I stopped using most L2s last year. Not because I dislike the teams. Because I did the math on my actual costs: bridge fees, slippage from fragmented liquidity, failed transactions, and the time I spent tracking which assets were where. The "cheap" fees weren't cheap. They were hidden.

Blockchain bridges have become standard infrastructure. They also represent the single largest attack vector in decentralized finance. Over 2.5 billion has been lost to bridge exploits since 2021. I don't consider this acceptable risk. I consider it architectural failure.

The Bridge Problem

Layer 2 scaling moves execution off the main chain to reduce congestion. This requires bridges to transfer assets between layers. These bridges are typically smart contracts holding billions in value, guarded by multi-signature schemes or validator sets that are often centralized and always exploitable.

The security model adds risk. Users inherit vulnerabilities from L1, L2, and the bridge itself. When bridges fail, funds disappear. No recovery mechanism exists.

Beyond security, bridges fragment liquidity. ETH on Arbitrum and ETH on Optimism are not the same asset. They trade at different prices. They require separate pools. This increases slippage and degrades experience. I have watched arbitrage bots extract value from this fragmentation while regular users eat the spread.

Why L2-First Became Default

Ethereum's congestion in 2020-2021 made L2s economically necessary. Gas exceeded 100 for simple transfers. The network could not scale vertically without compromising decentralization.

L2s offered a pragmatic path: inherit Ethereum's security while processing separately. The trade-off—bridges, delays, fragmentation—was accepted as temporary until sharding arrived.

Sharding remains unrealized. Bridges became permanent. The temporary compromise calcified into standard architecture. I accepted this until I saw alternatives.

Vanar's Alternative Approach

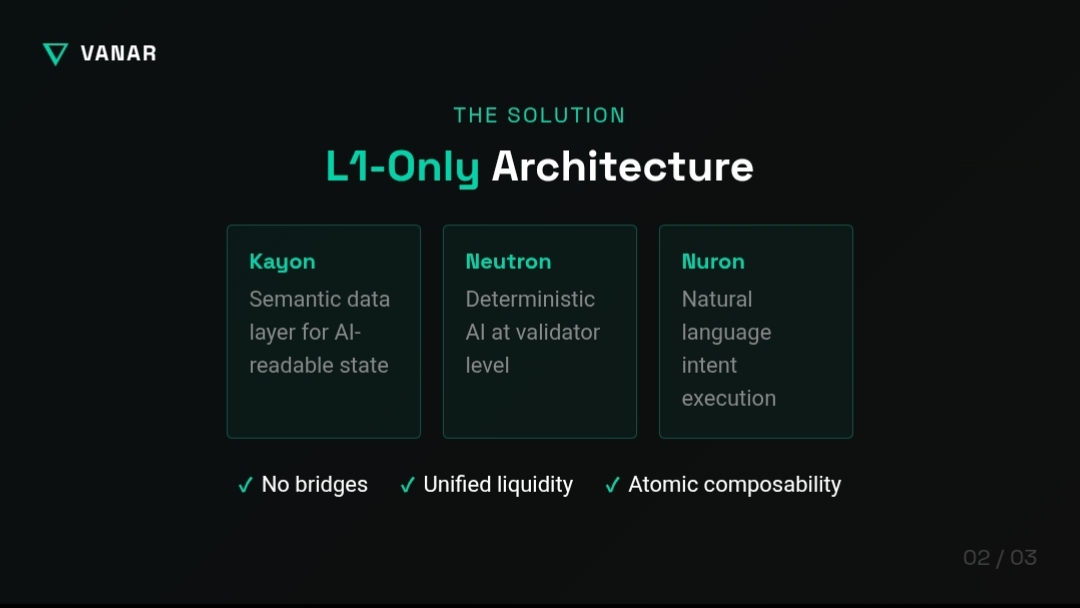

Vanar Chain proposes sufficient L1 throughput to eliminate L2s entirely. This requires architectural decisions at protocol inception, not retrofits.

Technical Implementation

Vanar's infrastructure has three integrated components.

Kayon structures on-chain information for machine-readable relationships. Traditional blockchains store state as key-value pairs. Kayon adds graph-based indexing, allowing the protocol to understand data context without external queries.

Neutron runs deterministic AI engines at validator level. These enable predictive gas pricing and load balancing without off-chain computation. Outputs are reproducible across nodes, maintaining consensus.

Nuron translates user intent into executable transactions through natural language. This reduces complexity for developers and users.

Scaling Without Sharding or L2s

Vanar achieves throughput through specific mechanisms.

Parallel execution identifies independent transactions and processes them simultaneously. State conflicts are detected pre-execution, preventing sequential bottlenecks common in traditional EVM chains.

AI-optimized scheduling predicts transaction patterns and pre-allocates resources. This prevents congestion spikes rather than reacting to them.

Compressed state access through Kayon's semantic structure reduces data required for complex queries. Validators access relevant state without scanning entire ledgers.

How This Compares to L2-Dependent Chains

I have used most major L2s extensively. The differences are concrete.

Finality time is the most obvious. On optimistic rollups, I wait days for true finality. On ZK rollups, minutes. On Vanar, seconds. This matters for anything time-sensitive—trading, liquidations, gaming.

Bridge risk is present in every L2 interaction I make. Vanar eliminates this entirely. No bridge contracts. No cross-chain message verification. No multi-sig custodians to trust.

Liquidity state affects every trade. On L2s, my capital fragments across chains. I maintain positions on Arbitrum, Optimism, Base, and others. Each requires separate management. On Vanar, liquidity is unified. One state. One balance. No wrapping.

Composability is theoretical on L2s. Smart contracts on different chains cannot interact atomically. Cross-chain messaging introduces delays and failure modes. Vanar enables true composability—contracts interact directly, immediately.

Operational complexity is what ultimately drove me away from L2s. Multiple gas tokens. Bridge interfaces. Different block explorers. Vanar operates as a single chain. One token. One interface. One mental model.

Trade-offs I Accept

L1 scaling has challenges. Vanar requires validators capable of running AI inference. This is more demanding than traditional nodes. The validator set may be smaller than Ethereum's, though hardware requirements are not prohibitive.

Vanar also sacrifices Ethereum's network effects. It does not inherit Ethereum's security budget or tooling natively. EVM compatibility helps, but migration requires effort.

These trade-offs are real. For my use case—high-frequency interaction, low tolerance for complexity—they are worth it.

My Assessment

The industry normalized bridges as necessary infrastructure. I no longer believe they are. They are engineering compromises that became permanent because alternatives were not available.

Vanar demonstrates that L1 scaling is achievable without sharding or L2s, given appropriate architectural foundations. This eliminates bridge risk, unifies liquidity, and restores composability.

Whether this trade-off is preferable depends on use case. For applications requiring high throughput, low latency, and minimal operational complexity, Vanar's L1-only architecture presents a coherent alternative. I have moved my activity accordingly.