When I first started hearing chatter about Fogo in the winter of 2025, it sounded like another blockchain buzzword “fast, low latency,” the usual spin you see around any new Layer 1. But over the past months, especially as Fogo’s mainnet went live in January 2026, I’ve had time to sit with its design, talk with builders, and actually use aspects of the testnets. The real question that nags at traders and developers alike is simple: Is Fogo truly meant for retail traders, or is it built for pros? After months in the weeds, watched through data, developer docs, and actual pain points, the answer isn’t a simple either/or, but understanding why Fogo feels different starts with two things every trader cares about speed and simplicity.

Let’s start with speed because that’s literally in the name of most conversations around Fogo. When Fogo launched its mainnet on January 13, 2026, it brought block times down into the sub 40 millisecond territory with finality in about 1.3 seconds. In the context of decentralized systems that juggle thousands of transactions at once, that’s not a small engineering footnote it’s cooked trader in the room fast. Compare that with most chains that take hundreds of milliseconds or worse during congestion spikes and you start to see why developers building trading apps took notice.

But what does super fast mean on a human level? It means your orders settle and finalize before most people have even seen the confirmation pop up. It means a market maker can price, hedge, and react in something closer to real-world financial speeds. Traditional high-frequency trading (HFT) rooms on Wall Street live and die by millisecond advantages if a decentralized chain can operate at that cadence, it attracts a certain class of trader. When I talk to institutional devs, that’s the first line of appeal: not “blockchain fast,” but “trading floor fast.”

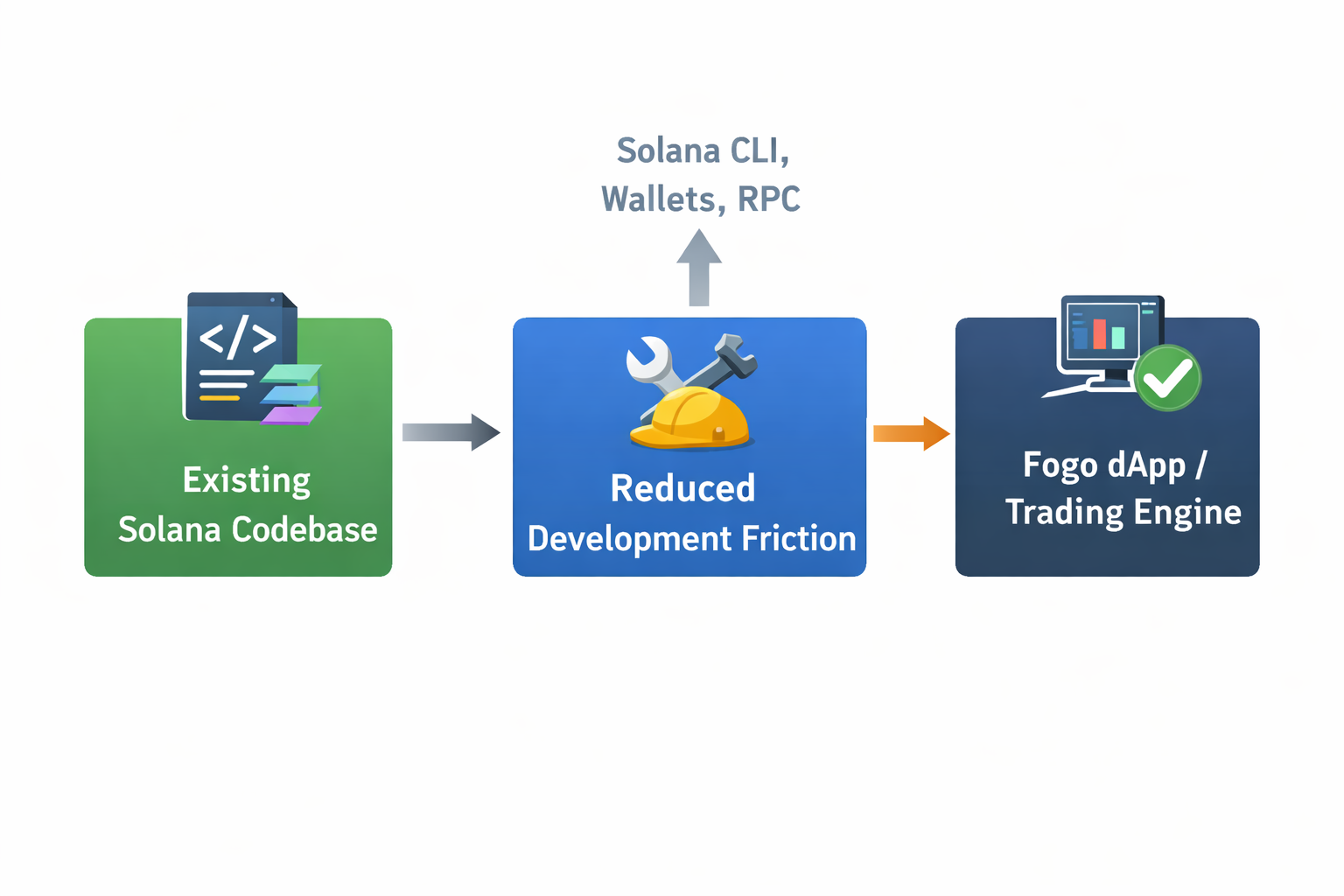

Then there’s simplicity and here’s where the story gets interesting for both retail and professional builders alike. Fogo doesn’t force developers to learn a brand new stack. Instead it reuses the Solana Virtual Machine (SVM) and most Solana tooling the CLI, common wallets, RPC patterns so existing codebases can plug in with minimal rewrites. For traders who have ever watched a promising chain struggle because developers balked at the learning curve, this matters. Developers can bring or migrate trading engines, dApps, and order tools without weeks of rug-pulling refactor work. It’s like upgrading a car’s engine without relearning how to drive.

That’s all part of what they call reduced development friction and it’s not just a buzzword. In the world of trading tech, friction means hours wasted syncing contracts, troubleshooting incompatible libraries, wrestling with slow RPC nodes. With Fogo’s SVM compatibility and tooling alignment, those headaches vanish or at least fade. If you’re a dev building a decentralized perpetual DEX or a real-time market data engine, you don’t want to reinvent your infrastructure you want it fast and familiar. And that’s exactly what Fogo’s architecture promises: performance without a steep development ramp.

Now, back to the retail angle. If you’re an everyday trader who buys a few altcoins or plays DeFi on weekends, how does Fogo impact you? In raw terms, the experience feels smoother fewer stuck transactions, fewer micro fees every time you sign something, and even features like “Fogo Sessions” that let you interact with apps without consenting to a signature for every little action. It’s like having a single login that keeps you moving instead of clicking “approve” a dozen times. That sounds trivial until you’ve wasted precious seconds drowning in popup fatigue while a market swings.

But here’s the nuance: while retail traders benefit from smoother UX, the reason these features exist is because Fogo was designed around real time finance and institutional behavior think decentralized order books, on chain derivatives, perpetual markets, and pricing oracles baked into the protocol itself. That’s not casual hobby trading that’s infrastructure built with professional markets in mind.

Are there retail spaces on Fogo? Absolutely. The simplicity features weren’t added to exclude anyone. But when the primary selling points are ultra low latency, deterministic execution, and a build environment that feels like you’re coding for a CEX marketplace rather than a weekend meme token, it’s clear who the core audience is. Retail traders benefit because the chain matches professional expectations not the other way around.

So is Fogo designed for retail or pros? The honest answer based on where we are in early 2026 is both but primarily built with professional, institution oriented trading and developers in mind. And that’s not a flaw; it’s a strategic choice. Speed and reduced development friction don’t just help whales and quant desks they make the entire market experience more reliable for everyone. But if you’re asking who the architects had in mind when they sketched out those 40ms blocks and Solana toolchain reuse the answer leans toward the pros first, the retail crowd second.

For traders, investors, or devs watching Fogo’s ecosystem grow, the best advice I can give is this: if you’re building or trading where milliseconds matter, Fogo is where the infrastructure feels like it was designed with your pain points in mind. Retail users will enjoy that too but it’s the professionals who will push it first.