Let’s be honest, the blockchain world doesn’t need another isolated chain. It needs networks that can talk to each other.

That’s why Fogo Coin’s integration with Wormhole stands out to me. This isn’t just a technical update. It’s a strategic move toward staying relevant in a multichain future.

We’re no longer in a phase where one ecosystem can realistically dominate everything. Liquidity is scattered. Developers are building across multiple chains. Users hold assets in different places. AI systems are beginning to automate decisions across networks. In that world, interoperability isn’t optional, it’s foundational.

And that’s where Fogo’s direction becomes interesting.

It’s Not About Speed Alone Anymore

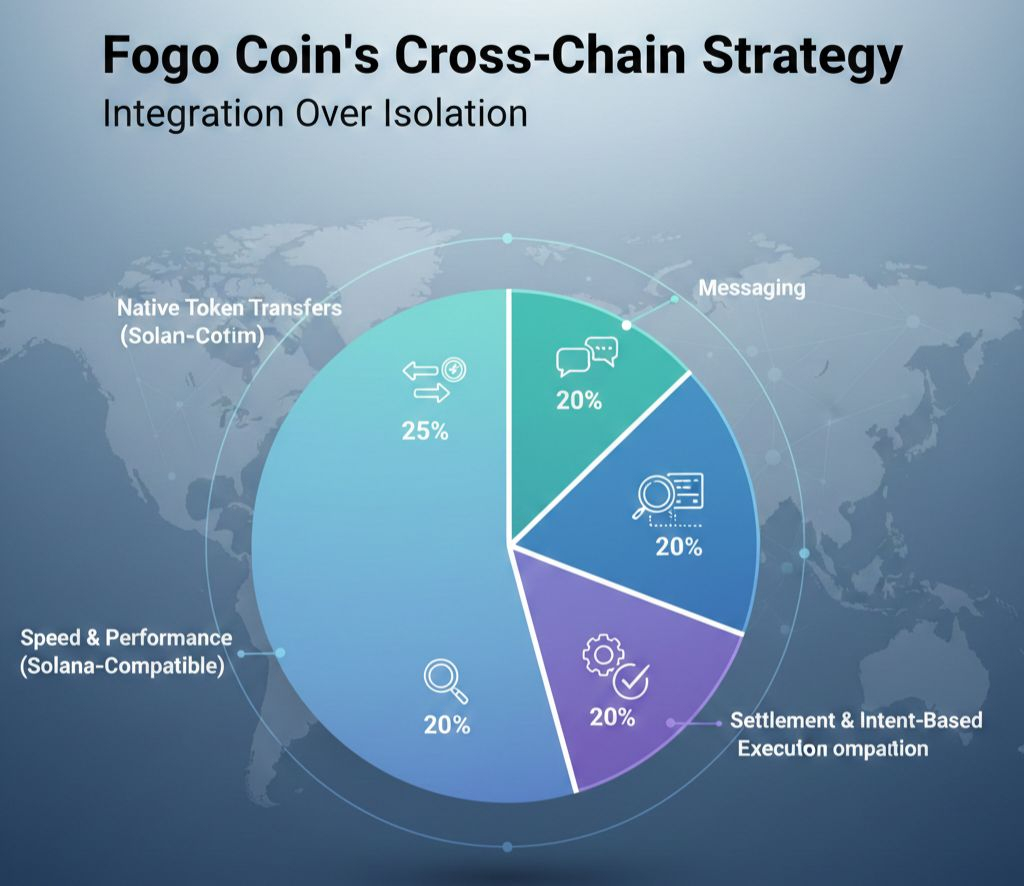

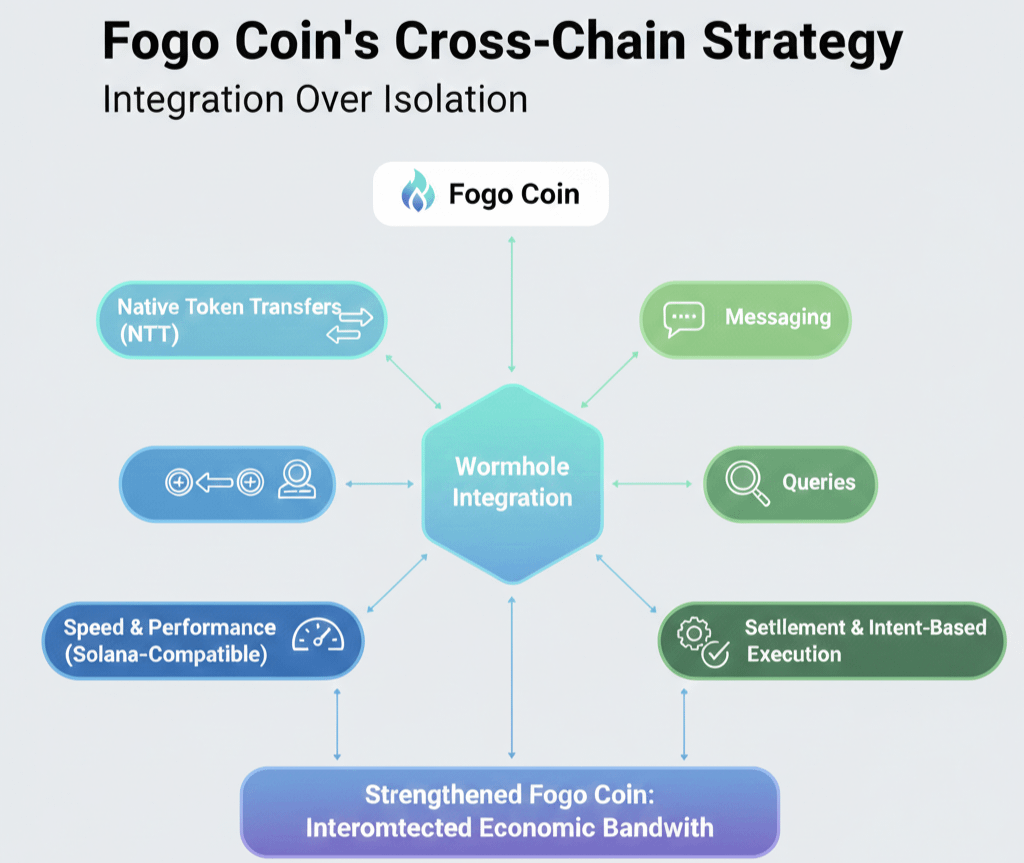

Yes, Fogo operates within a Solana-compatible framework, which already gives it performance benefits. But speed by itself doesn’t solve fragmentation.

If assets are stuck on other chains, if applications can’t coordinate across ecosystems, then performance becomes limited to whatever exists inside your own bubble.

By integrating Wormhole’s cross-chain infrastructure, Fogo removes that bubble effect. Assets and data can move between networks. Developers can build multichain logic. Liquidity doesn’t have to permanently relocate to participate.

From my perspective, that dramatically expands Fogo’s economic flexibility.

Native Token Transfers: Fixing an Old Problem

One thing that really stands out to me is Native Token Transfers (NTT).

Historically, bridging meant wrapping tokens. That introduced complexity and risk. You’d end up with “wrapped” versions of assets floating around and sometimes those wrapped tokens created fragmentation, security exposure or confusion.

NTT changes that dynamic. Tokens can move across chains while keeping their original properties intact, metadata, ownership, upgradeability, custom features.

In simple terms, the token stays itself.

To me, that’s a big deal. It preserves identity and reduces unnecessary abstraction layers. For developers building on Fogo, it means they don’t have to compromise token design just to go multichain.

Messaging: The Quiet Powerhouse

While most people focus on asset transfers, I actually think cross-chain messaging is more important long term.

Here’s why.

Messaging allows contracts on one chain to trigger actions on another. That means logic isn’t confined to a single ecosystem. Applications can coordinate across networks in a secure, verifiable way.

In an AI-driven future, that’s critical.

Imagine intelligent agents managing liquidity, adjusting positions or executing strategies across multiple chains simultaneously. That level of automation requires reliable cross-chain communication.

By supporting this messaging infrastructure, Fogo isn’t just enabling transfers, it’s enabling coordination.

And coordination is where real complexity (and value) lives.

Queries: Smarter Contracts, Broader Awareness

Another underrated feature is cross-chain queries.

Smart contracts on Fogo can access Guardian-attested data from other chains, prices, rates, liquidity conditions. That means developers don’t have to duplicate every data source locally.

For me, this feels like a move toward smarter infrastructure. Instead of rebuilding the same tools everywhere, ecosystems can reference each other’s state in a secure way.

That improves capital efficiency. It reduces redundancy. And it creates more intelligent applications.

If Fogo aims to position itself as AI-ready infrastructure, this kind of cross-chain awareness is essential.

Settlement and Intent-Based Execution

One thing I personally find fascinating is the solver-based settlement model.

Rather than forcing users to manually execute every step of a cross-chain transaction, off-chain agents can fulfill user-defined intents. The user specifies the outcome they want and the system coordinates the execution.

That’s a subtle but meaningful shift.

It moves blockchain UX closer to abstraction and automation, which is exactly where AI and next-generation applications are heading.

For Fogo, supporting this model shows that the team isn’t just thinking about raw throughput. They’re thinking about usability and long-term adaptability.

Why This Strengthens Fogo Coin

From an economic standpoint, interoperability changes everything.

When liquidity can flow in and out freely, the ecosystem becomes less isolated. When developers can deploy multichain strategies without abandoning Fogo, adoption barriers drop.

To me, that strengthens Fogo’s economic bandwidth. It’s not just about how fast the chain runs. It’s about how connected it is.

Connectivity reduces structural risk.

In a multichain world, isolated chains eventually struggle to stay competitive. Connected chains evolve alongside the broader ecosystem.

I don’t see Fogo Coin as trying to dominate the blockchain space. I see it trying to integrate into it intelligently.

That distinction matters.

Rather than positioning itself as a competitor to everything else, Fogo seems to be embedding itself within a larger network of chains. It’s refining execution quality while enabling cross-chain functionality.

That feels sustainable.

Of course, integration alone doesn’t guarantee success. Security, validator decentralization, consistent development and real adoption will ultimately determine long-term impact.

But direction matters.

And from where I stand, this direction makes sense.

The industry is shifting from “Which chain wins?” to “How do chains work together?”

Fogo’s interoperability layer reflects that shift. Cross-chain transfers, messaging, queries and solver-based settlement aren’t just features. They’re components of a broader architectural philosophy.

One that recognizes that the future isn’t isolated.

It’s interconnected.

And in my opinion, connectivity may end up being the most valuable asset any blockchain can have.