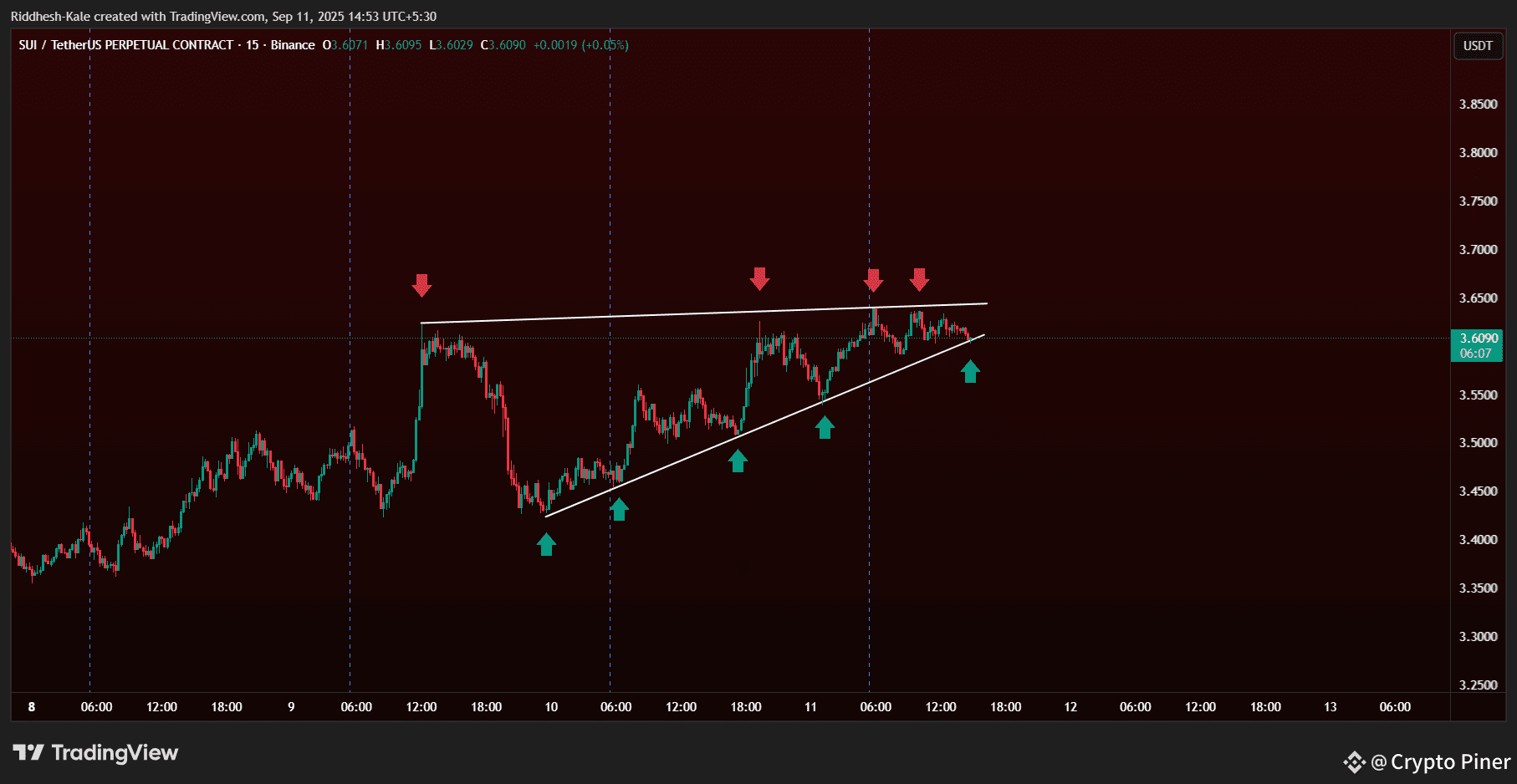

The Ascending Triangle is a bullish continuation pattern. It forms when the price creates higher lows (🔼) while facing consistent resistance at the same horizontal level (🔴).

🧐 How to Identify It

1) Flat Resistance Line

Price hits the same level multiple times and gets rejected

This creates a horizontal line on top

2) Rising Support Trendline

Each dip forms a higher low, indicating buying pressure

Connect the swing lows with a rising trendline

📊 How to Trade It

1) Entry 📌 : Breakout Entry: Enter when price breaks and closes above the resistance line with high volume 💥 , Conservative traders wait for a retest of the breakout zone (resistance becomes support).

2) Target 🎯 : Measure the height of the triangle and project it upward from the breakout point

Example: If triangle height = $0.30, add $0.30 above breakout

3) Stop Loss 🛡️ : Below the last higher low Or slightly below the triangle support trendline

🔍 Real Example $SUIUSDT (15-min chart)