For a long time, I just figured MEV was the "tax" you paid for using DeFi.

You hit swap, your trade sits in limbo for a heartbeat, and in that tiny window, someone sees it. They front-run it, sandwich it, and shave off a piece of your profit. Everyone kind of shrugs and calls it the cost of doing business on-chain. But after digging into Fogo SVM runtime layer+1 lately, I’m starting to think we just got used to bad design.

The thing that hooked me wasn't the flashy marketing... it was the block timing. We’re talking Fogo's 40-millisecond slots and finality in about 1.3 seconds. It’s consistent, too. Usually, sending a transaction feels like throwing a message in a bottle into a crowded waiting room, just hoping a friendly validator picks it up. Fogo doesn't feel like that.

People forget that MEV actually needs time to breathe. It needs a gap between the moment your trade is visible and the moment the state is finalized. If that gap is wide enough, you can build an entire sub-economy around it—private relays, MEV-Boost, order flow auctions. Entire validator businesses are literally built on exploiting that delay.

Fogo built for low latency dispiline on Solana virtual machine basically chokes that window out.

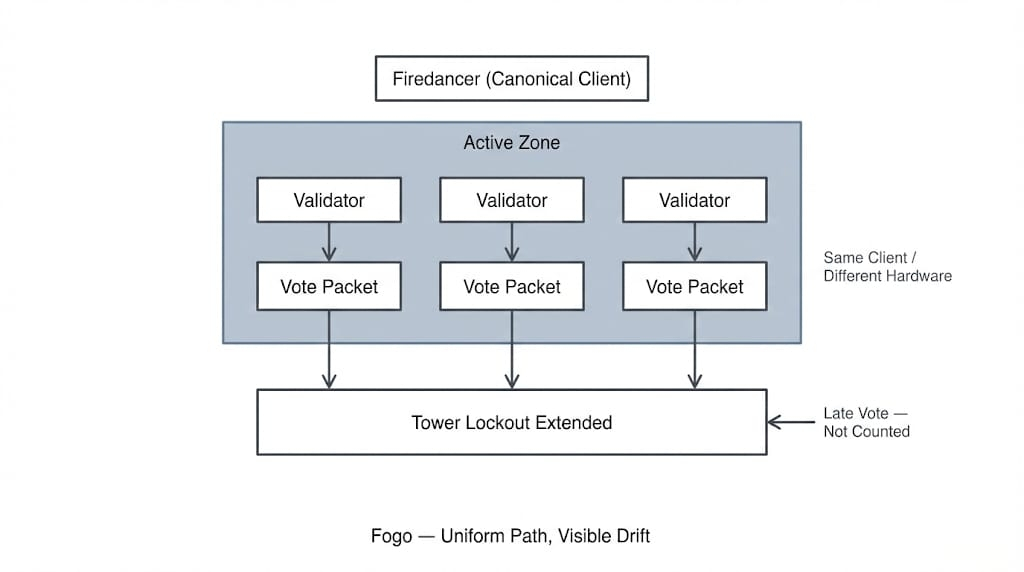

They’re ( @Fogo Official ) using Multi-Local Consensus across global hubs and running Firedancer on a tight validator set. The PoH clock just keeps ticking, the banking stage executes, and the state moves on. There’s no "breathing room" to jump in front of a trade when you barely have time to see it happen.

Other chains treat MEV protection like a feature or a product they can sell you. They say, "We’ll shield your trade" or "We’ll share the profits with you." Fogo’s approach feels way more fundamental. It’s not about shielding you from the extraction; it’s about removing the structural lag that made the extraction profitable to begin with.

But honestly? There’s a catch.

MEV might be parasitic, but it’s also how validators get paid. On Ethereum, that extra yield is a massive part of why people run high-end hardware. If you squeeze MEV out of the system, you have to wonder what fills that hole in the budget.

Fogo is betting on raw volume. The idea is that if the chain is optimized for high-frequency trading and on-chain order books, the value comes from actual network activity, not from reordering transactions. It’s a much cleaner model in theory, but it’s definitely a pivot.

You’re trading away the "hobbyist node" dream for professional infrastructure that can handle a 40ms cadence. You lose some of the decentralization optics to get actual execution quality.

I don't expect MEV to just vanish with Fogo's low latency block timing... traders always find a way to game the system—but when you remove that time buffer, the whole vibe changes. You stop treating extraction like a law of nature and start seeing it for what it really was... a side effect of slow blocks. That’s a much bigger deal than just "making things faster."