In this post, let’s break down how rate cuts and other big macro events price in before they happen — and how you can position smartly to stay ahead of the move. 👇

In this post, let’s break down how rate cuts and other big macro events price in before they happen — and how you can position smartly to stay ahead of the move. 👇

---

🔹 Why Price Dips After “Good News”?

If we all expect a rate cut and it actually happens… why does the market still dump?

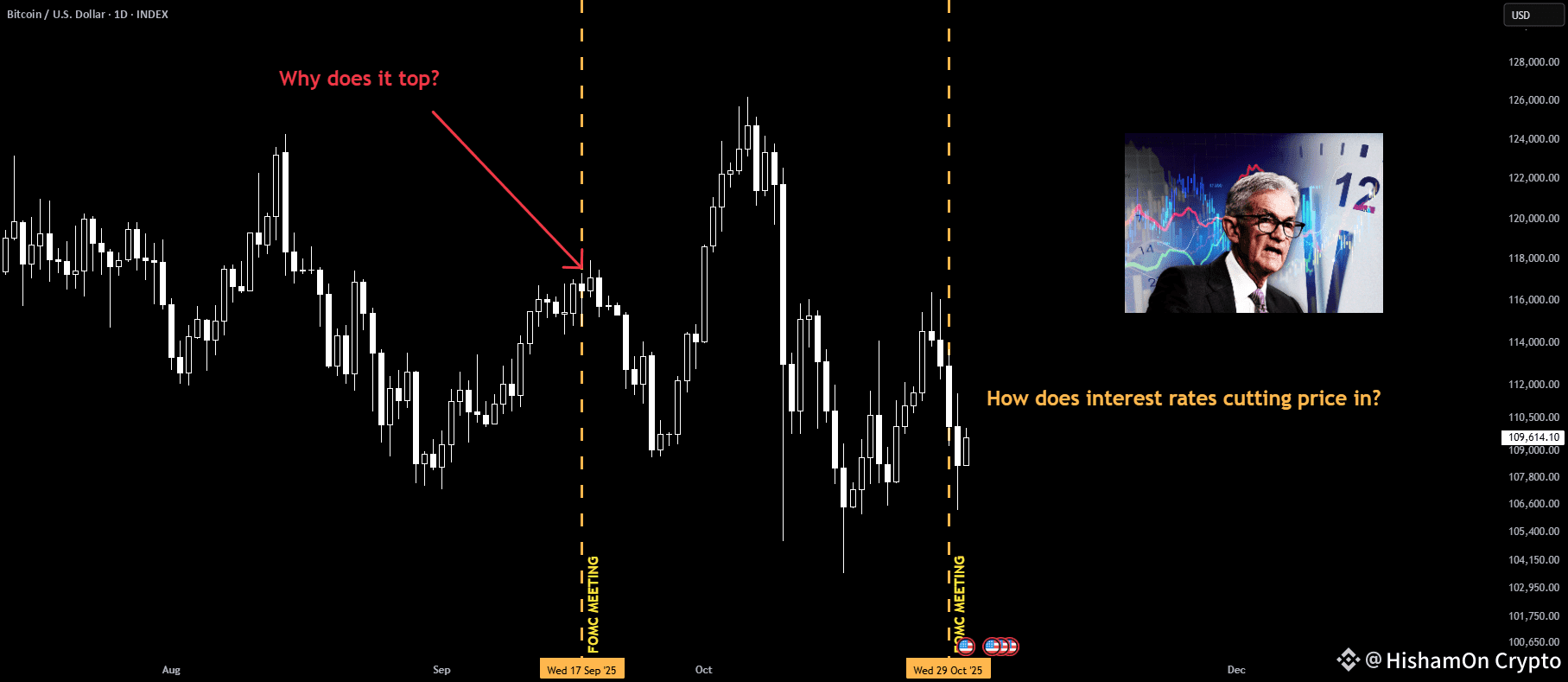

Example — September 17th, 25bps cut. Everyone was hyped, yet price fell.

👉 Reason: It was already priced in.

Markets usually pump 1–2 weeks before the expected event — then sell off once it’s confirmed.

---

🔹 Market Reaction Scenarios

Event Reaction Reason

No Change 🔴 Hard Dump Expectations missed

25bps Cut 🔴 Dump Already priced in

50bps Cut 🟢 Pump Unexpected surprise

When a bullish event is expected, it’s often already in the charts before the announcement.

---

🔹 Expected vs Unexpected

Expected Events (Rate cuts, CPI, halving): price in before the event.

Unexpected Events (War, hacks, policy shifts): market reacts instantly.

---

🔹 How to Position 💼

1️⃣ Start preparing 1–2 weeks early.

2️⃣ Check forecasts & Polymarket odds (majority bet = most likely).

3️⃣ If it plays out as expected → close position.

4️⃣ If something unexpected happens → hold/add.

5️⃣ If “no change” when a cut was expected → flip short.

---

⚠️ Disclaimer: Not financial advice. Do your own research.

💭 What’s your take? How do you position before FOMC events? Drop your thoughts below 👇