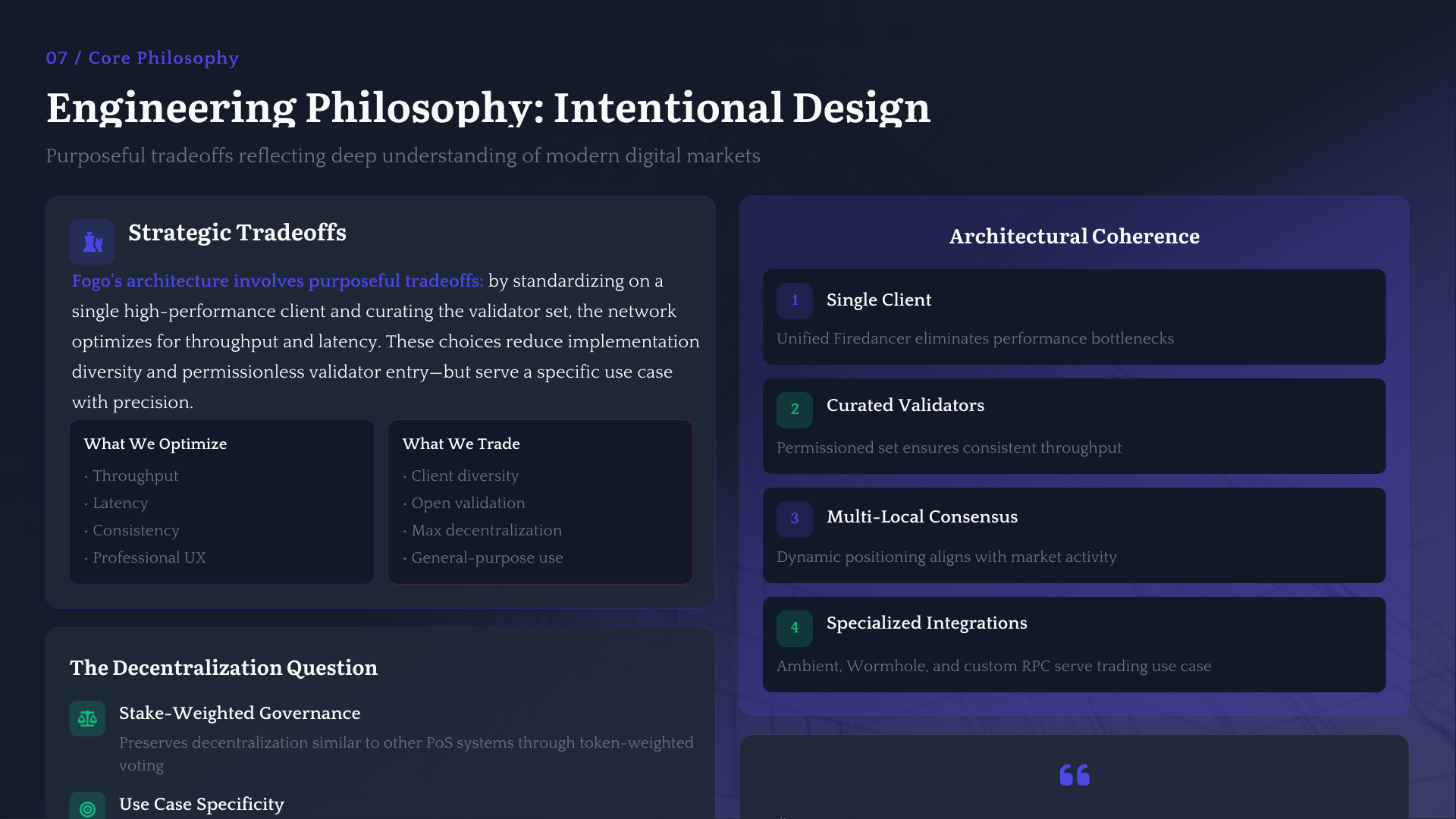

Under the hood, the use of a single Firedancer client strengthens performance consistency. A streamlined client architecture reduces unnecessary fragmentation and focuses engineering effort on execution quality. Firedancer is known for its high performance capabilities, and embedding it directly into Fogo’s core stack indicates that execution efficiency is not an afterthought. It is foundational.

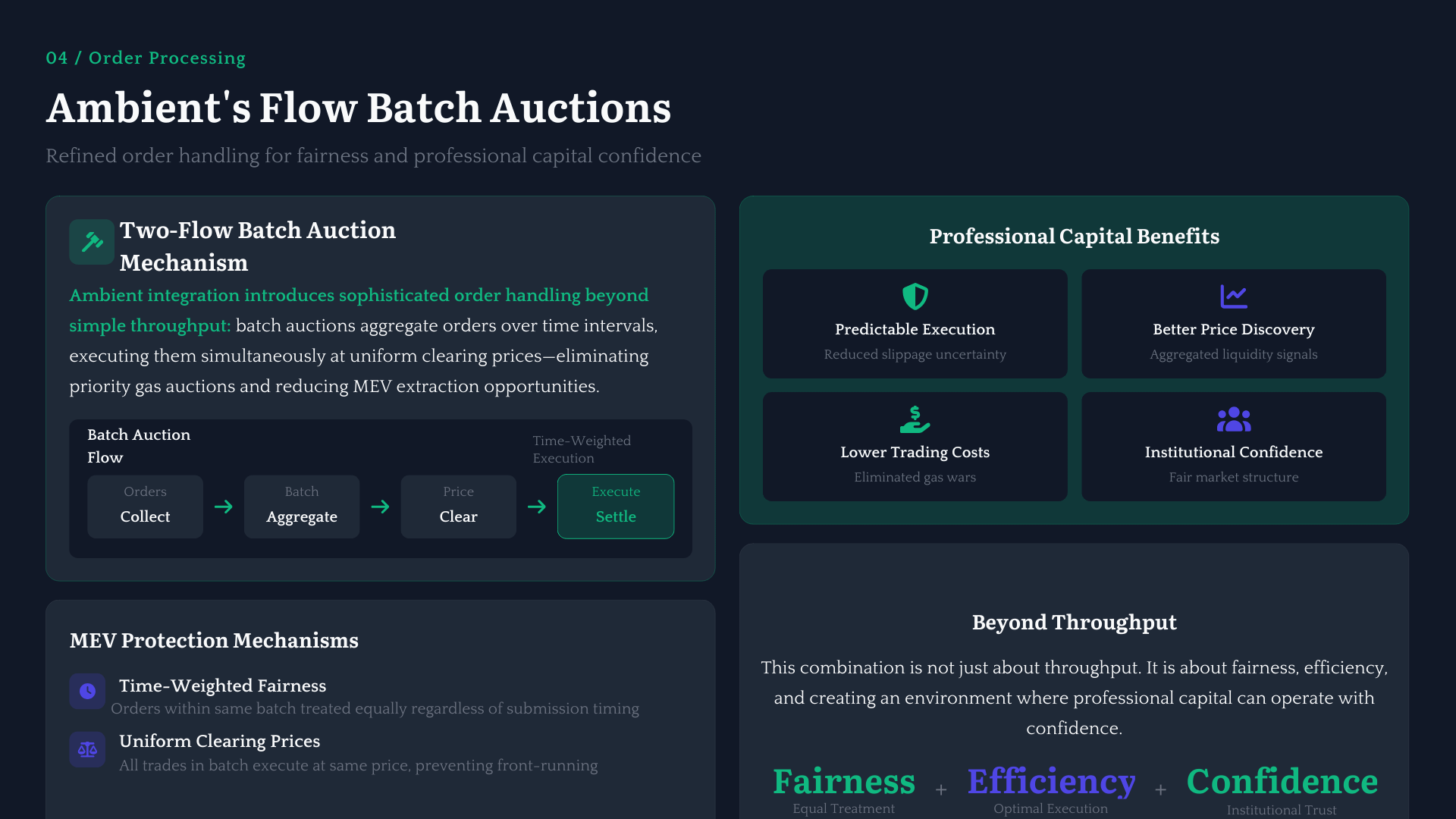

Execution quality becomes even more interesting when combined with Ambient’s two flow batch auctions. Traditional first come first served models can introduce inefficiencies and opportunities for manipulation, especially in high frequency environments. Batch auction mechanisms aim to reduce these distortions by grouping orders and executing them in a more structured way. By implementing a two flow batch auction system, Fogo is signaling that fairness and order integrity matter just as much as speed.

This is a crucial distinction. Many networks advertise low latency. Few address the deeper mechanics of how trades are matched and how participants interact under load. Fogo appears to be tackling both layers simultaneously.

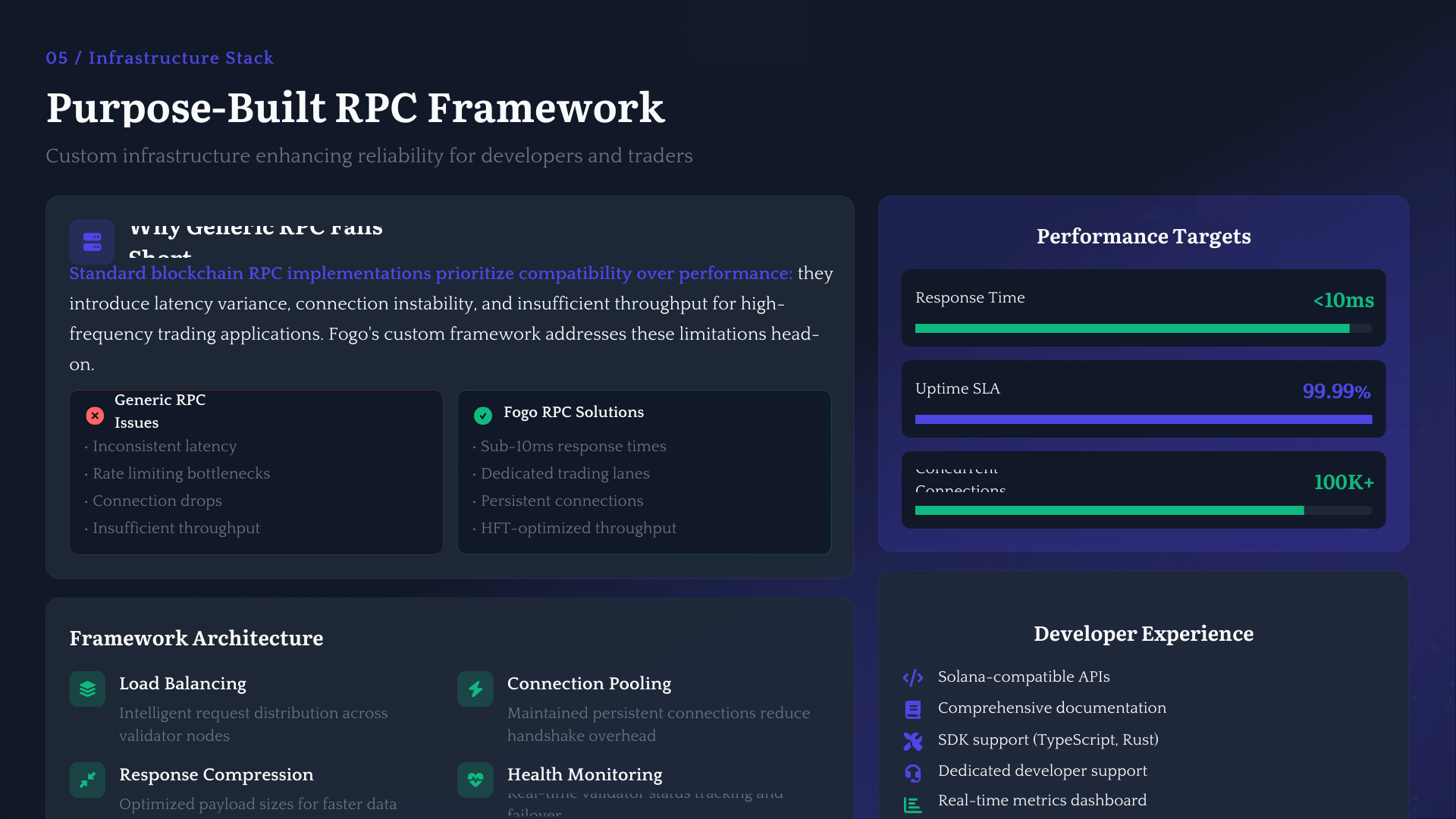

Beyond the execution engine, the supporting infrastructure further reinforces its positioning as trading infrastructure rather than a general purpose chain. Its dedicated RPC framework is designed to handle serious throughput and deliver reliable connectivity for developers, market makers, and trading systems. In professional environments, RPC reliability is not a minor detail. It directly impacts uptime, strategy execution, and risk management.

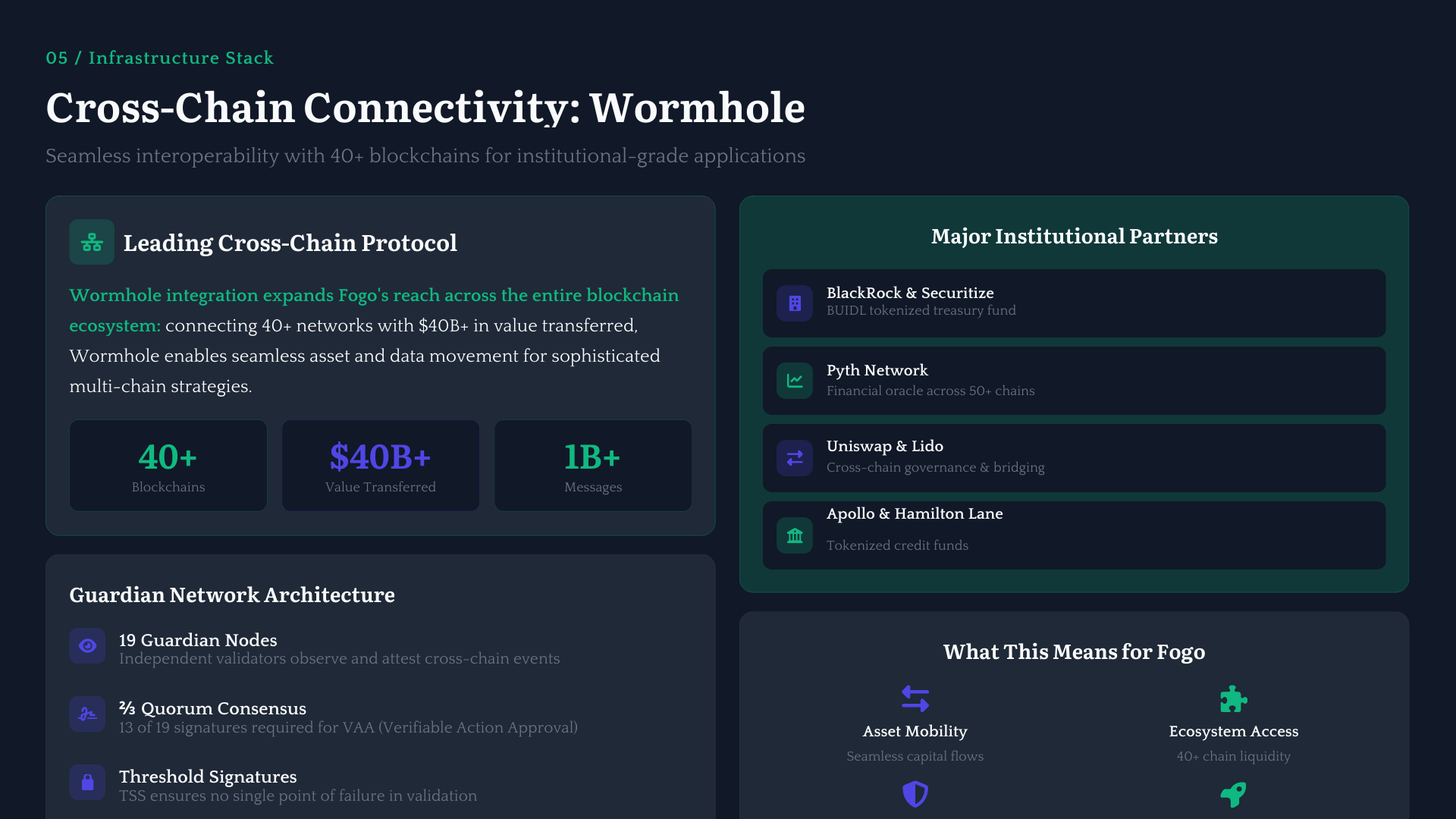

Interoperability also plays a key role. Integration with Wormhole allows Fogo to connect across ecosystems, enabling capital to move without friction. In today’s market landscape, liquidity is fragmented across chains. A network that aims to serve traders cannot exist in isolation. By enabling cross chain connectivity, Fogo expands its addressable liquidity base and ensures it can participate in broader digital asset flows.

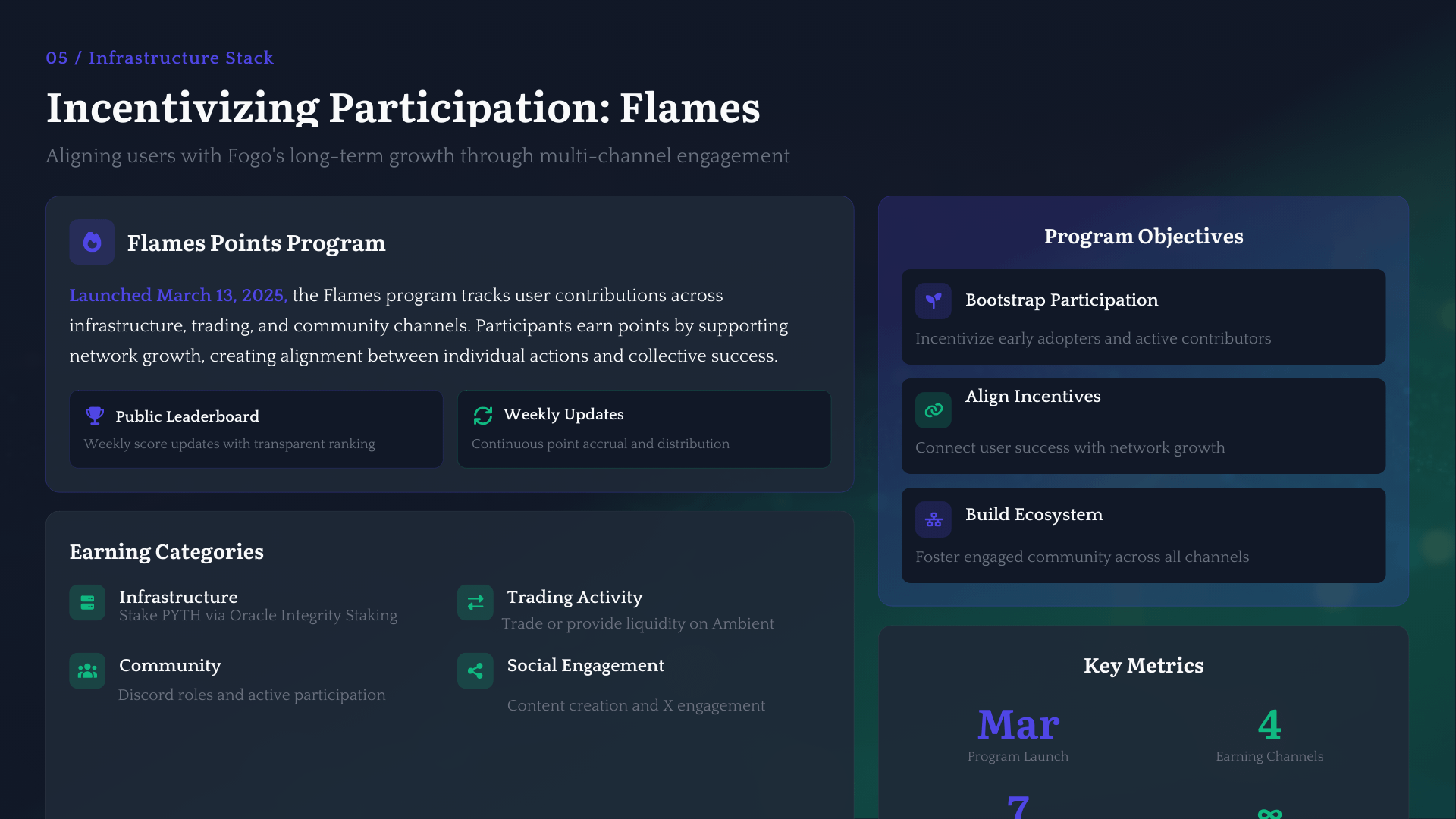

The Flames points program introduces an incentive layer that aligns network participants with long term growth. Incentive design is often overlooked, yet it determines how communities form and sustain themselves. By rewarding meaningful engagement, Fogo is cultivating an ecosystem that extends beyond passive holders. It encourages active participation, which is essential for a trading focused network.

When you step back and view these elements together, a cohesive vision emerges. Follow the sun consensus aligns infrastructure with global liquidity cycles. Fire-dancer ensures high performance execution. Two flow batch auctions promote fairness and structured order matching. A purpose built RPC stack supports professional grade connectivity. Wormhole integration unlocks cross ecosystem capital. Flames points incentivize engagement and loyalty.

Each component reinforces the others. None feel accidental.

This is why describing Fogo as merely fast undersells what is being built. Transactions per second are easy to advertise. Designing infrastructure that understands market behavior, time zone liquidity flows, execution fairness, and cross chain capital mobility requires a deeper level of engineering and strategic thinking.

In many ways, Fogo feels closer to financial market infrastructure than to a typical blockchain experiment. It appears optimized for traders, market makers, and institutions that demand performance consistency and structural integrity. That positioning could prove significant as digital asset markets continue to mature and professional capital becomes more selective about where it operates.

What stands out most is intentionality. The design choices suggest a team that understands that real adoption in trading environments depends on more than raw speed. It depends on fairness, reliability, alignment with global market hours, and seamless connectivity.

For these reasons, Fogo commands attention. It is not trying to be everything to everyone. It is building with a clear focus on becoming foundational infrastructure for digital trading.

That is not just fast. That is strategic engineering.