The discussions surrounding the idea of blockchain scaling would be a matter of block size, shading and or raw throughput measures over the years. But the further limitation was architectural. Most Layer 1 networks combine execution, consensus, and state into stateful vertically integrated systems. This design was compiling on each application to have an identical congestion profile. The pressure in terms of latency and fee due to demand spikes in one protocol was absorbed by the whole network. Sequential implementation was considered to be inevitable. As a matter of fact, it was just a design decision.

Block space was never the critical path. It was the universal queue on a worldwide transaction that was made by monolithic execution environments. All dealings, whether independent or not, took their time. This resulted in predictable fee spikes, intermittent confirmation times and internal inefficiencies that was particularly troublesome to real time financial applications.

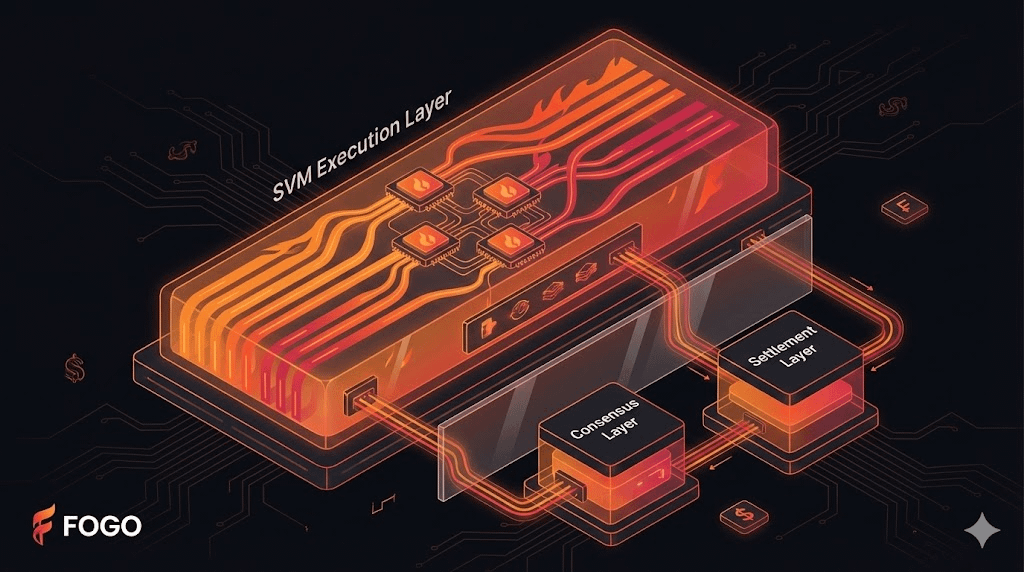

The architecture of Fogo refutes that notion by using the Solana Virtual Machine as an implementation of the portable layer of execution instead of creating a new virtual machine. It is not a cosmetic choice and is a significant change in the philosophy of infrastructure. The system competes at the level of instruction-set level, instead competing at the level of execution realism- maximizing physical constraints, latency bounds, and deterministic throughput.

Parallel execution is the key feature of Solana Virtual Machine. Transactions also explicitly state the state that they are going to read and write, and then transaction execution starts. Two transactions that are not overlapped in the state access can be run in parallel in more than one computational thread. This does away with the requirement of a common sequential queue and contention under load is greatly minimized. Parallelization in this case is not just a cosmetic form of optimization, but a structural basis.

By decoupling this execution engine with the context in which it originally exists, execution may be viewed as a modular infrastructure component. Similar to cloud computing: storage and compute distance, portability of execution enables networks to follow established standards without the need to inherit the old-designed architecture limitations. It changes differentiation towards creating new virtual machines and optimizing deployment, network, and coordination of validators.

This leads to the centrality of performance of validators in such a system. Answering the motivations of the engineering culture of high-performance clients including those related with the Fire dancer project of Jump Crypto, the infrastructure focuses on low-level networking efficiency, zero-copy data flow, and sustained throughput in the presence of volatility. Financial markets cannot operate just on throughput. Deterministic throughput is what counts, i.e. the capacity to execute in a predictable manner even in the event of the heaviest demand.

Latency is unavoidable with physical geography. To solve this, the network architecture is equipped with geographically coordinated zones of validators that rotate with time compressing the communication delays and aiming at sub 40-milliseconds block times. The strategy emphasizes consistency in execution rather than the greatest possible geographic spread. It willingly gives up a smaller margin of decentralization in order to gain performance equity and smaller variance.

This model of performance is reinforced by economic incentives. The $FOGO asset anchors validator membership, staking rewards and penalties directly tied to quantifiable uptime and latency metrics. High throughput Hardware quality is not an option in a high-throughput environment. Enterprise-level infrastructure is also a requirement and the token model corresponds with the same. The participation is organized on the basis of operational competence as opposed to symbolic decentralization.

Developers also find it easy to execute frictionlessly. Since the same underlying SVM architecture is still there, audited smart contracts can be migrated without necessarily rewriting core logic. This minimizes switching costs of decentralized finance protocols that need simultaneous state transitions, execution at high frequency, and deterministic confirmation windows. Rather than spreading the liquidity in incompatible environments, developers are provided with a performance-optimized environment that is constructed around an already existing execution standard.

Nevertheless, these benefits put structural tradeoffs. The high transaction throughput is bound to accelerate state growth which overtime will require more storage by the validators. Hardware barriers rise. An operator set and geographically coordinated zones comprise infrastructure that has been concentrated among well-capitalized operators. Though this enhances performance guarantees, it questions the purist concept of maximal decentralization. Also, liquidity bootstrapping is not necessarily resolved with the execution portability; new networks still have to contend with capital in an ecosystem in which the liquidity is a compounded phenomenon.

The importance of this direction in architecture is not limited to a network. Should execution machines like the SVM be standardized elements that are installed in various infrastructures, differences will become more apparent at the physical deployment, validator economics, and liquidity routing than at the virtual machine design. The competitive edge moves away as to the discovery of new computational models, to the capacity to optimize conditions in the real world.

By separating execution and settlement, decoupling makes blockchain scalability an engineering science based on physical constraints and not hypothetical throughput assertions. It focuses on parallel processing, imposing hardware-consistent economic costs, and making use of the existing developer tooling, the model is a direct challenge to the traditional bottlenecks of sequential execution and the latency of the network. Its sustainability in the long term will be determined by its ability to maintain validator performance, govern state growth as well as strike a balance between execution determinism and pressure towards decentralization. Provided a success, the portability of execution can potentially become a breakthrough in the manner high performance blockchain infrastructure is structured and measured.