Blockchain trackers found a transfer connected to BlackRock. It was 2,563 Bitcoin and 49,852 Ethereum, which's about $250 million. This money went into Coinbase Prime. In February 2026 we have seen a lot of movements of crypto by institutions and this one is getting a lot of attention.

Most people are getting it wrong when they talk about this news. Coinbase Prime is a place where institutions can keep and trade their crypto it is not a way for them to get out of the market. When they move their assets to this platform it means they have options, not that they are going to sell away. BlackRock has a Bitcoin fund and an Ethereum fund. When people take their money out it makes the company rebalance its own funds. This transfer is a normal part of how things work it does not mean that BlackRock is panicking.

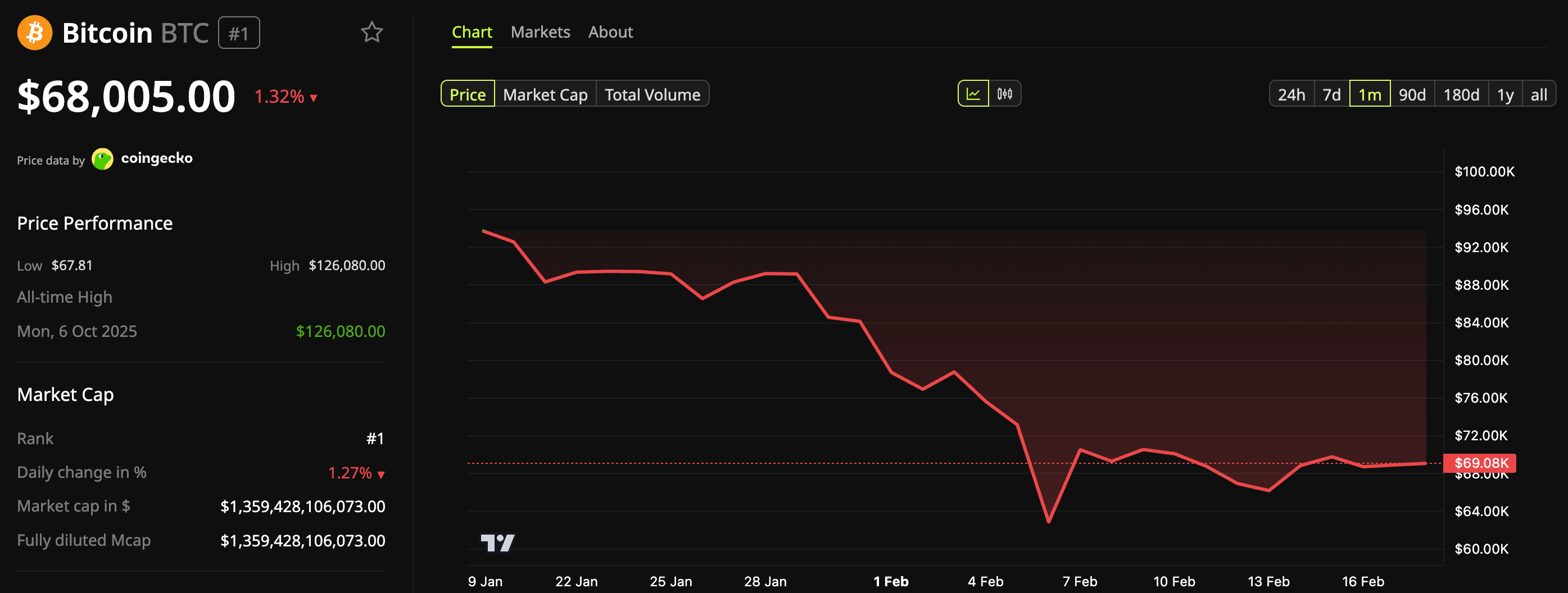

When we look at the bigger picture it is not so good. On February 18 Bitcoin funds lost $134 million. Blackrocks fund lost $85 million of that. In January it was worse. Almost $1 billion was taken out of US crypto funds in just one day when Bitcoin was near $81,000.

The reason for this is what is happening in the world. People are worried about what the Fed will do with interest rates. There is a risk of the government shutting down and there are more problems between countries. All of this makes institutions more careful. When people on Wall Street are not willing to take risks it affects the crypto market.

What is important now is what happens to the price of Bitcoin. If Bitcoin stays above $60,000 that is good.. If it goes below that it could cause a lot of problems, for people who have borrowed money to buy crypto. BlackRock has not said it is going to change its strategy. Institutions usually do not tell us what they are going to do before they do it.

We need to watch what is happening with the money and the blockchain. The blockchain just shows us what is really happening it does not try to tell us a story.