Every so often in crypto, a project appears that doesn’t just challenge your intellect but quietly unsettles your emotions, and Fogo is one of those rare arrivals. It does not rely on loud marketing or exaggerated claims about impossible throughput; instead, it confronts a question that has lingered in the background of decentralized finance for years: can we create a blockchain that genuinely satisfies the ruthless demands of professional traders while still honoring the spirit of decentralization that inspired this movement in the first place? That tension between performance and principle has shaped the evolution of crypto since its inception, and Fogo steps directly into that unresolved space with unusual clarity and conviction.

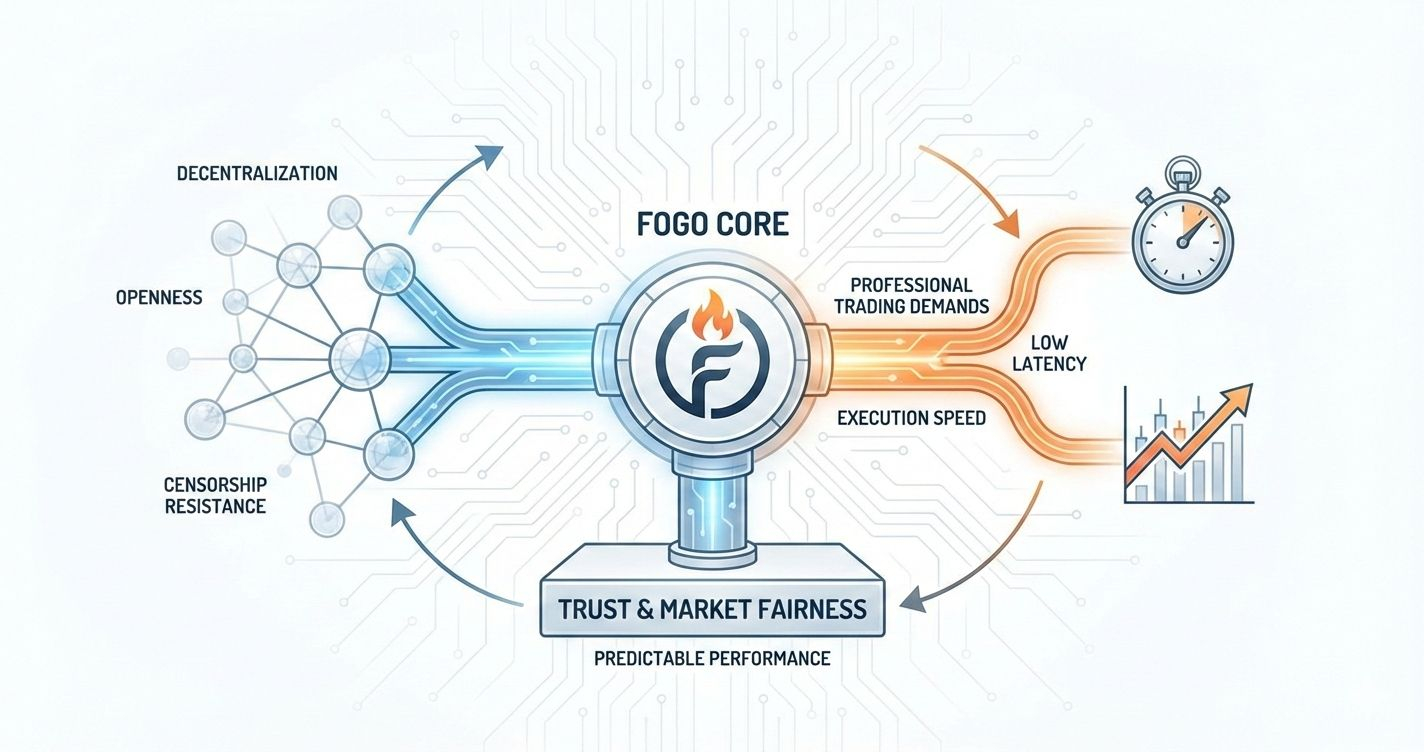

For much of crypto’s history, we have lived within a contradiction. We champion openness, censorship resistance, and neutrality, yet when serious capital and sophisticated trading strategies enter the ecosystem, the limitations of infrastructure become painfully visible. Execution speed is not cosmetic in markets; it is foundational. Latency determines profitability. Order sequencing determines fairness. A fraction of a second can mean the difference between a successful hedge and a costly loss. When blockchains hesitate or behave unpredictably under load, traders do not experience it as an academic flaw; they experience it as financial exposure. Over time, that exposure erodes trust, and trust, more than technology, is what sustains markets.

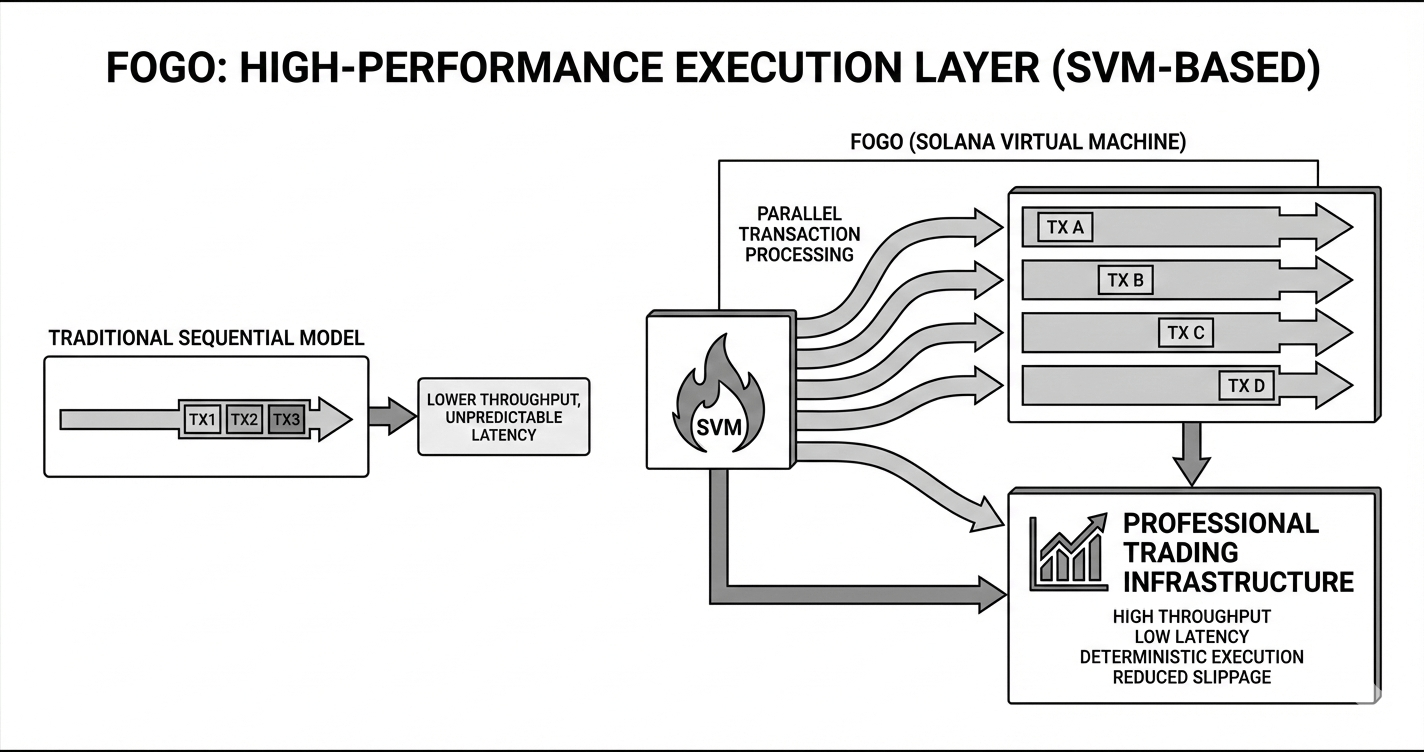

Fogo is built on the execution environment developed by Solana Labs for Solana, leveraging the Solana Virtual Machine and its parallel transaction processing design. Unlike traditional sequential models where transactions are processed one after another in strict order, the SVM allows non-conflicting transactions to execute simultaneously, unlocking a level of throughput and responsiveness that more closely resembles professional trading infrastructure.

This architectural choice is not merely about higher numbers on a dashboard; it reflects an understanding that modern financial strategies depend on determinism and predictability. Traders build quantitative systems on assumptions about timing, slippage, and execution order. When those assumptions fail, strategies unravel. By embracing a high-performance execution layer, Fogo signals that it is not content with symbolic decentralization that cannot withstand real market stress. It recognizes that if decentralized venues are to compete with centralized exchanges, they must match them not only in ideology but in operational quality.

However, speed without fairness has historically amplified inequality within decentralized markets. The rise of MEV, sandwich attacks, and transaction reordering has demonstrated that open systems can still produce structural advantages for those with superior tooling and capital. Many retail participants have felt this imbalance directly when expected prices shift at the last moment or when their transactions are exploited by faster actors. Fogo’s ambition appears to extend beyond raw performance; it seeks to structure execution in a way that reduces adversarial ordering while maintaining open participation. That is an extraordinarily delicate balance, because too much control risks centralization, while too little structure invites chaos. Attempting to navigate that middle path requires not just technical engineering but philosophical discipline.

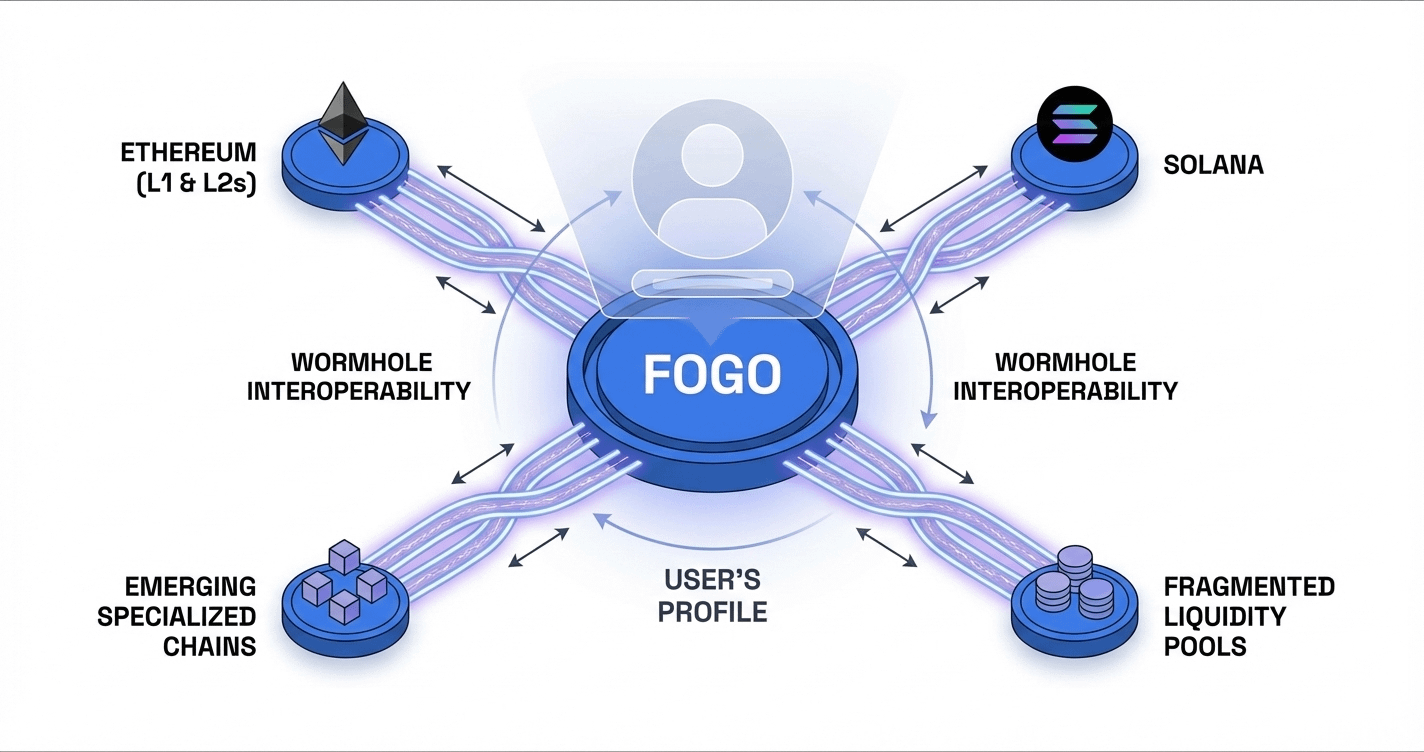

Yet no blockchain, regardless of its execution model, can thrive in isolation. Liquidity in today’s crypto ecosystem is fragmented across multiple networks, including Ethereum, Solana, various Layer-2 solutions, and emerging specialized chains. Traders do not operate with tribal loyalty to a single ecosystem; they pursue efficiency wherever it exists. Fogo’s designers appear to understand this reality, which is why cross-chain connectivity forms a central pillar of its vision. Through integration with Wormhole, Fogo becomes part of a broader interoperable fabric rather than a siloed experiment.

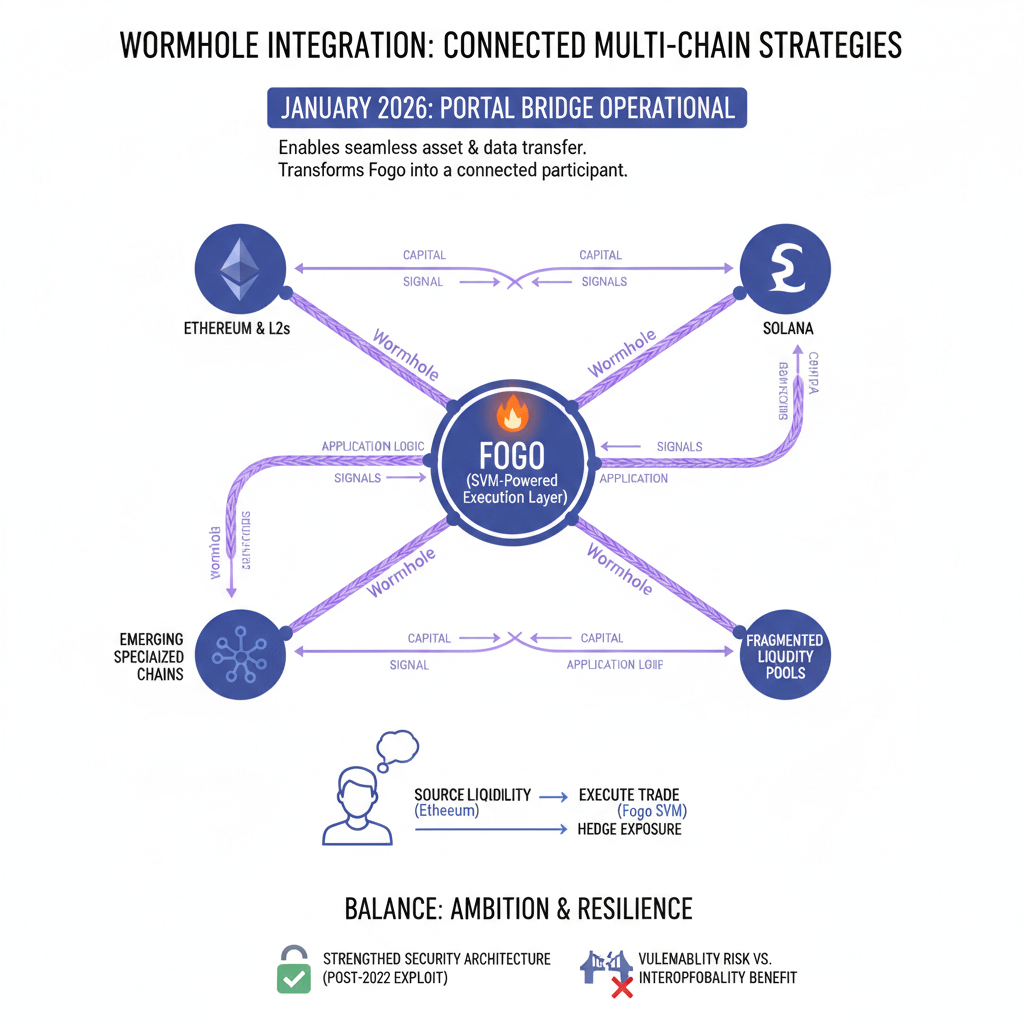

Wormhole operates as a cross-chain messaging protocol supported by a decentralized network of guardians that observe and verify events across connected chains, enabling not only asset transfers but also arbitrary data communication. In January 2026, the Portal Bridge infrastructure became operational for transfers into and out of Fogo, marking a pivotal milestone that transformed the chain from an isolated high-performance environment into a connected participant within a multi-chain world. This integration allows capital, signals, and application logic to move fluidly between ecosystems, which is essential for any platform aspiring to host serious trading activity. A trader may source liquidity on one network, execute on Fogo’s SVM-powered layer for speed and determinism, and hedge exposure elsewhere, all within an interconnected framework.

Emotionally, this connectivity addresses one of crypto’s quiet frustrations: fragmentation. For years, interoperability has been promised more often than delivered in seamless form. The ability to move assets and information reliably between chains does not merely enhance convenience; it enables strategies that were previously impractical. At the same time, history reminds us that bridges have been vulnerable attack surfaces, and Wormhole itself endured a significant exploit in 2022 before strengthening its security architecture. Any cross-chain vision must therefore balance ambition with resilience, because trust can evaporate quickly in this industry.

Fogo’s broader experiment feels meaningful because it does not pretend that trade-offs disappear; instead, it attempts to engineer around them. High-performance systems must guard against validator concentration and hardware centralization. Trader-focused ecosystems must ensure they do not marginalize everyday participants in pursuit of institutional capital. Token incentives must align validators, users, and long-term governance rather than rewarding short-term extraction. These challenges are structural, not cosmetic, and addressing them requires sustained commitment rather than narrative momentum.

At its core, Fogo represents a wager that decentralization can mature without losing its soul. It suggests that efficiency and fairness do not have to exist in opposition, and that markets built on transparent, high-speed infrastructure can still honor open access and credible neutrality. Whether this wager ultimately succeeds remains uncertain, because markets are unforgiving and technology evolves rapidly. Yet the willingness to confront the tension directly, rather than hiding behind slogans, is itself significant. In a landscape often dominated by noise, Fogo’s approach feels like a deliberate attempt to reconcile the ideals that sparked crypto with the practical demands of modern financial systems, and that reconciliation, if achieved, could redefine what decentralized trading truly means.